Answered step by step

Verified Expert Solution

Question

1 Approved Answer

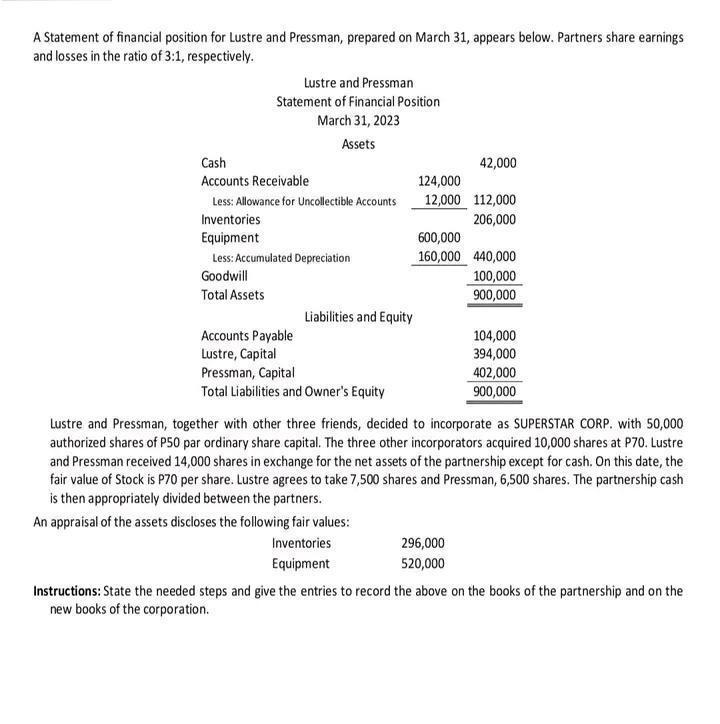

A Statement of financial position for Lustre and Pressman, prepared on March 31, appears below. Partners share earnings and losses in the ratio of

A Statement of financial position for Lustre and Pressman, prepared on March 31, appears below. Partners share earnings and losses in the ratio of 3:1, respectively. Lustre and Pressman Statement of Financial Position March 31, 2023 Assets Cash Accounts Receivable Less: Allowance for Uncollectible Accounts Inventories Equipment Less: Accumulated Depreciation Goodwill Total Assets Liabilities and Equity Accounts Payable Lustre, Capital Pressman, Capital Total Liabilities and Owner's Equity An appraisal of the assets discloses the following fair values: Inventories Equipment 42,000 124,000 12,000 112,000 206,000 600,000 160,000 440,000 296,000 520,000 100,000 900,000 Lustre and Pressman, together with other three friends, decided to incorporate as SUPERSTAR CORP. with 50,000 authorized shares of P50 par ordinary share capital. The three other incorporators acquired 10,000 shares at P70. Lustre and Pressman received 14,000 shares in exchange for the net assets of the partnership except for cash. On this date, the fair value of Stock is P70 per share. Lustre agrees to take 7,500 shares and Pressman, 6,500 shares. The partnership cash is then appropriately divided between the partners. 104,000 394,000 402,000 900,000 Instructions: State the needed steps and give the entries to record the above on the books of the partnership and on the new books of the corporation.

Step by Step Solution

★★★★★

3.43 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Answer Answer To record the conversion of the partnership Lustre and Pressman into Superstar Corp th...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started