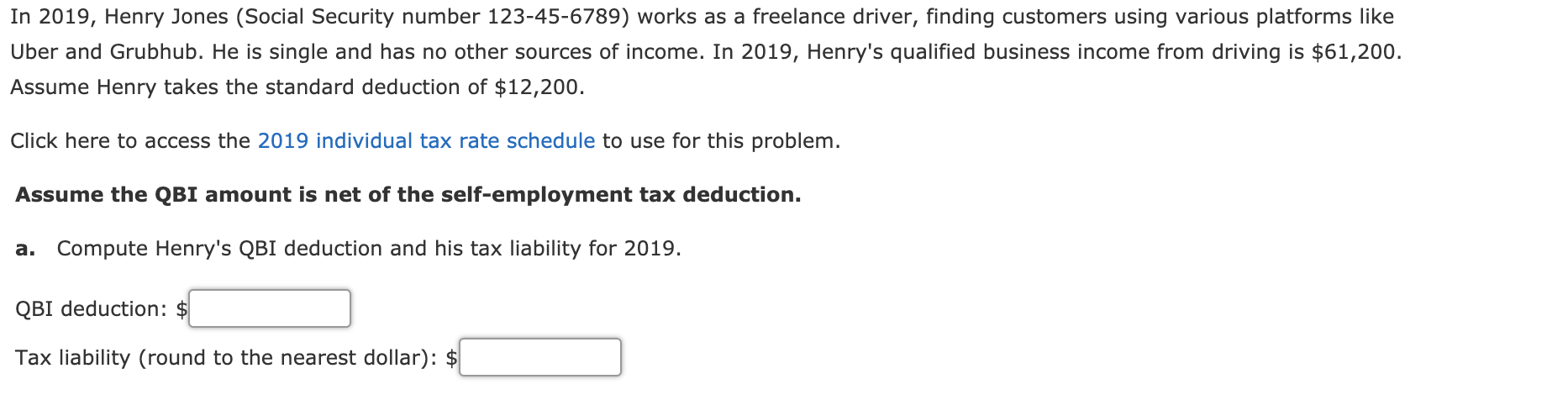

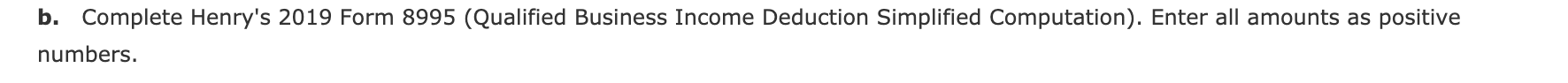

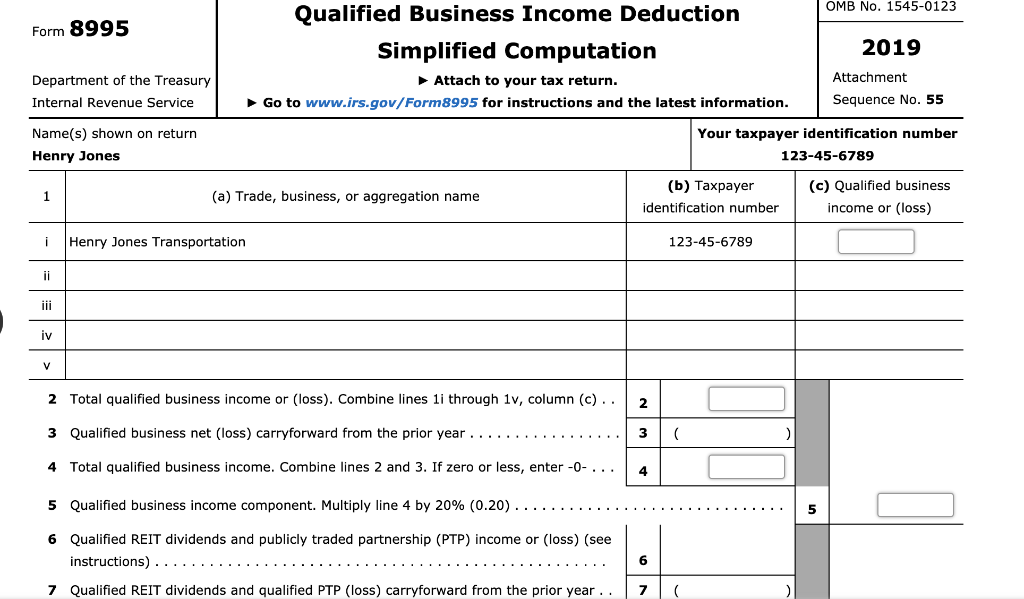

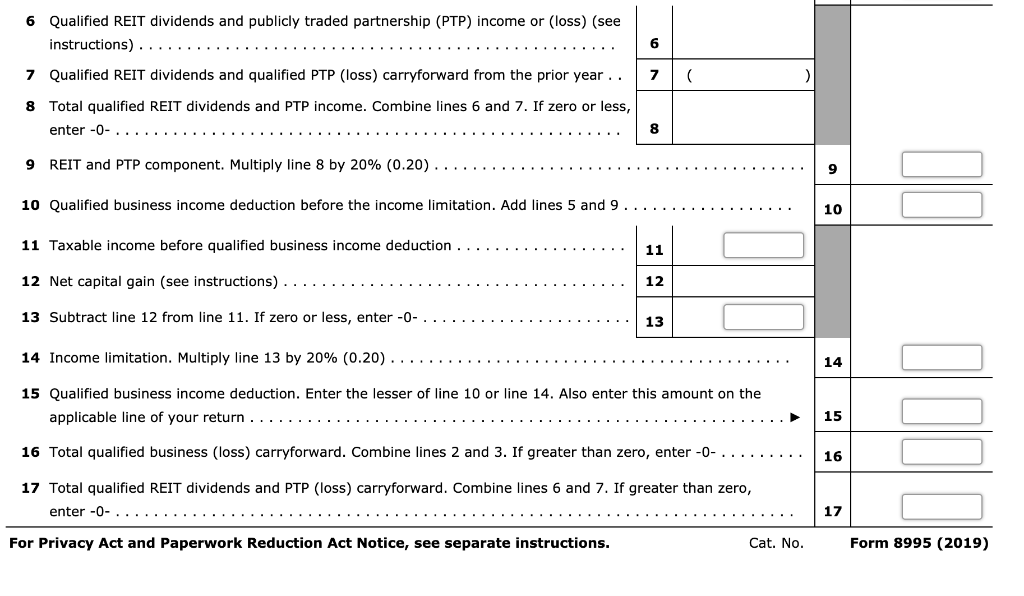

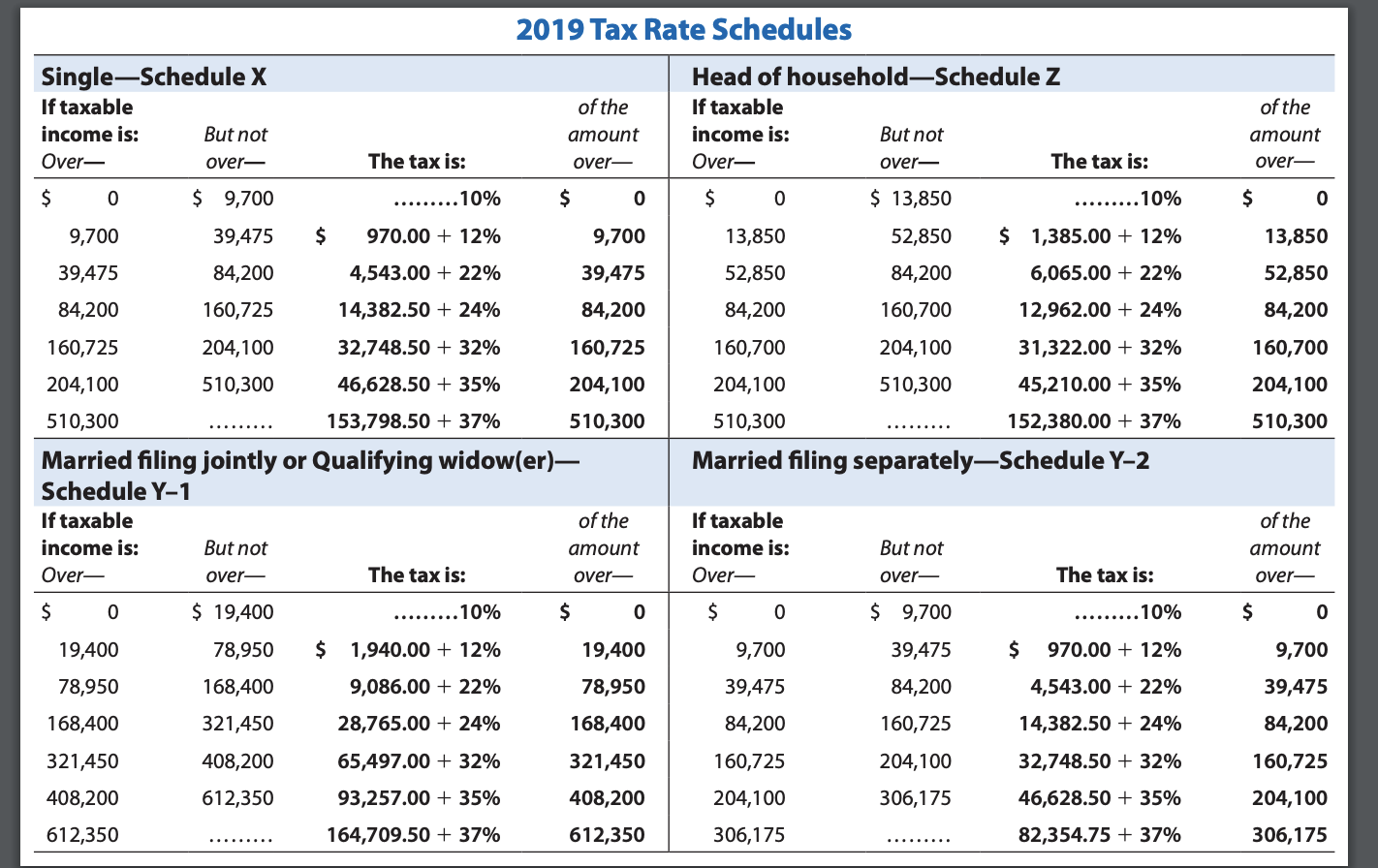

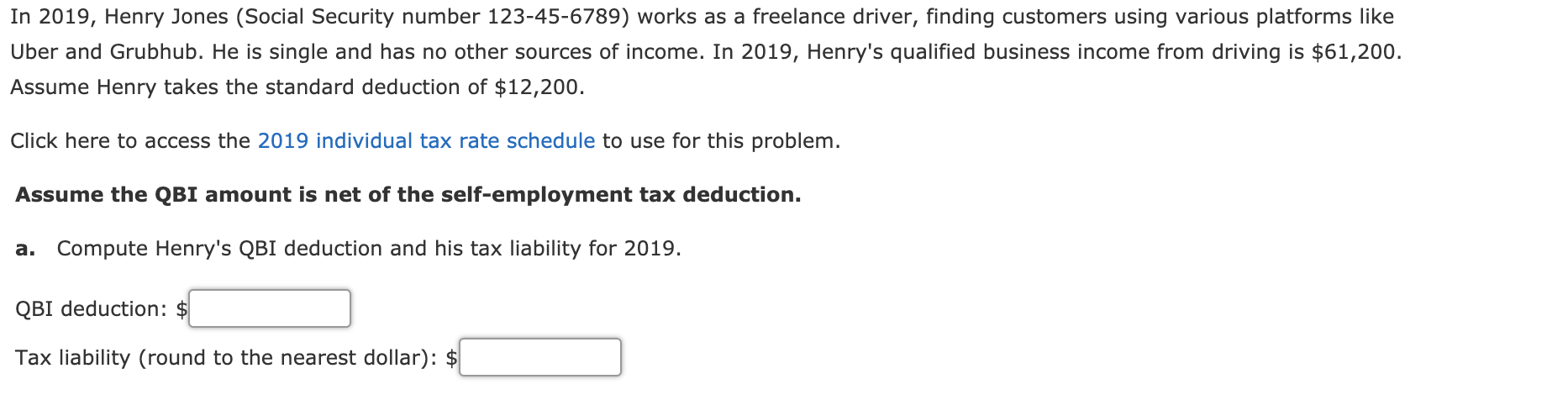

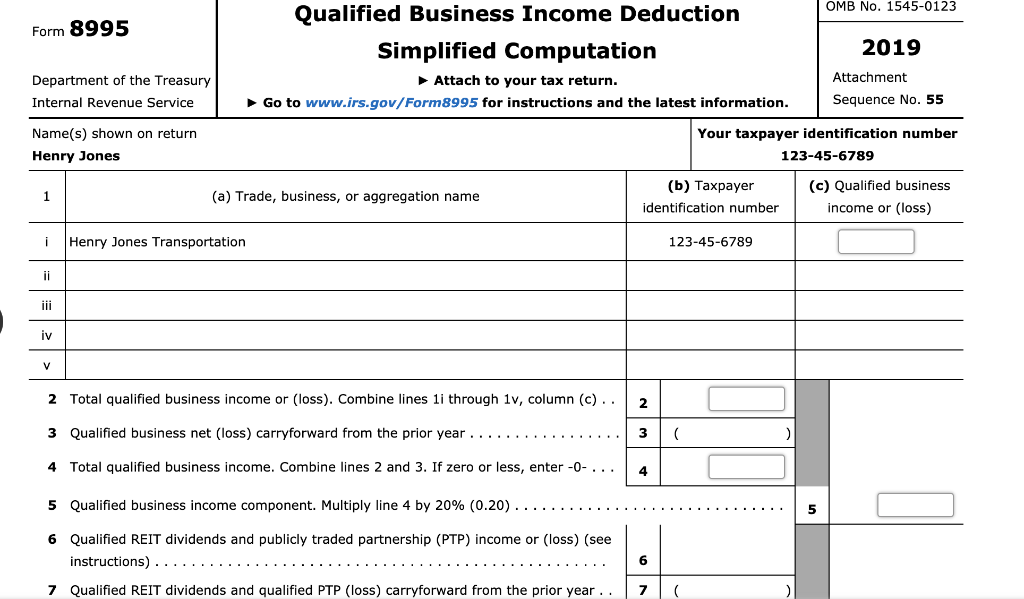

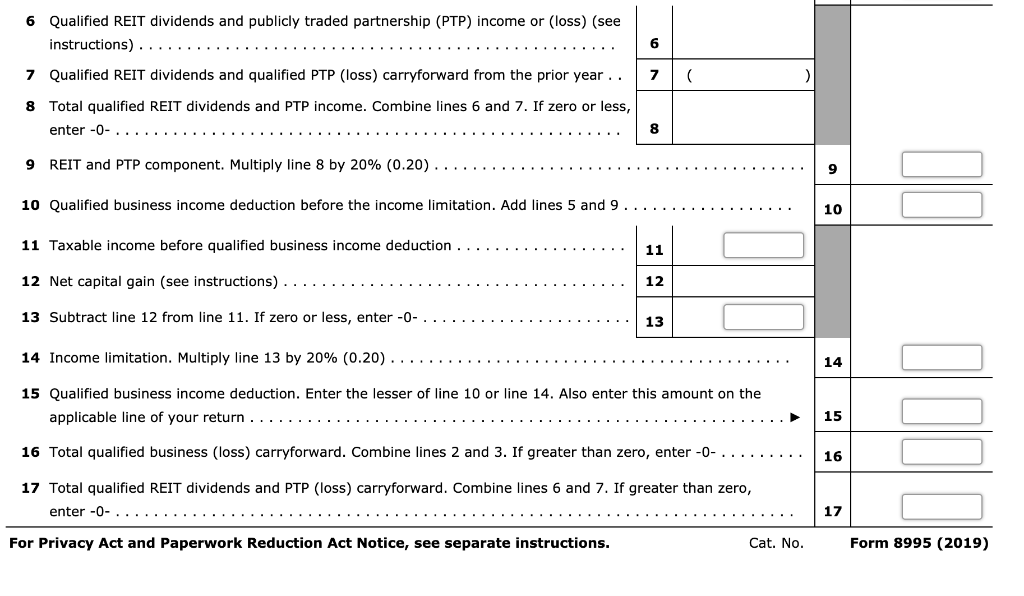

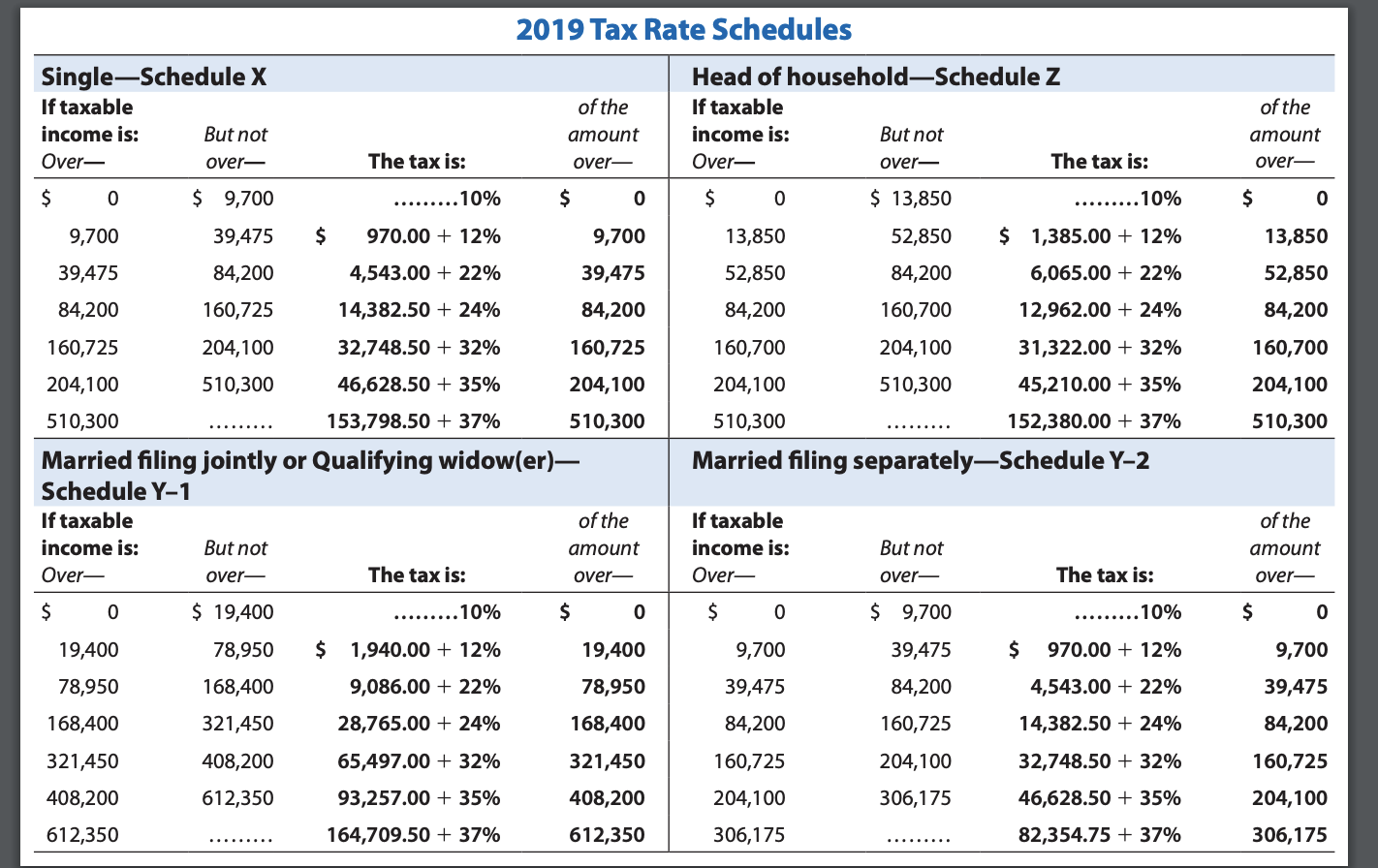

In 2019, Henry Jones (Social Security number 123-45-6789) works as a freelance driver, finding customers using various platforms like Uber and Grubhub. He is single and has no other sources of income. In 2019, Henry's qualified business income from driving is $61,200. Assume Henry takes the standard deduction of $12,200. Click here to access the 2019 individual tax rate schedule to use for this problem. Assume the QBI amount is net of the self-employment tax deduction. a. Compute Henry's QBI deduction and his tax liability for 2019. QBI deduction: Tax liability (round to the nearest dollar): $ b. Complete Henry's 2019 Form 8995 (Qualified Business Income Deduction Simplified Computation). Enter all amounts as positive numbers. OMB No. 1545-0123 Form 8995 Qualified Business Income Deduction Simplified Computation Attach to your tax return. Go to www.irs.gov/Form8995 for instructions and the latest information. 2019 Department of the Treasury Internal Revenue Service Attachment Sequence No. 55 Name(s) shown on return Henry Jones Your taxpayer identification number 123-45-6789 1 (a) Trade, business, or aggregation name (b) Taxpayer identification number (c) Qualified business income or (loss) i Henry Jones Transportation 123-45-6789 ii iv V 2 Total qualified business income or (loss). Combine lines li through 1v, column (c).. 2 3 Qualified business net (loss) carryforward from the prior year. 3 ( 4 Total qualified business income. Combine lines 2 and 3. If zero or less, enter-O-. 4 5 Qualified business income component. Multiply line 4 by 20% (0.20). 5 6 Qualified REIT dividends and publicly traded partnership (PTP) income or (loss) (see instructions) 7 Qualified REIT dividends and qualified PTP (loss) carryforward from the prior year.. 6 7 6 6 Qualified REIT dividends and publicly traded partnership (PTP) income or (loss) (see instructions) 7 Qualified REIT dividends and qualified PTP (loss) carryforward from the prior year . . 7 ( 8 Total qualified REIT dividends and PTP income. Combine lines 6 and 7. If zero or less, enter -O- 8 9 REIT and PTP component. Multiply line 8 by 20% (0.20). 9 10 Qualified business income deduction before the income limitation. Add lines 5 and 9 10 11 Taxable income before qualified business income deduction .. 11 12 Net capital gain (see instructions). 12 13 Subtract line 12 from line 11. If zero or less, enter -O- 13 14 Income limitation. Multiply line 13 by 20% (0.20) 14 15 Qualified business income deduction. Enter the lesser of line 10 or line 14. Also enter this amount on the applicable line of your return 15 ODDD 16 Total qualified business (loss) carryforward. Combine lines 2 and 3. If greater than zero, enter -0- 16 17 Total qualified REIT dividends and PTP (loss) carryforward. Combine lines 6 and 7. If greater than zero, enter -0-...... 17 For Privacy Act and Paperwork Reduction Act Notice, see separate instructions. Cat. No. Form 8995 (2019) 2019 Tax Rate Schedules Single-Schedule X If taxable income is: But not Over- over- of the amount Head of householdSchedule Z If taxable income is: But not Over- over- The tax is: of the amount over- The tax is: over- $ 0 $ 9,700 .........10% $ 0 $ 0 $ 13,850 ......... 10% $ 0 13,850 52,850 9,700 39,475 $ 970.00 + 12% 9,700 39,475 84,200 4,543.00 + 22% 39,475 84,200 160,725 14,382.50 + 24% 84,200 160,725 204,100 32,748.50 + 32% 160,725 204,100 510,300 46,628.50 + 35% 204,100 510,300 153,798.50 + 37% 510,300 Married filing jointly or Qualifying widow(er)- Schedule Y-1 If taxable of the income is: But not amount Over- over- The tax is: over- $ 0 $ 19,400 ......... 10% $ 0 13,850 52,850 $ 1,385.00 + 12% 52,850 84,200 6,065.00 + 22% 84,200 160,700 12,962.00 + 24% 160,700 204,100 31,322.00 + 32% 204,100 510,300 45,210.00 + 35% 510,300 152,380.00 + 37% Married filing separatelySchedule Y-2 84,200 160,700 204,100 510,300 If taxable income is: Over- of the amount But not over- The tax is: over- $ 0 $ 9,700 .........10% $ 0 $ 1,940.00 + 12% 9,700 $ 970.00 + 12% 9,700 19,400 78,950 78,950 168,400 19,400 78,950 39,475 84,200 39,475 4,543.00 + 22% 39,475 9,086.00 + 22% 28,765.00 + 24% 168,400 321,450 168,400 84,200 160,725 14,382.50 + 24% 84,200 321,450 408,200 65,497.00 + 32% 321,450 160,725 204,100 32,748.50 + 32% 160,725 408,200 612,350 93,257.00 + 35% 408,200 204,100 306,175 46,628.50 + 35% 204,100 306,175 612,350 164,709.50 + 37% 612,350 306,175 82,354.75 + 37% In 2019, Henry Jones (Social Security number 123-45-6789) works as a freelance driver, finding customers using various platforms like Uber and Grubhub. He is single and has no other sources of income. In 2019, Henry's qualified business income from driving is $61,200. Assume Henry takes the standard deduction of $12,200. Click here to access the 2019 individual tax rate schedule to use for this problem. Assume the QBI amount is net of the self-employment tax deduction. a. Compute Henry's QBI deduction and his tax liability for 2019. QBI deduction: Tax liability (round to the nearest dollar): $ b. Complete Henry's 2019 Form 8995 (Qualified Business Income Deduction Simplified Computation). Enter all amounts as positive numbers. OMB No. 1545-0123 Form 8995 Qualified Business Income Deduction Simplified Computation Attach to your tax return. Go to www.irs.gov/Form8995 for instructions and the latest information. 2019 Department of the Treasury Internal Revenue Service Attachment Sequence No. 55 Name(s) shown on return Henry Jones Your taxpayer identification number 123-45-6789 1 (a) Trade, business, or aggregation name (b) Taxpayer identification number (c) Qualified business income or (loss) i Henry Jones Transportation 123-45-6789 ii iv V 2 Total qualified business income or (loss). Combine lines li through 1v, column (c).. 2 3 Qualified business net (loss) carryforward from the prior year. 3 ( 4 Total qualified business income. Combine lines 2 and 3. If zero or less, enter-O-. 4 5 Qualified business income component. Multiply line 4 by 20% (0.20). 5 6 Qualified REIT dividends and publicly traded partnership (PTP) income or (loss) (see instructions) 7 Qualified REIT dividends and qualified PTP (loss) carryforward from the prior year.. 6 7 6 6 Qualified REIT dividends and publicly traded partnership (PTP) income or (loss) (see instructions) 7 Qualified REIT dividends and qualified PTP (loss) carryforward from the prior year . . 7 ( 8 Total qualified REIT dividends and PTP income. Combine lines 6 and 7. If zero or less, enter -O- 8 9 REIT and PTP component. Multiply line 8 by 20% (0.20). 9 10 Qualified business income deduction before the income limitation. Add lines 5 and 9 10 11 Taxable income before qualified business income deduction .. 11 12 Net capital gain (see instructions). 12 13 Subtract line 12 from line 11. If zero or less, enter -O- 13 14 Income limitation. Multiply line 13 by 20% (0.20) 14 15 Qualified business income deduction. Enter the lesser of line 10 or line 14. Also enter this amount on the applicable line of your return 15 ODDD 16 Total qualified business (loss) carryforward. Combine lines 2 and 3. If greater than zero, enter -0- 16 17 Total qualified REIT dividends and PTP (loss) carryforward. Combine lines 6 and 7. If greater than zero, enter -0-...... 17 For Privacy Act and Paperwork Reduction Act Notice, see separate instructions. Cat. No. Form 8995 (2019) 2019 Tax Rate Schedules Single-Schedule X If taxable income is: But not Over- over- of the amount Head of householdSchedule Z If taxable income is: But not Over- over- The tax is: of the amount over- The tax is: over- $ 0 $ 9,700 .........10% $ 0 $ 0 $ 13,850 ......... 10% $ 0 13,850 52,850 9,700 39,475 $ 970.00 + 12% 9,700 39,475 84,200 4,543.00 + 22% 39,475 84,200 160,725 14,382.50 + 24% 84,200 160,725 204,100 32,748.50 + 32% 160,725 204,100 510,300 46,628.50 + 35% 204,100 510,300 153,798.50 + 37% 510,300 Married filing jointly or Qualifying widow(er)- Schedule Y-1 If taxable of the income is: But not amount Over- over- The tax is: over- $ 0 $ 19,400 ......... 10% $ 0 13,850 52,850 $ 1,385.00 + 12% 52,850 84,200 6,065.00 + 22% 84,200 160,700 12,962.00 + 24% 160,700 204,100 31,322.00 + 32% 204,100 510,300 45,210.00 + 35% 510,300 152,380.00 + 37% Married filing separatelySchedule Y-2 84,200 160,700 204,100 510,300 If taxable income is: Over- of the amount But not over- The tax is: over- $ 0 $ 9,700 .........10% $ 0 $ 1,940.00 + 12% 9,700 $ 970.00 + 12% 9,700 19,400 78,950 78,950 168,400 19,400 78,950 39,475 84,200 39,475 4,543.00 + 22% 39,475 9,086.00 + 22% 28,765.00 + 24% 168,400 321,450 168,400 84,200 160,725 14,382.50 + 24% 84,200 321,450 408,200 65,497.00 + 32% 321,450 160,725 204,100 32,748.50 + 32% 160,725 408,200 612,350 93,257.00 + 35% 408,200 204,100 306,175 46,628.50 + 35% 204,100 306,175 612,350 164,709.50 + 37% 612,350 306,175 82,354.75 + 37%