Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In 2019, an employee of a public corporation (Pubco) received a stock option to acquire 1,000 Pubco shares at a price of $15 per

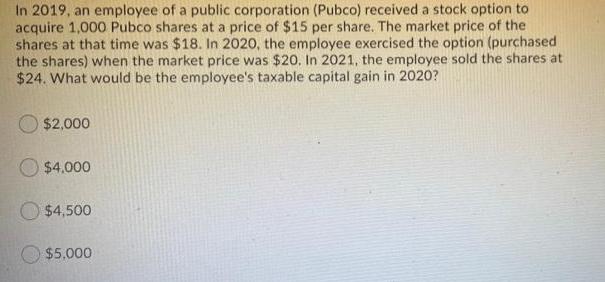

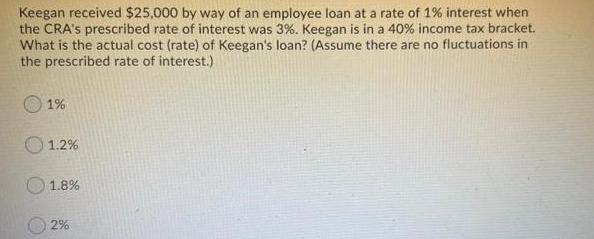

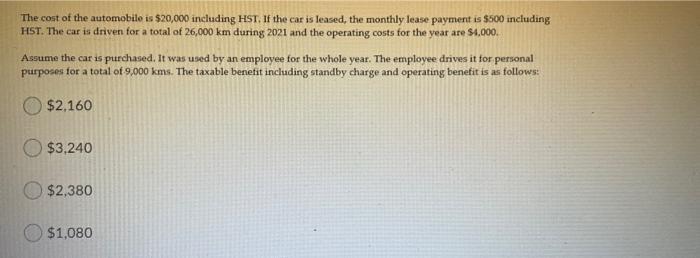

In 2019, an employee of a public corporation (Pubco) received a stock option to acquire 1,000 Pubco shares at a price of $15 per share. The market price of the shares at that time was $18. In 2020, the employee exercised the option (purchased the shares) when the market price was $20. In 2021, the employee sold the shares at $24. What would be the employee's taxable capital gain in 2020? $2,000 $4,000 O $4,500 $5,000 Keegan received $25,000 by way of an employee loan at a rate of 1% interest when the CRA's prescribed rate of interest was 3%. Keegan is in a 40% income tax bracket. What is the actual cost (rate) of Keegan's loan? (Assume there are no fluctuations in the prescribed rate of interest.) 1% 1.2% 1.8% 2% The cost of the automobile is $20,000 including HST. If the car is leased, the monthly lease payment is $500 including HST. The car is driven for a total of 26,000 km during 2021 and the operating costs for the year are $4,000. Assume the car is purchased. It was used by an employee for the whole year. The employee drives it for personal purposes for a total of 9,000 kms. The taxable benefit including standby charge and operating benefit is as follows: $2,160 $3,240 $2,380 $1,080 In 2019, an employee of a public corporation (Pubco) received a stock option to acquire 1,000 Pubco shares at a price of $15 per share. The market price of the shares at that time was $18. In 2020, the employee exercised the option (purchased the shares) when the market price was $20. In 2021, the employee sold the shares at $24. What would be the employee's taxable capital gain in 2020? $2,000 $4,000 O $4,500 $5,000 Keegan received $25,000 by way of an employee loan at a rate of 1% interest when the CRA's prescribed rate of interest was 3%. Keegan is in a 40% income tax bracket. What is the actual cost (rate) of Keegan's loan? (Assume there are no fluctuations in the prescribed rate of interest.) 1% 1.2% 1.8% 2% The cost of the automobile is $20,000 including HST. If the car is leased, the monthly lease payment is $500 including HST. The car is driven for a total of 26,000 km during 2021 and the operating costs for the year are $4,000. Assume the car is purchased. It was used by an employee for the whole year. The employee drives it for personal purposes for a total of 9,000 kms. The taxable benefit including standby charge and operating benefit is as follows: $2,160 $3,240 $2,380 $1,080 In 2019, an employee of a public corporation (Pubco) received a stock option to acquire 1,000 Pubco shares at a price of $15 per share. The market price of the shares at that time was $18. In 2020, the employee exercised the option (purchased the shares) when the market price was $20. In 2021, the employee sold the shares at $24. What would be the employee's taxable capital gain in 2020? $2,000 $4,000 O $4,500 $5,000 Keegan received $25,000 by way of an employee loan at a rate of 1% interest when the CRA's prescribed rate of interest was 3%. Keegan is in a 40% income tax bracket. What is the actual cost (rate) of Keegan's loan? (Assume there are no fluctuations in the prescribed rate of interest.) 1% 1.2% 1.8% 2% The cost of the automobile is $20,000 including HST. If the car is leased, the monthly lease payment is $500 including HST. The car is driven for a total of 26,000 km during 2021 and the operating costs for the year are $4,000. Assume the car is purchased. It was used by an employee for the whole year. The employee drives it for personal purposes for a total of 9,000 kms. The taxable benefit including standby charge and operating benefit is as follows: $2,160 $3,240 $2,380 $1,080 In 2019, an employee of a public corporation (Pubco) received a stock option to acquire 1,000 Pubco shares at a price of $15 per share. The market price of the shares at that time was $18. In 2020, the employee exercised the option (purchased the shares) when the market price was $20. In 2021, the employee sold the shares at $24. What would be the employee's taxable capital gain in 2020? $2,000 $4,000 O $4,500 $5,000 Keegan received $25,000 by way of an employee loan at a rate of 1% interest when the CRA's prescribed rate of interest was 3%. Keegan is in a 40% income tax bracket. What is the actual cost (rate) of Keegan's loan? (Assume there are no fluctuations in the prescribed rate of interest.) 1% 1.2% 1.8% 2% The cost of the automobile is $20,000 including HST. If the car is leased, the monthly lease payment is $500 including HST. The car is driven for a total of 26,000 km during 2021 and the operating costs for the year are $4,000. Assume the car is purchased. It was used by an employee for the whole year. The employee drives it for personal purposes for a total of 9,000 kms. The taxable benefit including standby charge and operating benefit is as follows: $2,160 $3,240 $2,380 $1,080

Step by Step Solution

★★★★★

3.41 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Ansuer 3 oftion Bis Lout Enplanation Baralle cain selemaeket valus ate...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started