In 2019, Bill and Joyce Schnappauf live in Wakefield, R.I. Bill is 53, and Joyce is 51. Bill is a district sales manager for USC Equipment Corporation, a Rhode Island firm that manufactures and distributes gaming equipment. Joyce is a self-employed author of chil-drens books. The Schnappaufs have three children, Will, 21, Dan, 19, and Tom, 16. In February 2020, the Schnappaufs provide the following basic information for preparing their 2019 federal income tax return:

1. The Schnappaufs use the cash method of accounting and file their return on a calendar-year basis.

2. Unless otherwise stated, assume that the Schnappaufs want to minimize the cur-rent years tax liability. That is, they would like to defer income when possible and take the largest deductions possible, a practice they have followed in the past.

3. Joyces Social Security number is 371-42-5207. 4. Bills Social Security number is 150-52-0546. 5. Wills Social Security number is 372-46-2611. 6. Dans Social Security number is 377-42-3411. 7. Toms Social Security number is 375-49-6511. 8. The Schnappaufs do not have any foreign bank accounts or foreign trusts. 9. Their address is 27 Northup Street, Wakefield, R.I. (02879).

10. The Schnappaufs do not wish to contribute to the presidential election campaign.

The first phase of the tax return problem is designed to introduce you to some of the tax forms and the supporting documentation (Forms W-2, 1099-INT, etc.) needed to com-plete a basic tax return. The first four chapters focus on the income aspects of individual taxation. Accordingly, this phase of the tax return focuses on the basic income concepts.

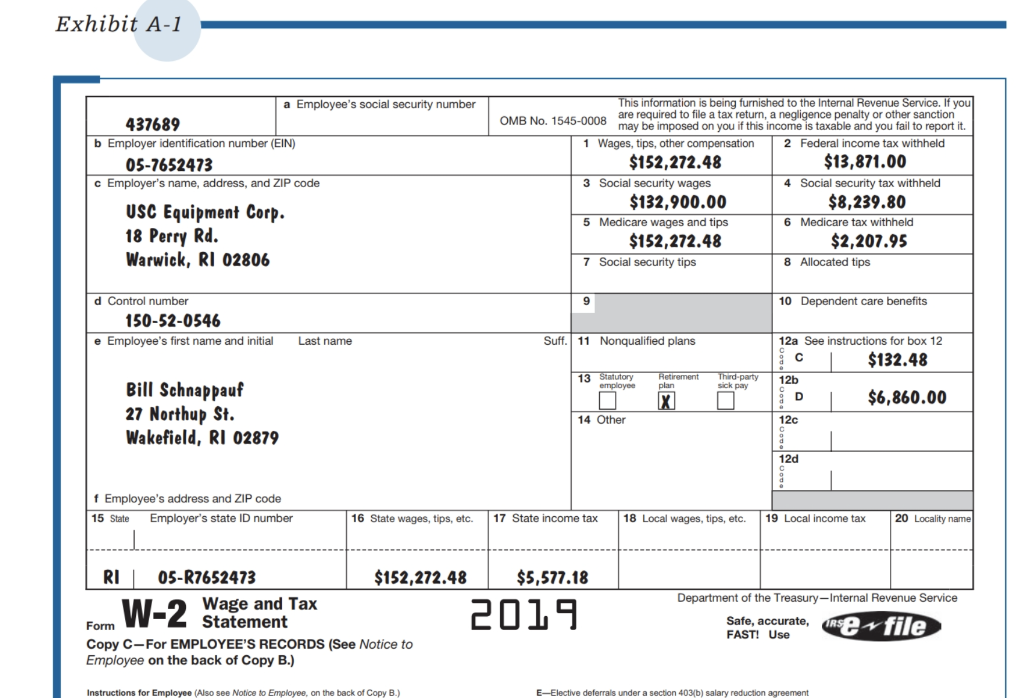

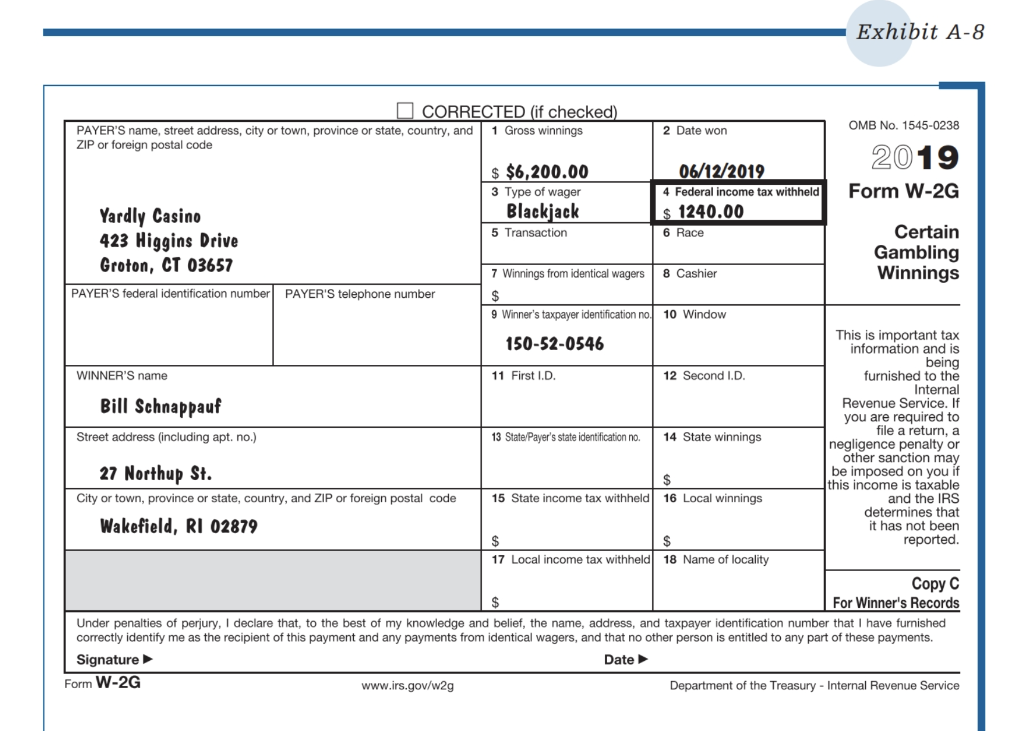

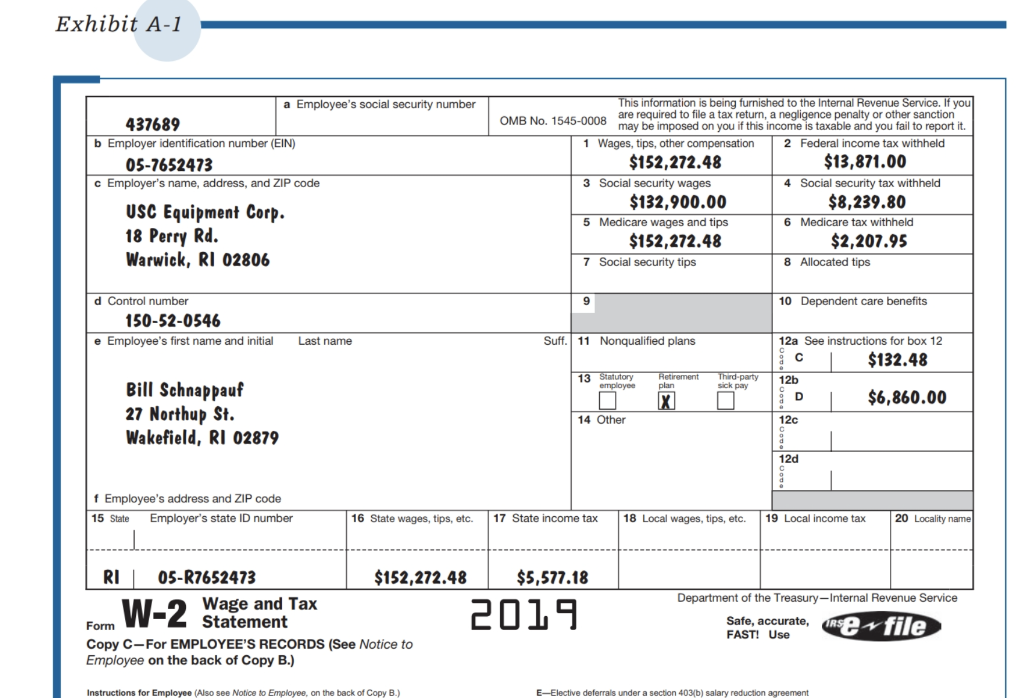

1. Bills W-2 is provided (Exhibit A-1). The 2019 W-2 includes his salary ($98,000), bonus ($61,000), and income from group-term life insurance coverage in excess of $50,000 ($132.48), and is reduced by his 7 percent contribution ($6,860) to USCs qualified pension plan. The company matches Bills contribution to the plan.

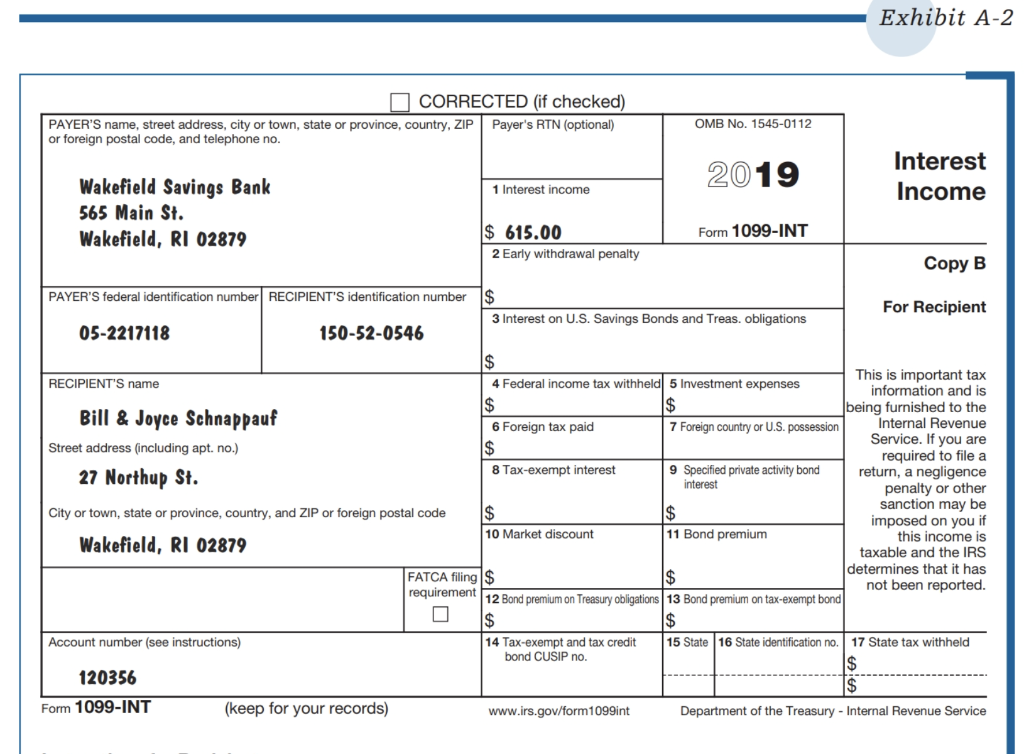

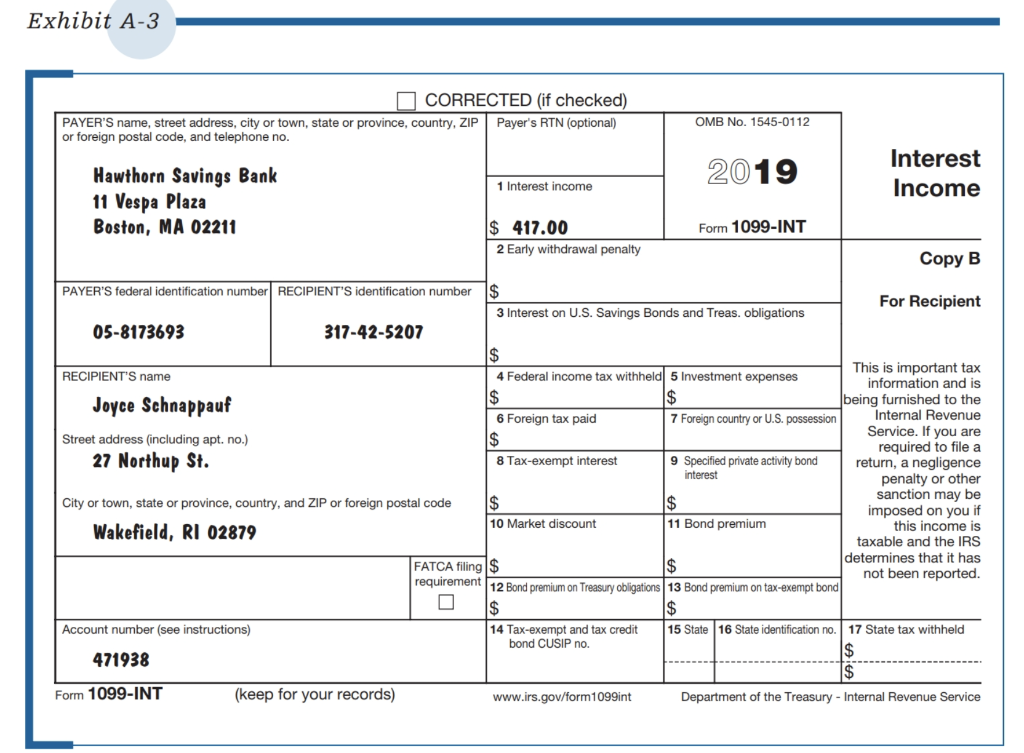

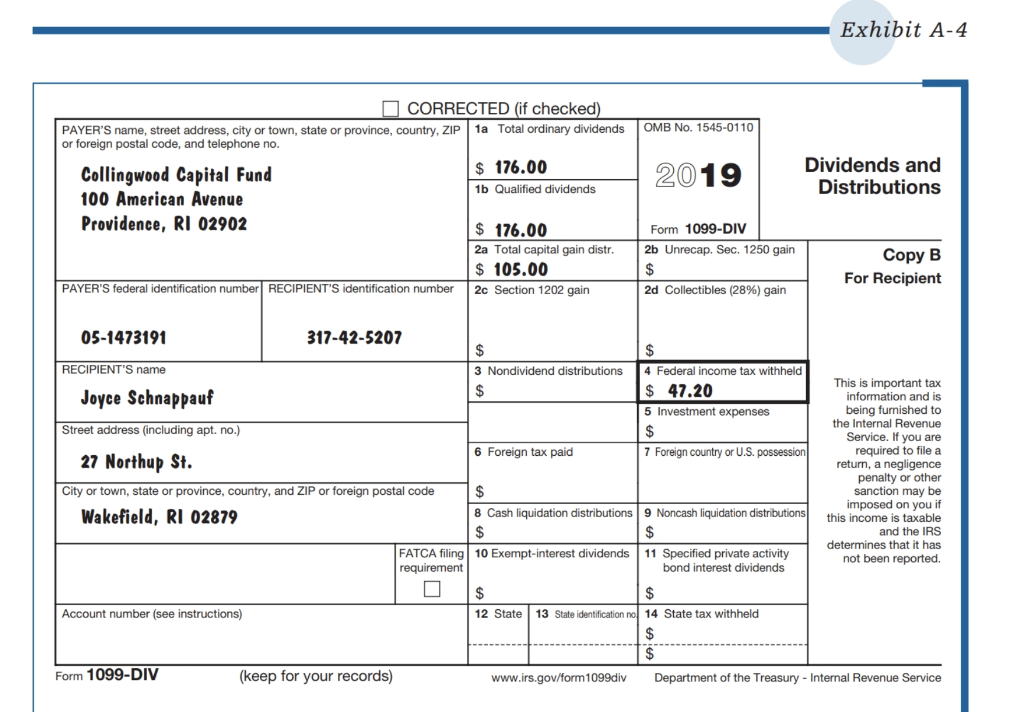

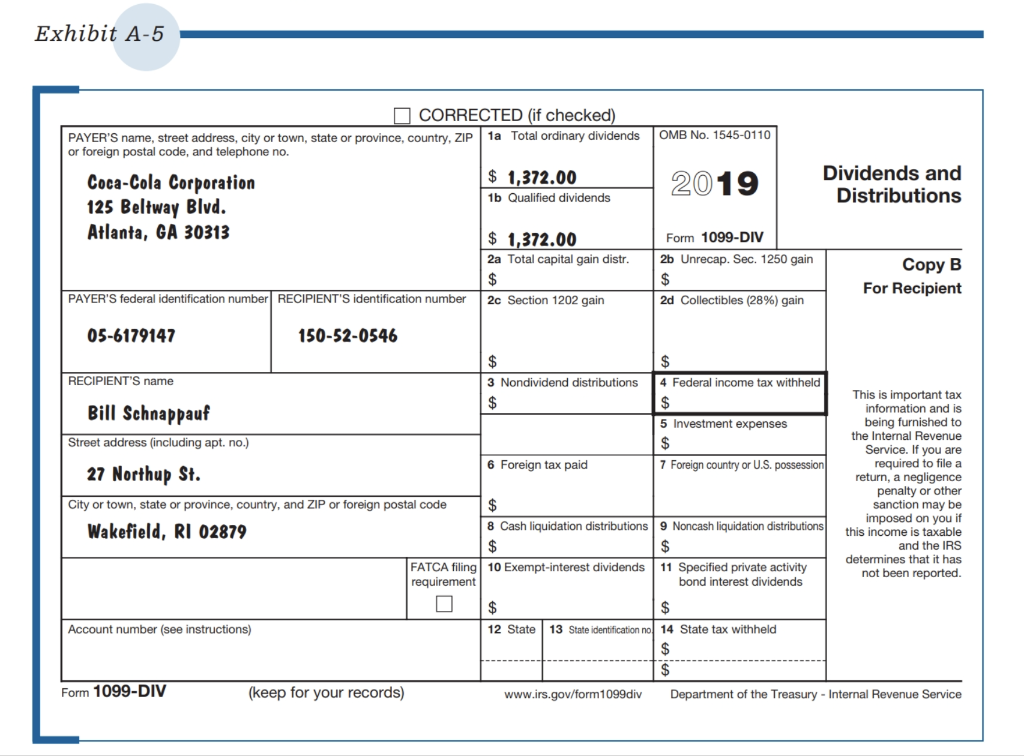

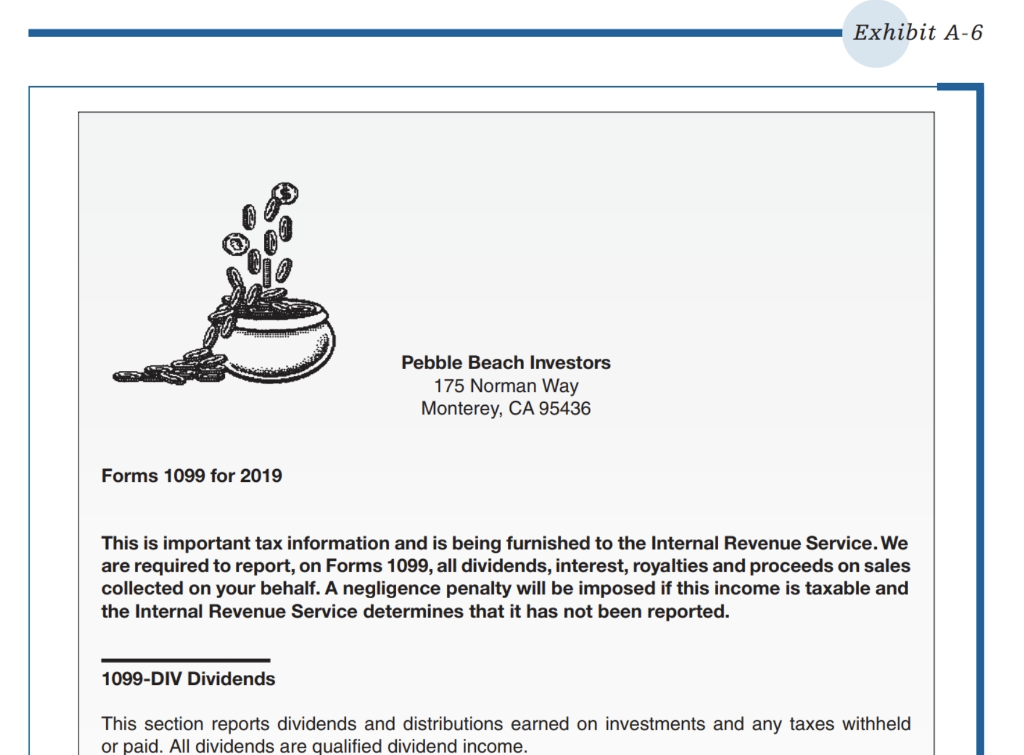

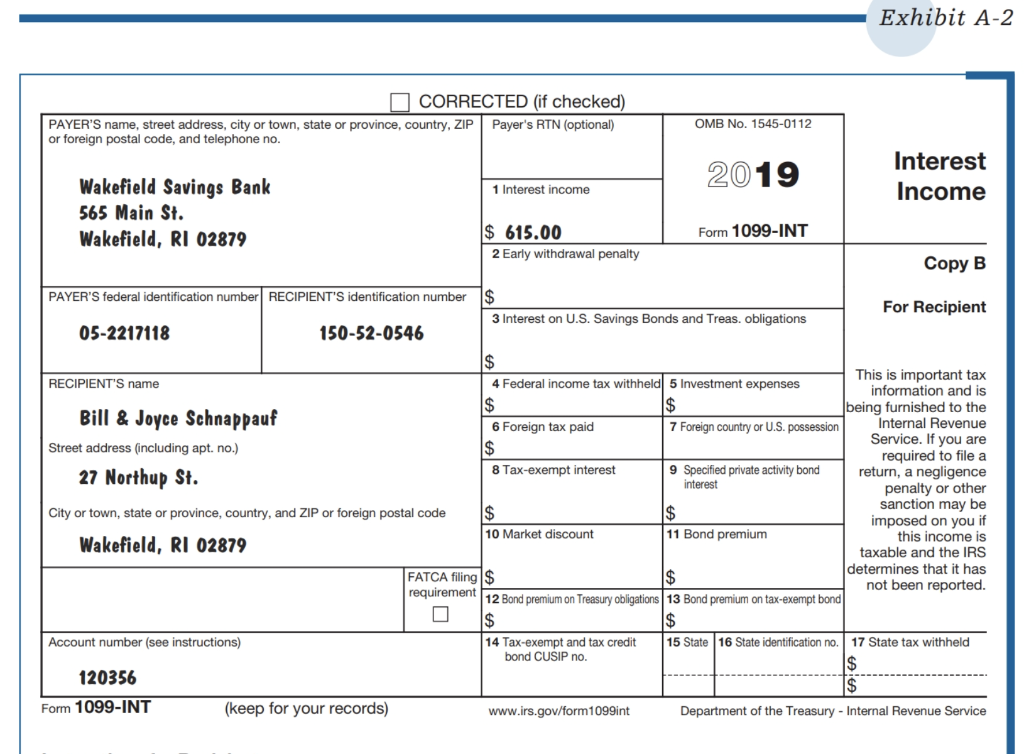

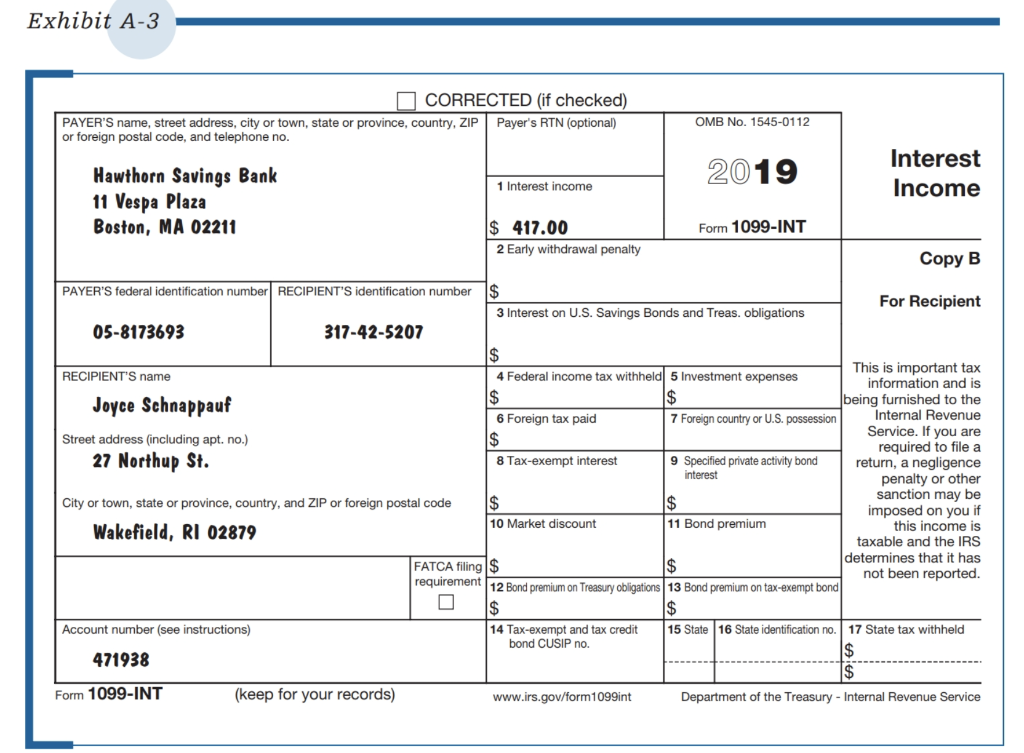

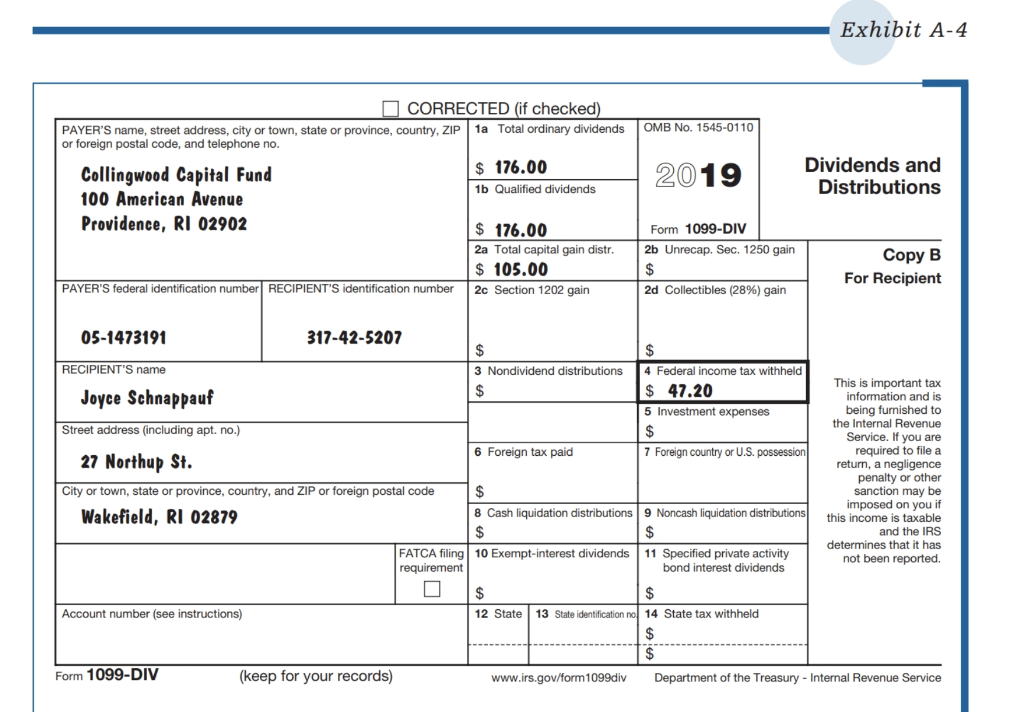

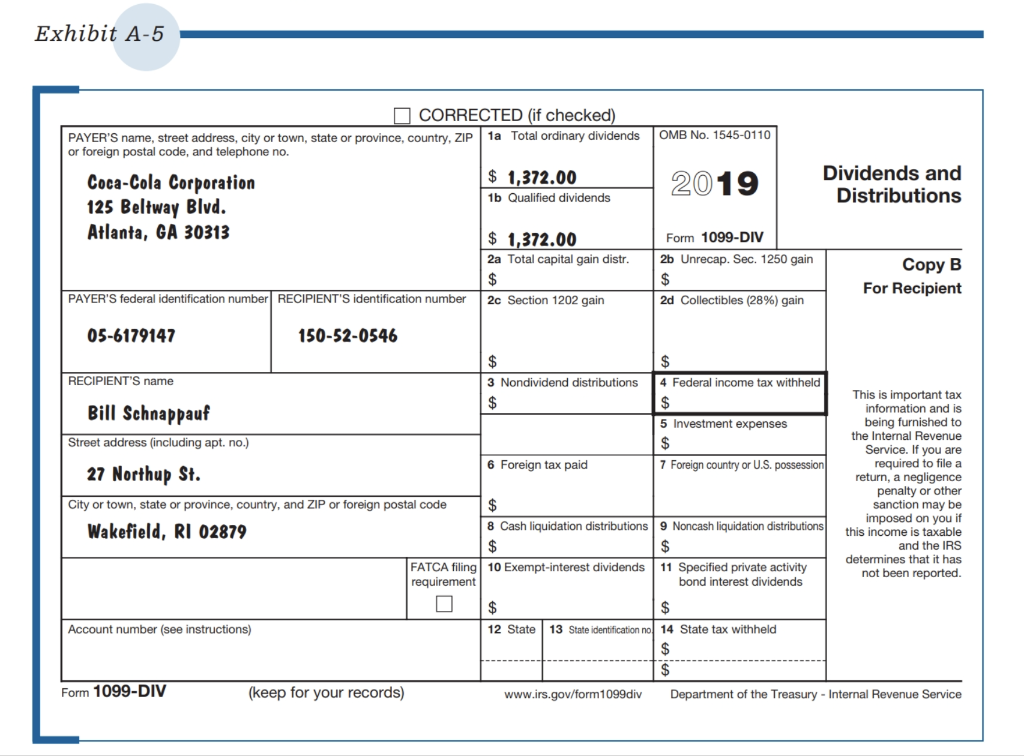

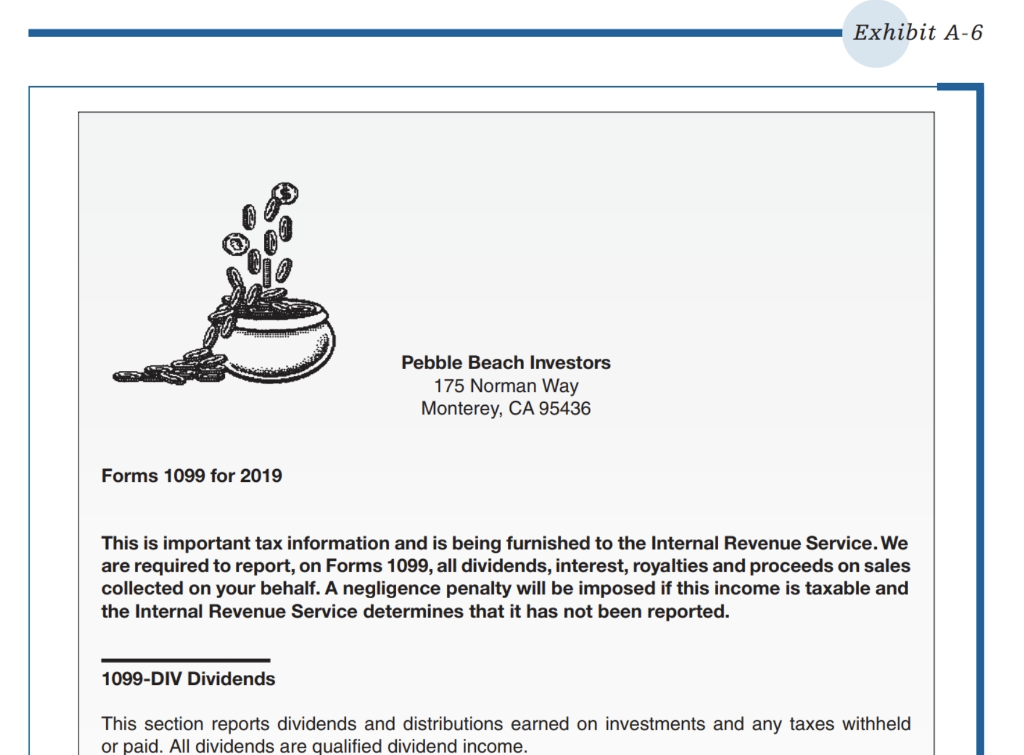

2. The Schnappaufs receive two 1099-INTs for interest (Exhibits A-2 and A-3), two 1099-DIVs for dividends (Exhibits A-4 and A-5), and a combined interest and dividend statement (Exhibit A-6).

3. Joyce and her brother, Bob, are co-owners of, and active participants in, a furniture-restoration business. Joyce owns 30 percent, and Bob owns 70 percent of the business. The business was formed as an S corporation in 2011. During 2019, the company pays $5,000 in dividends. The basis of Joyces stock is $33,000.

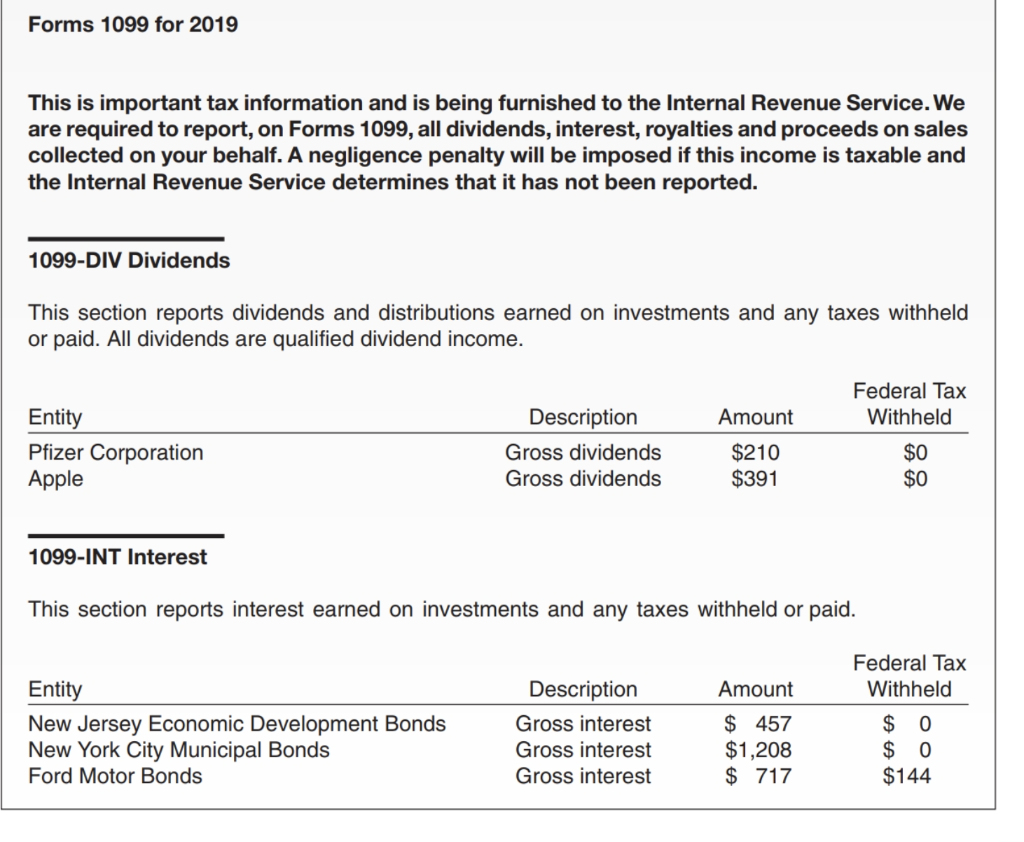

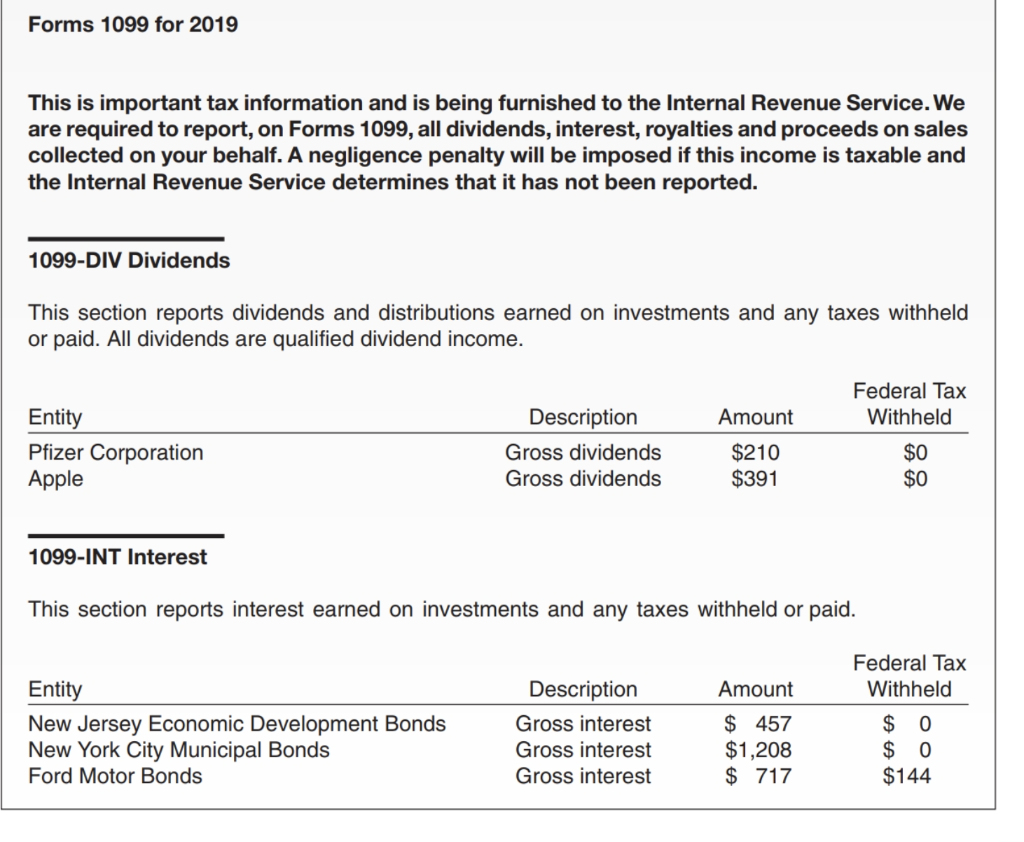

4. The Schnappaufs receive a 2018 federal income tax refund of $818 on May 12, 2019. On May 15, 2019, they receive their income tax refund from the state of Rhode Island. In January 2020, the state mails the Schnappaufs a Form 1099-G (Exhibit A-7). Their total itemized deductions in 2018 were $20,161.

5. During 2019, Joyce is the lucky ninety-third caller to a local radio station and wins $300 in cash and a Tablet. Despite repeated calls to the radio station, she has not received a Form 1099MISC. In announcing the prize, the radio station host said that the manufacturers suggested retail price for the Tablet is $720. However, Joyce has a catalog from Supersonic Electronics that advertises the Tablet for $595.

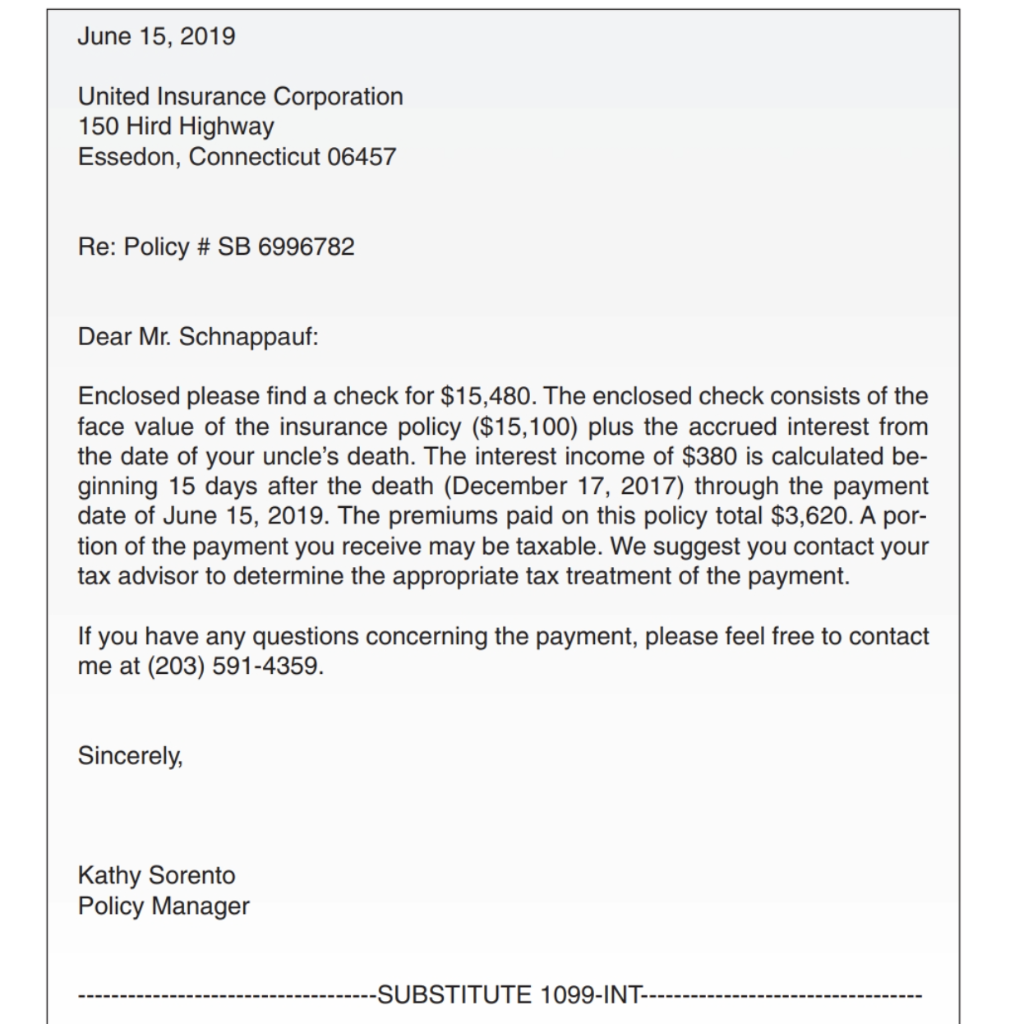

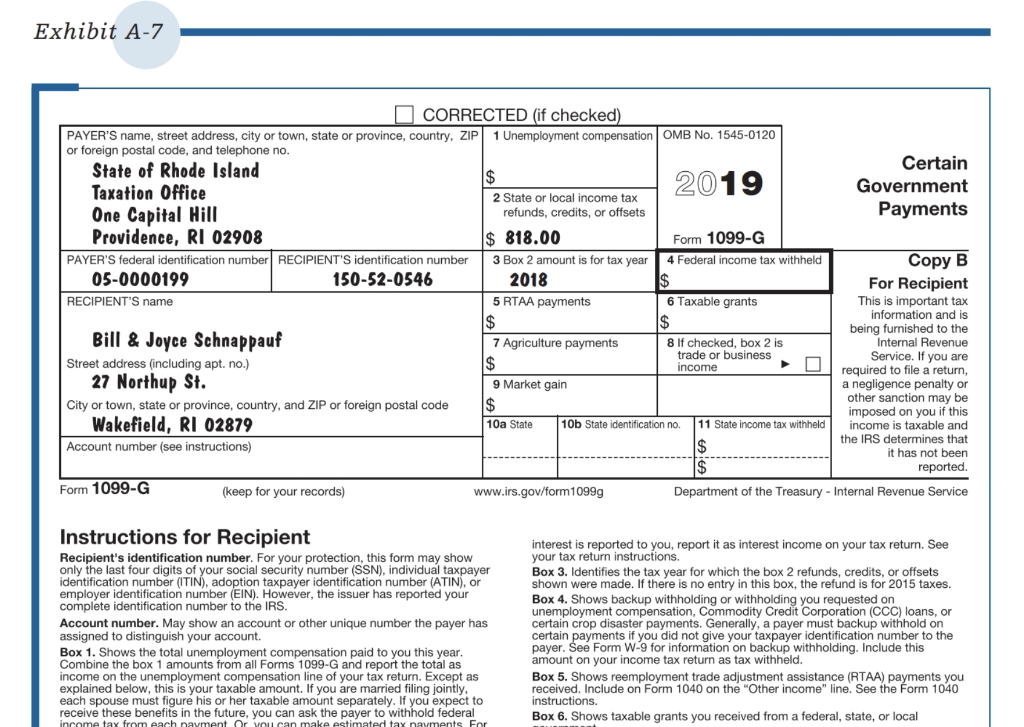

6. The Schnappaufs receive a Form W-2G (Exhibit A-8) for their winnings at the Yardley Casino in Connecticut.

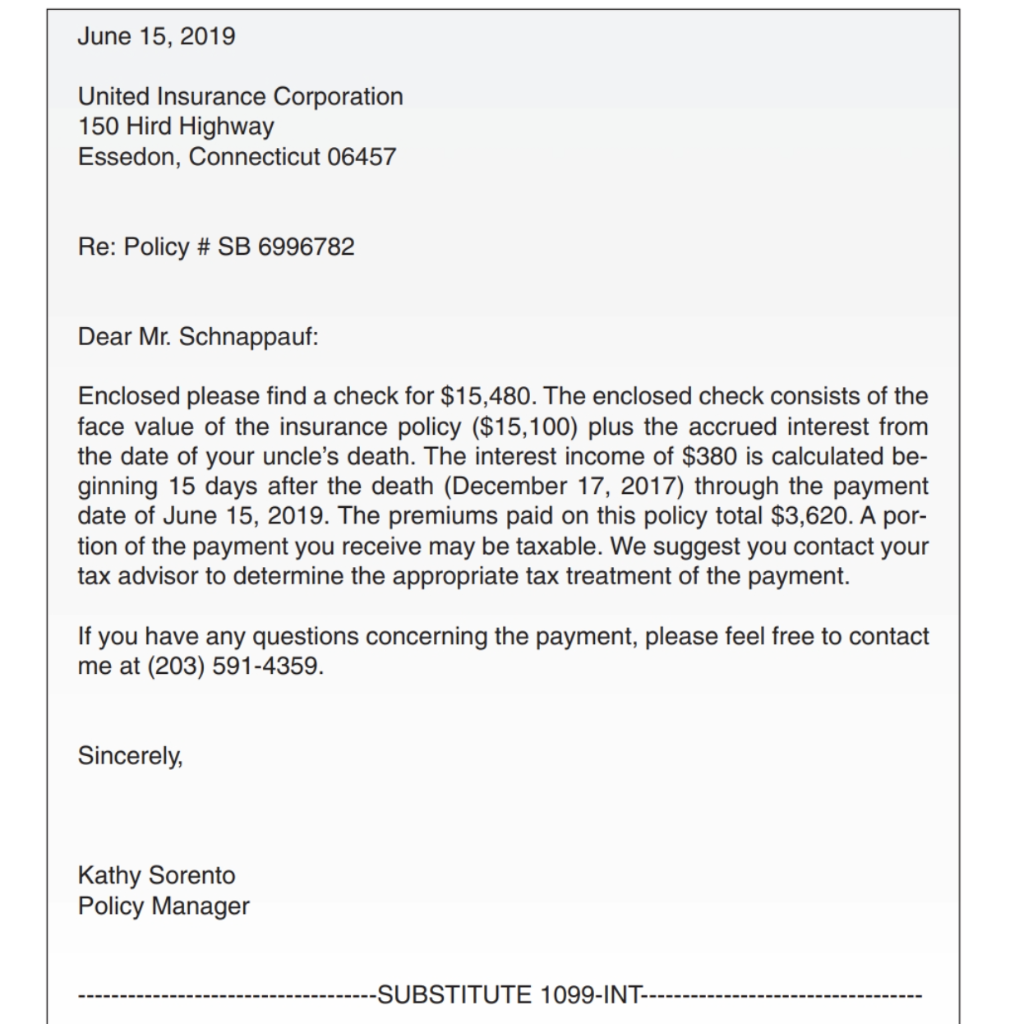

7. On June 26, 2019, Bill receives a check for $15,480 from the United Insurance Corporation. Though he was unaware of it, he was the designated beneficiary of an insurance policy on the life of his uncle. The policy had a maturity value of $15,100, and the letter from the company stated that his uncle had paid premiums on the policy of $3,620 (Exhibit A-9).

8. Joyce is active in the school PTO. During the year, she receives an award for outstanding service to the organization. She receives a plaque and two $125 gift certificates that were donated to the PTO by local merchants.

9. To complete phase I, you will need Form 1040, Schedule B, and Schedule D.

The only form that can be totaled is Schedule B. b. Only post the appropriate information to Schedule D. Do not total any columns. More information is provided in phase III of the tax return problem.

c. Do not calculate total income or adjusted gross income on page 1 of Form 1040. d. Post the appropriate information on page 2 of Form 1040, but do not total this page, compute the federal tax liability, or determine the refund or balance due.

Exhibit A-1 a Employee's social security number 437689 b Employer identification number (EIN) 05-7652473 c Employer's name, address, and ZIP code USC Equipment Corp. 18 Perry Rd. Warwick, RI 02806 This information is being furnished to the Internal Revenue Service. If you OMB No. 1545-0008 may be imposed on you if this income is taxable and you fail to report it. are required to file a tax return, a negligence penalty or other sanction 1 Wages, tips, other compensation 2 Federal income tax withheld $152,272.48 $13,871.00 3 Social security wages 4 Social security tax withheld $132,900.00 $8,239.80 5 Medicare wages and tips 6 Medicare tax withheld $152,272.48 $2,207.95 7 Social security tips 8 Allocated tips 9 10 Dependent care benefits d Control number 150-52-0546 e Employee's first name and initial Last name Suff. 11 Nonqualified plans 12a See instructions for box 12 $132.48 12b D $6,860.00 13 Statutory employee Retirement plan Third-party sick pay Bill Schnappauf 27 Northup St. Wakefield, RI 02879 14 Other 12c 12d f Employee's address and ZIP code 15 State Employer's state ID number 16 State wages, tips, etc. 17 State income tax 18 Local wages, tips, etc 19 Local income tax 20 Locality name $5,577.18 RI 05-R7652473 $152,272.48 Wage and Tax Statement Copy C-For EMPLOYEE'S RECORDS (See Notice to Employee on the back of Copy B.) W-2 2019 Department of the Treasury-Internal Revenue Service Safe, accurate, se file FAST! Use Form Instructions for Employee Also see Notice to Employee, on the back of Copy B.) E-Elective deferrals under a section 403/b) salary reduction agreement Exhibit A-2 CORRECTED (if checked) PAYER'S name, street address, city or town, state or province, country, ZIP Payer's RTN (optional) or foreign postal code, and telephone no. OMB No. 1545-0112 2019 Interest Income 1 Interest income Wakefield Savings Bank 565 Main St. Wakefield, RI 02879 Form 1099-INT $ 615.00 2 Early withdrawal penalty Copy B PAYER'S federal identification number RECIPIENT'S identification number $ For Recipient 3 Interest on U.S. Savings Bonds and Treas. obligations 05-2217118 150-52-0546 $ This is RECIPIENT'S name tax important 4 Federal income tax withheld 5 Investment expenses information and is $ $ being furnished to the Bill & Joyce Schnappauf 6 Foreign tax paid 7 Foreign country or U.S. possession Internal Revenue Service. If you are Street address (including apt. no.) $ required to file a 8 Tax-exempt interest 9 Specified private activity bond return, a negligence 27 Northup St. interest penalty or other sanction may be City or town, state or province, country, and ZIP or foreign postal code $ $ imposed on you it if 10 Market discount 11 Bond premium this income is Wakefield, RI 02879 taxable and the IRS FATCA filing $ determines that it has $ not been reported. requirement 12 Bond premium on Treasury obligations 13 Bond premium on tax-exempt bond $ $ Account number (see instructions) 14 Tax-exempt and tax credit 15 State 16 State identification no. 17 State tax withheld bond CUSIP no. 120356 Form 1099-INT (keep for your records) www.irs.gov/form1099int Department of the Treasury - Internal Revenue Service Exhibit A-3 CORRECTED (if checked) PAYER'S name, street address, city or town, state or province, country, ZIP Payer's RTN (optional) or foreign postal code, and telephone no. OMB No. 1545-0112 2019 Interest Income 1 Interest income Hawthorn Savings Bank 11 Vespa Plaza Boston, MA 02211 Form 1099-INT $ 417.00 2 Early withdrawal penalty Copy B PAYER'S federal identification number RECIPIENT'S identification number $ For Recipient 3 Interest on U.S. Savings Bonds and Treas. obligations 05-8173693 317-42-5207 $ This is important tax RECIPIENT'S name 4 Federal income tax withheld 5 Investment expenses information and is $ $ Joyce Schnappauf being furnished to the 6 Foreign tax paid 7 Foreign country or U.S. possession Internal Revenue Street address (including apt. no.) $ Service. If you are required to file a 27 Northup St. 8 Tax-exempt interest 9 Specified private activity bond return, a negligence interest penalty or other sanction may be City or town, state or province, country, and ZIP or foreign postal code $ $ imposed on you 10 Market discount 11 Bond premium this income is Wakefield, RI 02879 taxable and the IRS FATCA filing $ determines that it has $ not been reported. requirement 12 Bond premium on Treasury obligations 13 Bond premium on tax-exempt bond $ $ Account number (see instructions) 14 Tax-exempt and tax credit 15 State 16 State identification no. 17 State tax withheld bond CUSIP no. $ 471938 $ Form 1099-INT (keep for your records) www.irs.gov/form1099int Department of the Treasury - Internal Revenue Service Exhibit A-4 OMB No. 1545-0110 $ 176.00 2019 Dividends and Distributions CORRECTED (if checked) PAYER'S name, street address, city or town, state or province, country, ZIP 1a Total ordinary dividends or foreign postal code, and telephone no. Collingwood Capital Fund 1b Qualified dividends 100 American Avenue Providence, RI 02902 $ 176.00 2a Total capital gain distr. $ 105.00 PAYER'S federal identification number RECIPIENT'S identification number 2c Section 1202 gain Form 1099-DIV 2b Unrecap. Sec. 1250 gain $ 2d Collectibles (28%) gain Copy B For Recipient 05-1473191 317-42-5207 $ $ RECIPIENT'S name 3 Nondividend distributions 4 Federal income tax withheld $ $ 47.20 Joyce Schnappauf 5 Investment expenses Street address (including apt. no.) $ 6 Foreign tax paid 7 Foreign country or U.S. possession 27 Northup St. City or town, state or province, country, and ZIP or foreign postal code $ Wakefield, RI 02879 8 Cash liquidation distributions 9 Noncash liquidation distributions $ $ FATCA filing 10 Exempt-interest dividends 11 Specified private activity requirement bond interest dividends This is important tax information and is being furnished to the Internal Revenue Service. If you are required to file a return, a negligence penalty or other sanction may be imposed on you if this income is taxable and the IRS determines that it has not been reported. $ 12 State $ 13 State identification no 14 State tax withheld Account number (see instructions) Form 1099-DIV (keep for your records) www.irs.gov/form 1099div Department of the Treasury - Internal Revenue Service Exhibit A-5 OMB No. 1545-0110 CORRECTED (if checked) PAYER'S name, street address, city or town, state or province, country, ZIP 1a Total ordinary dividends or foreign postal code, and telephone no. Coca-Cola Corporation $ 1,372.00 1b Qualified dividends 125 Beltway Blvd. Atlanta, GA 30313 $ 1,372.00 2a Total capital gain distr. 2019 Dividends and Distributions Form 1099-DIV $ 2c Section 1202 gain 2b Unrecap. Sec. 1250 gain $ 2d Collectibles (28%) gain Copy B For Recipient PAYER'S federal identification number RECIPIENT'S identification number Bill Schnappauf 05-6179147 150-52-0546 $ $ RECIPIENT'S name 3 Nondividend distributions 4 Federal income tax withheld $ $ 5 Investment expenses Street address (including apt. no.) $ 6 Foreign tax paid 7 Foreign country or U.S. possession 27 Northup St. City or town, state or province, country, and ZIP or foreign postal code $ Wakefield, RI 02879 8 Cash liquidation distributions | 9 Noncash liquidation distributions $ $ FATCA filing 10 Exempt-interest dividends 11 Specified private activity requirement bond interest dividends This is important tax information and is being furnished to the Internal Revenue Service. If you are required to file a return, a negligence penalty or other sanction may be imposed on you if this income is taxable and the IRS determines that it has not been reported. $ 12 State Account number (see instructions) $ 13 State identification no. 14 State tax withheld $ $ Form 1099-DIV (keep for your records) www.irs.gov/form1099div Department of the Treasury - Internal Revenue Service Exhibit A-6 Pebble Beach Investors 175 Norman Way Monterey, CA 95436 Forms 1099 for 2019 This is important tax information and is being furnished to the Internal Revenue Service. We are required to report, on Forms 1099, all dividends, interest, royalties and proceeds on sales collected on your behalf. A negligence penalty will be imposed if this income is taxable and the Internal Revenue Service determines that it has not been reported. 1099-DIV Dividends This section reports dividends and distributions earned on investments and any taxes withheld or paid. All dividends are qualified dividend income. Forms 1099 for 2019 This is important tax information and is being furnished to the Internal Revenue Service. We are required to report, on Forms 1099, all dividends, interest, royalties and proceeds on sales collected on your behalf. A negligence penalty will be imposed if this income is taxable and the Internal Revenue Service determines that it has not been reported. 1099-DIV Dividends This section reports dividends and distributions earned on investments and any taxes withheld or paid. All dividends are qualified dividend income. Federal Tax Withheld Entity Pfizer Corporation Description Gross dividends Gross dividends Amount $210 $391 $0 $0 Apple 1099-INT Interest This section reports interest earned on investments and any taxes withheld or paid. Federal Tax Withheld Amount Entity New Jersey Economic Development Bonds New York City Municipal Bonds Ford Motor Bonds Description Gross interest Gross interest Gross interest $ 457 $1,208 $ 717 $ 0 $ 0 $144 Exhibit A-7 2019 CORRECTED (if checked) PAYER'S name, street address, city or town, state or province, country, ZIP 1 Unemployment compensation OMB No. 1545-0120 or foreign postal code, and telephone no. State of Rhode Island Certain $ Taxation Office Government 2 State or local income tax One Capital Hill refunds, credits, or offsets Payments Providence, RI 02908 $ 818.00 Form 1099-G PAYER'S federal identification number RECIPIENT'S identification number 3 Box 2 amount is for tax year 4 Federal income tax withheld Copy B 05-0000199 150-52-0546 2018 $ For Recipient RECIPIENT'S name 5 RTAA payments 6 Taxable grants This is important tax information and is $ $ being furnished to the Bill & Joyce Schnappauf 7 Agriculture payments 8 If checked, box 2 is Internal Revenue trade or business Service. If you are Street address (including apt. no.) $ income required to file a return, 27 Northup St. 9 Market gain a negligence penalty or other sanction may be City or town, state or province, country, and ZIP or foreign postal code $ imposed on you if this Wakefield, RI 02879 10a State 10b State identification no. 11 State income tax withheld income is taxable and the IRS determines that Account number (see instructions) it has not been reported. Form 1099-G (keep for your records) www.irs.gov/form10999 Department of the Treasury - Internal Revenue Service Instructions for Recipient Recipient's identification number. For your protection, this form may show only the last four digits of your social security number (SSN), individual taxpayer identification number (TIN), adoption taxpayer identification number (ATIN), or employer identification number (EIN). However, the issuer has reported your complete identification number to the IRS. Account number. May show an account or other unique number the payer has assigned to distinguish your account. Box 1. Shows the total unemployment compensation paid to you this year. Combine the box 1 amounts from all Forms 1099-G and report the total as income on the unemployment compensation line of your tax return. Except as explained below, this is your taxable amount. If you are married filing jointly, each spouse must figure his or her taxable amount separately. If you expect to receive these benefits in the future, you can ask the payer to withhold federal income tax from each payment Or you can make estimated tax payments For interest is reported to you, report it as interest income on your tax return. See your tax return instructions. Box 3. Identifies the tax year for which the box 2 refunds, credits, or offsets shown were made. If there is no entry in this box, the refund is for 2015 taxes. Box 4. Shows backup withholding or withholding you requested on unemployment compensation, Commodity Credit Corporation (CCC) loans, or certain crop disaster payments. Generally, a payer must backup withhold on certain payments if you did not give your taxpayer identification number to the payer. See Form W-9 for information on backup withholding. Include this amount on your income tax return as tax withheld. Box 5. Shows reemployment trade adjustment assistance (RTAA) payments you received. Include on Form 1040 on the "Other income" line. See the form 1040 instructions. Box 6. Shows taxable grants you received from a federal, state, or local Exhibit A-8 O CORRECTED (if checked) PAYER'S name, street address, city or town, province or state, country, and 1 Gross winnings 2 Date won OMB No. 1545-0238 ZIP or foreign postal code 2019 $ $6,200.00 06/12/2012 3 Type of wager 4 Federal income tax withheld Form W-2G Yardly Casino Blackjack s 1240.00 5 Transaction 6 Race Certain 423 Higgins Drive Gambling Groton, CT 03657 7 Winnings from identical wagers 8 Cashier Winnings PAYER'S federal identification number PAYER'S telephone number $ 9 Winner's taxpayer identification no. 10 Window This is important tax 150-52-0546 information and is being WINNER'S name 11 First I.D 12 Second I.D. furnished to the Internal Bill Schnappauf Revenue Service. If you are required to file a return, a Street address (including apt. no.) 13 State/Payer's state identification no. 14 State winnings negligence penalty or other sanction may 27 Northup St. be imposed on you if $ this income is taxable City or town, province or state, country, and ZIP or foreign postal code 15 State income tax withheld 16 Local winnings and the IRS determines that Wakefield, RI 02879 it has not been $ $ reported. 17 Local income tax withheld 18 Name of locality S Copy C For Winner's Records Under penalties of perjury, I declare that, to the best of my knowledge and belief, the name, address, and taxpayer identification number that I have furnished correctly identify me as the recipient of this payment and any payments from identical wagers, and that no other person is entitled to any part of these payments. Signature Date Form W-2G www.irs.gov/w2g Department of the Treasury - Internal Revenue Service June 15, 2019 United Insurance Corporation 150 Hird Highway Essedon, Connecticut 06457 Re: Policy # SB 6996782 Dear Mr. Schnappauf: Enclosed please find a check for $15,480. The enclosed check consists of the face value of the insurance policy ($15,100) plus the accrued interest from the date of your uncle's death. The interest income of $380 is calculated be- ginning 15 days after the death (December 17, 2017) through the payment date of June 15, 2019. The premiums paid on this policy total $3,620. A por- tion of the payment you receive may be taxable. We suggest you contact your tax advisor to determine the appropriate tax treatment of the payment. If you have any questions concerning the payment, please feel free to contact me at (203) 591-4359. Sincerely, Kathy Sorento Policy Manager -SUBSTITUTE 1099-INT