Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In 2019, Ivanhoe Trucking Company negotiated and closed a long-term lease contract for newly constructed truck terminals and freight storage facilities. The buildings were

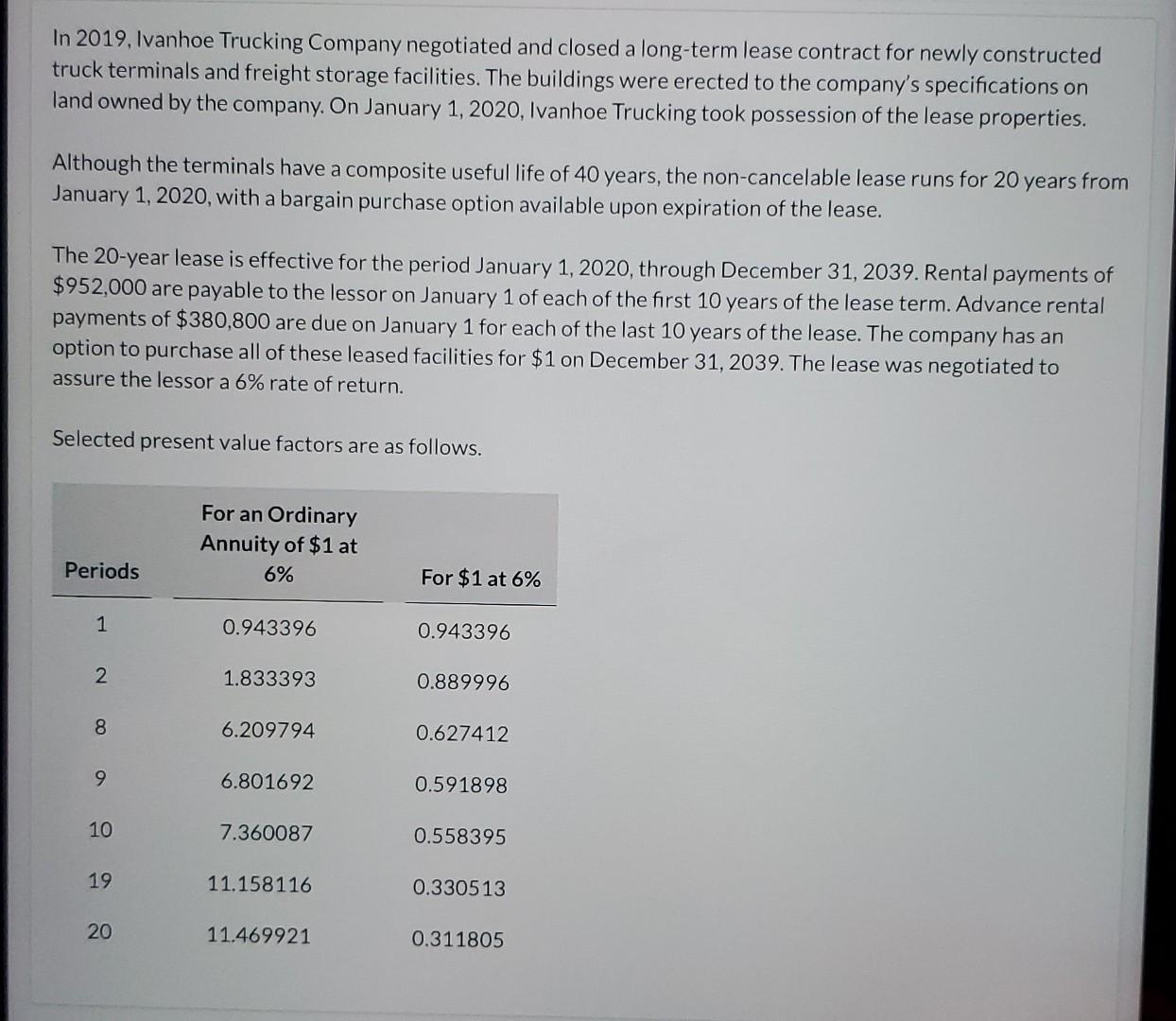

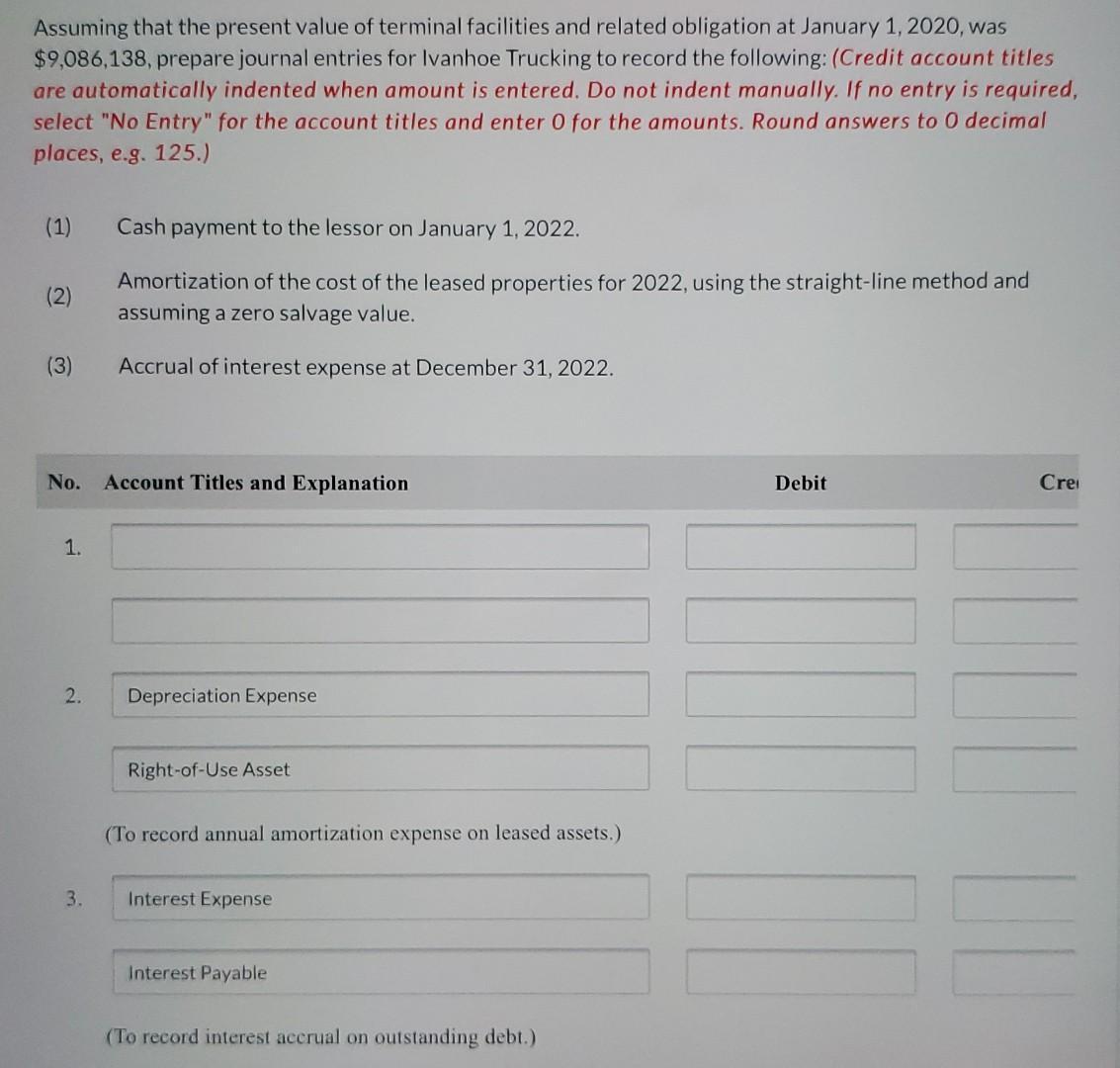

In 2019, Ivanhoe Trucking Company negotiated and closed a long-term lease contract for newly constructed truck terminals and freight storage facilities. The buildings were erected to the company's specifications on land owned by the company. On January 1, 2020, Ivanhoe Trucking took possession of the lease properties. Although the terminals have a composite useful life of 40 years, the non-cancelable lease runs for 20 years from January 1, 2020, with a bargain purchase option available upon expiration of the lease. The 20-year lease is effective for the period January 1, 2020, through December 31, 2039. Rental payments of $952,000 are payable to the lessor on January 1 of each of the first 10 years of the lease term. Advance rental payments of $380,800 are due on January 1 for each of the last 10 years of the lease. The company has an option to purchase all of these leased facilities for $1 on December 31, 2039. The lease was negotiated to assure the lessor a 6% rate of return. Selected present value factors are as follows. Periods 1 2 8 9 10 19 20 For an Ordinary Annuity of $1 at 6% 0.943396 1.833393 6.209794 6.801692 7.360087 11.158116 11.469921 For $1 at 6% 0.943396 0.889996 0.627412 0.591898 0.558395 0.330513 0.311805 Assuming that the present value of terminal facilities and related obligation at January 1, 2020, was $9,086,138, prepare journal entries for Ivanhoe Trucking to record the following: (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Round answers to 0 decimal places, e.g. 125.) (1) (2) (3) No. Account Titles and Explanation 1. 2. Cash payment to the lessor on January 1, 2022. Amortization of the cost of the leased properties for 2022, using the straight-line method and assuming a zero salvage value. Accrual of interest expense at December 31, 2022. 3. Depreciation Expense Right-of-Use Asset (To record annual amortization expense on leased assets.) Interest Expense Interest Payable (To record interest accrual on outstanding debt.) Debit Cre

Step by Step Solution

★★★★★

3.49 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

A B C 1 Lease liability amortization schedule 2 a b 3 Year 4 31Dec20 5 31Dec21 6 31Dec22 7 31Dec23 8 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started