Question

In 2019, Lepanto Mining Company purchased property with natural resources for P28,000,000. The property had a residual value of P5,000,000. However, the entity is required

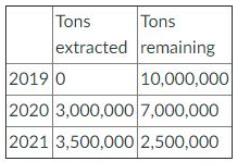

In 2019, Lepanto Mining Company purchased property with natural resources for P28,000,000. The property had a residual value of P5,000,000. However, the entity is required to restore the property to the original condition at a discounted amount of P2,000,000. In 2019, the entity spent P1,000,000 in development costs and constructed a building on the property costing P3,000,000 The entity does not anticipate that the building will have utility after the natural resources are removed. In 2020, an amount of P1,000,000 was spent for additional development on the mine. The tonnage mined and estimated remaining tons are:

Prepare journal entries for 2019, 2020 and 2021 based on the transactions.

Tons Tons extracted remaining 10,000,000 2019 0 2020 3,000,000 7,000,000 2021 3,500,000 2,500,000

Step by Step Solution

3.45 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Year Particulars Debit Credit 2019 Property Ac Dr 30000000 To Cash Ac 30000000 Being Pr...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started