Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In 2019, Hexafun, Inc., had sales of $530,000, costs of $325,000, depreciation expense of $70,000, and interest expense of $40,000. Assume a tax rate

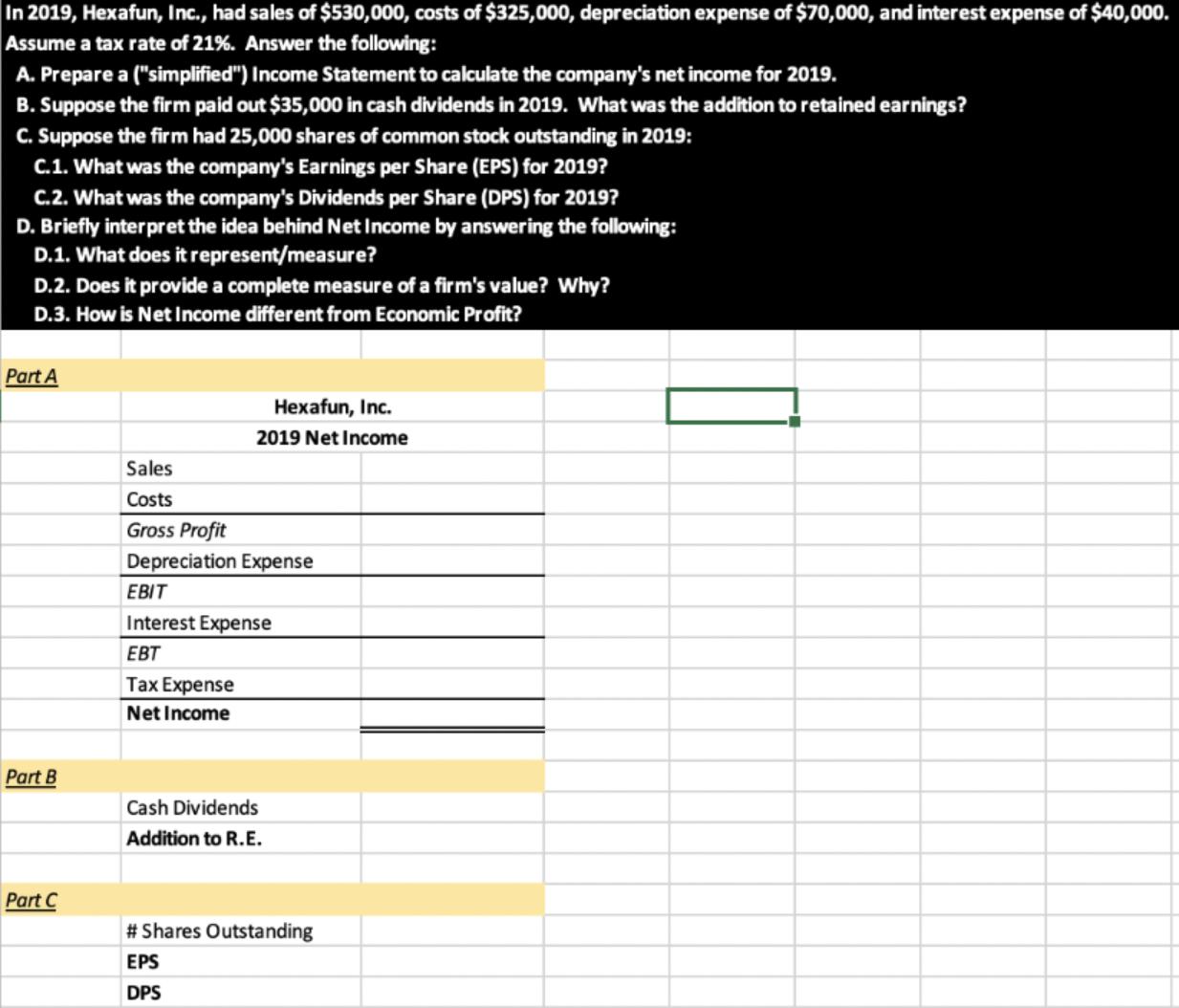

In 2019, Hexafun, Inc., had sales of $530,000, costs of $325,000, depreciation expense of $70,000, and interest expense of $40,000. Assume a tax rate of 21%. Answer the following: A. Prepare a ("simplified") Income Statement to calculate the company's net income for 2019. B. Suppose the firm paid out $35,000 in cash dividends in 2019. What was the addition to retained earnings? C. Suppose the firm had 25,000 shares of common stock outstanding in 2019: C.1. What was the company's Earnings per Share (EPS) for 2019? C.2. What was the company's Dividends per Share (DPS) for 2019? D. Briefly interpret the idea behind Net Income by answering the following: D.1. What does it represent/measure? D.2. Does it provide a complete measure of a firm's value? Why? D.3. How is Net Income different from Economic Profit? Part A Hexafun, Inc. 2019 Net Income Sales Costs Gross Profit Depreciation Expense EBIT Interest Expense EBT Tax Expense Net Income Part B Cash Dividends Addition to R.E. Part C # Shares Outstanding EPS DPS

Step by Step Solution

★★★★★

3.48 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

A Hexafun Inc 2019 Net income Particulars Amount S 530000 S 3...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started