Alpha has owned 80% of the equity shares of Beta since the incorporation of Beta. On 1 July 20X6 Alpha purchased 60% of the equity

Note 1 €“ Inter-company sales

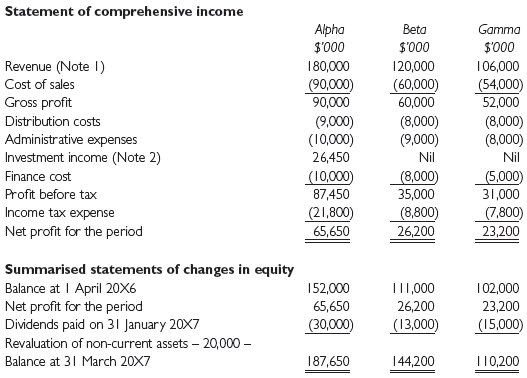

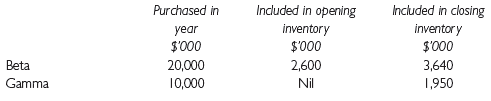

Alpha sells products to Beta and Gamma, making a profit of 30% on the cost of the products sold. All the sales to Gamma took place in the post-acquisition period. Details of the purchases of the products by Beta and Gamma, together with the amounts included in opening and closing inventories in respect of the products, are given below:

Note 2 €“ Investment income

Alpha€™s investment income includes dividends received from Beta and Gamma and interest receivable from Beta. The dividend received from Gamma has been credited to the statement of comprehensive income of Alpha without time apportionment. The interest receivable is in respect of a loan of $60 million to Beta at a fixed rate of interest of 6% per annum. The loan has been outstanding for the whole of the year ended 31 March 20X7.

Note 3 €“ Details of acquisition of shares in Gamma

On 1 July 20X6 Alpha purchased 15 million of Gamma€™s issued equity shares by a share exchange. Alpha issued 4 new equity shares for every 3 shares acquired in Gamma. The market value of the shares in Alpha and Gamma at 1 July 20X6 was $5 and $5.50 respectively. The non-controlling interest in Gamma is measured using method 1.

The fair values of the net assets of Gamma closely approximated to their carrying values in Gamma€™s financial statements with the exception of the following items:

(i) A property that had a carrying value of $20 million at the date of acquisition had a market value of $30 million. $16 million of this amount was attributable to the building, which had an estimated useful future economic life of 40 years at 1 July 20X6. In the year ended 31 March 20X7 Gamma had charged depreciation of $200,000 in its own financial statements in respect of this property.

(ii) Plant and equipment that had a carrying value of $6 million at the date of acquisition and a market value of $8 million. The estimated useful future economic life of the plant at 1 July 20X6 was 4 years. None of this plant and equipment had been sold or scrapped prior to 31 March 20X7.

(iii) Inventor y that had a carrying value of $3 million at the date of acquisition had a fair value of $3.5 million. This entire inventory had been sold by Gamma prior to 31 March 20X7.

Note 4 €“ Other information

(i) Gamma charges depreciation and impairment of assets to cost of sales.

(ii) On 31 March 20X7 the directors of Alpha computed the recoverable amount of Gamma as a single cash-generating unit. They concluded that the recoverable amount was $150 million.

(iii) When the directors of Beta and Gamma prepared the individual financial statements of these companies no impairment of any assets of either company was found to be necessary.

(iv) On 31 March 20X7 Beta revalued its non-current assets. This resulted in a surplus of £20,000 which was credited to Beta€™s revaluation reserve.

Required:

Prepare the consolidated statement of comprehensive income and consolidated statement of changes in equity of Alpha for the year ended 31 March 20X7. Notes to the consolidated statement of comprehensive income are not required. Ignore deferredtax.

Statement of comprehensive income Alpha Beta Gamma $'000 $'000 $'000 Revenue (Note I) 180,000 (90,000) 90,000 120,000 106,000 Cost of sales (60,000) (54,000) 52,000 Gross profit Distribution costs Administrative expenses Investment income (Note 2) 60,000 (9,000) (10,000) (8,000) (9,000) (8,000) (8,000) 26,450 Nil Nil (10,000) 87,450 (5,000) Finance cost (8,000) 35,000 Profit before tax 31,000 Income tax expense (21,800) 65,650 (8,800) 26,200 (7,800) 23,200 Net profit for the period Summarised statements of changes in equity Balance at I April 20X6 Net profit for the period Dividends paid on 31 January 20X7 152,000 TII,000 102,000 65,650 26,200 23,200 (30,000) (13,000) (15,000) Revaluation of non-current assets 20,000 - T 10,200 187,650 Balance at 31 March 20X7 144,200

Step by Step Solution

3.48 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

i Consolidated statement of comprehensive income for the year ended 31 March 20X7 000 Revenue 180000 120000 912 106000 20000 10000 W1 349500 Cost of sales balancing figure 172770 Gross profit W2 17673... View full answer

Get step-by-step solutions from verified subject matter experts

100% Satisfaction Guaranteed-or Get a Refund!

Step: 2Unlock detailed examples and clear explanations to master concepts

Step: 3Unlock to practice, ask and learn with real-world examples

Document Format ( 1 attachment)

168-B-A-G-F-A (1139).docx

120 KBs Word File

See step-by-step solutions with expert insights and AI powered tools for academic success

-

Access 30 Million+ textbook solutions.

Access 30 Million+ textbook solutions.

-

Ask unlimited questions from AI Tutors.

Ask unlimited questions from AI Tutors.

-

Order free textbooks.

Order free textbooks.

-

100% Satisfaction Guaranteed-or Get a Refund!

100% Satisfaction Guaranteed-or Get a Refund!

Claim Your Hoodie Now!

Study Smart with AI Flashcards

Access a vast library of flashcards, create your own, and experience a game-changing transformation in how you learn and retain knowledge

Explore Flashcards