Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Serbia Ltd will require $15 million in capital in order to be viable and produce $2 million annual cash flows in perpetuity. The directors

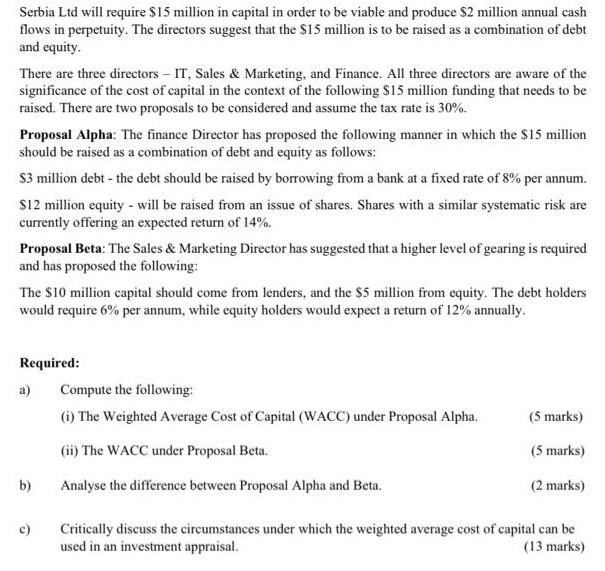

Serbia Ltd will require $15 million in capital in order to be viable and produce $2 million annual cash flows in perpetuity. The directors suggest that the $15 million is to be raised as a combination of debt and equity. There are three directors - IT, Sales & Marketing, and Finance. All three directors are aware of the significance of the cost of capital in the context of the following $15 million funding that needs to be raised. There are two proposals to be considered and assume the tax rate is 30%. Proposal Alpha: The finance Director has proposed the following manner in which the $15 million should be raised as a combination of debt and equity as follows: $3 million debt - the debt should be raised by borrowing from a bank at a fixed rate of 8% per annum. $12 million equity - will be raised from an issue of shares. Shares with a similar systematic risk are currently offering an expected return of 14%. Proposal Beta: The Sales & Marketing Director has suggested that a higher level of gearing is required and has proposed the following: The $10 million capital should come from lenders, and the $5 million from equity. The debt holders would require 6% per annum, while equity holders would expect a return of 12% annually. Required: a) b) c) Compute the following: (i) The Weighted Average Cost of Capital (WACC) under Proposal Alpha. (ii) The WACC under Proposal Beta. Analyse the difference between Proposal Alpha and Beta. (5 marks) (5 marks) (2 marks) Critically discuss the circumstances under which the weighted average cost of capital can be used in an investment appraisal. (13 marks)

Step by Step Solution

★★★★★

3.40 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

a Question 1 The WACC for proposal Alpha is 1071 Calculation 3000000 x 8 240000 12000000 x 14 1680000 WACC 240000 1680000 15000000 1071 Question 2 The ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started