Answered step by step

Verified Expert Solution

Question

1 Approved Answer

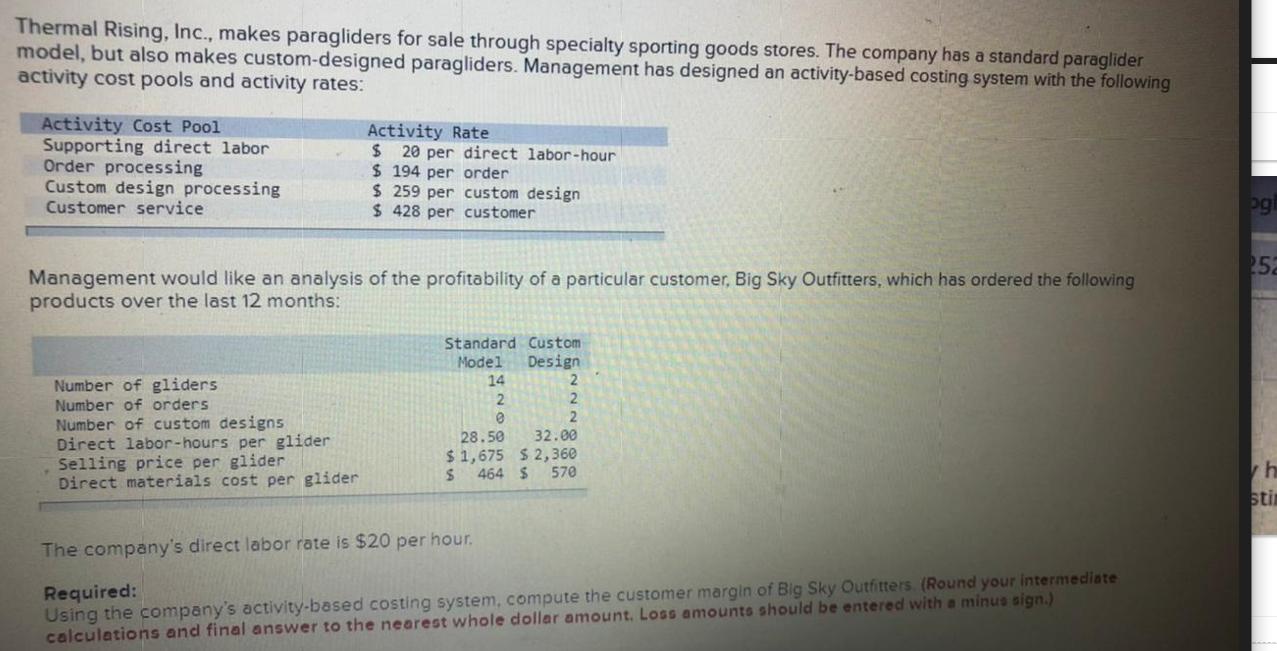

Thermal Rising, Inc., makes paragliders for sale through specialty sporting goods stores. The company has a standard paraglider model, but also makes custom-designed paragliders.

Thermal Rising, Inc., makes paragliders for sale through specialty sporting goods stores. The company has a standard paraglider model, but also makes custom-designed paragliders. Management has designed an activity-based costing system with the following activity cost pools and activity rates: Activity Cost Pool Supporting direct labor Order processing Custom design processing Customer service Number of gliders Number of orders Activity Rate Number of custom designs Direct labor-hours per glider Selling price per glider Direct materials cost per glider 20 per direct labor-hour Management would like an analysis of the profitability of a particular customer, Big Sky Outfitters, which has ordered the following products over the last 12 months: $ $ 194 per order $ 259 per custom design $ 428 per customer Standard Custom Model Design 14 2 0 The company's direct labor rate is $20 per hour. 28.50 $1,675 $ 2 2 32.00 $2,360 464 $ 570 Required: Using the company's activity-based costing system, compute the customer margin of Big Sky Outfitters. (Round your intermediate calculations and final answer to the nearest whole dollar amount. Loss amounts should be entered with a minus sign.) pg 252 h sti

Step by Step Solution

★★★★★

3.36 Rating (140 Votes )

There are 3 Steps involved in it

Step: 1

Explanation According to the scenario computation of the given data ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started