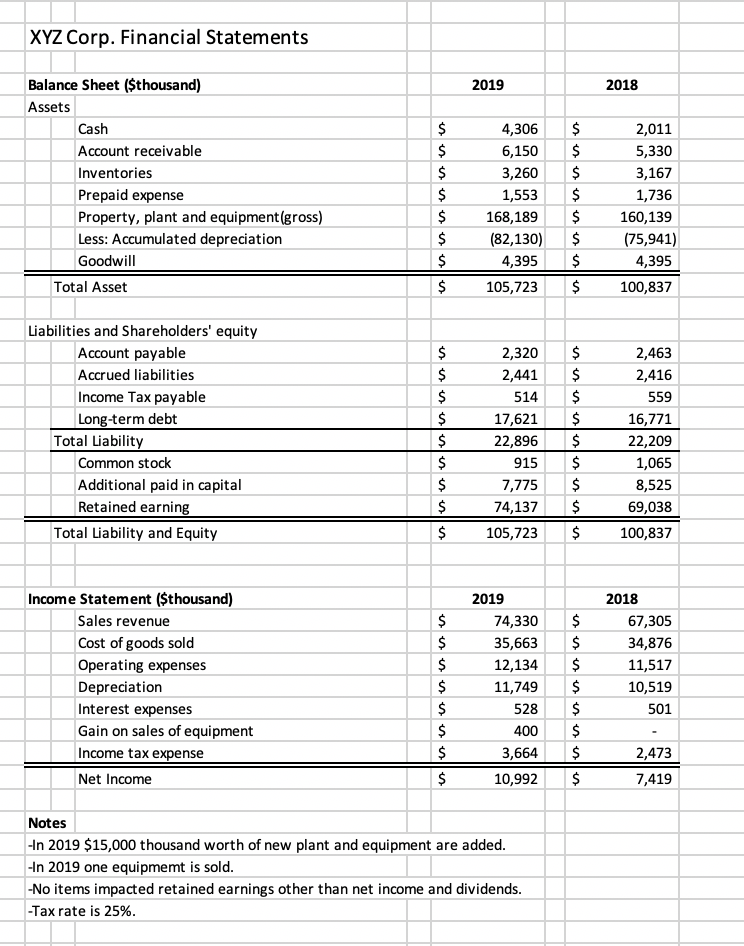

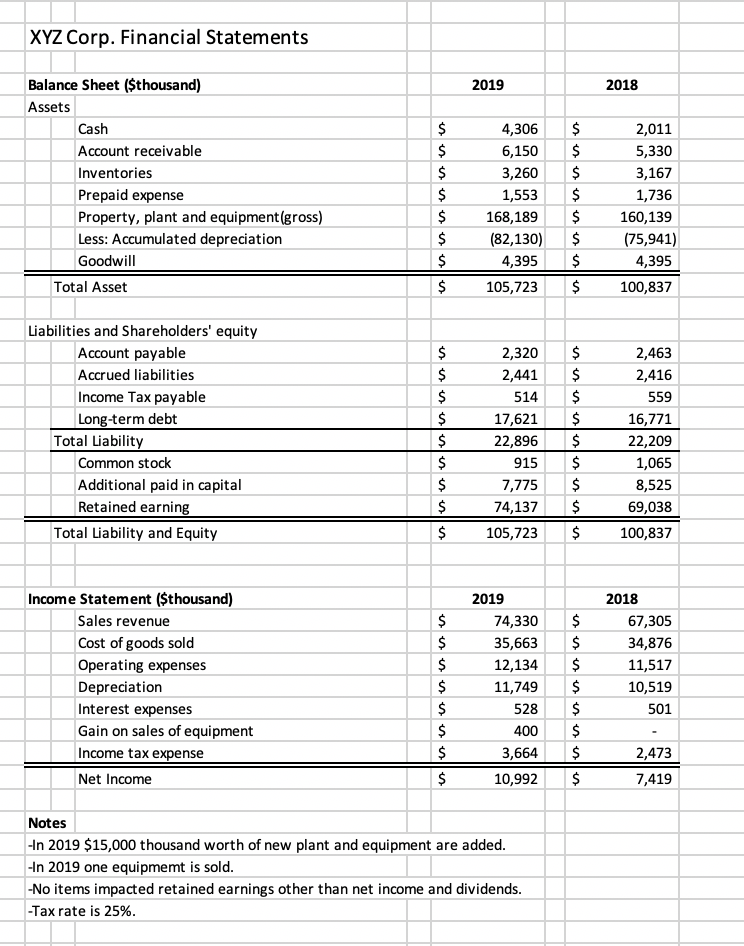

In 2019, XYZ sold one huge equipment as it became inefficient. The gross book value of that equipment was $ thousand. Download the financial statements. It shows the condensed balance sheet, income statement and a part of notes for XYZ Corp. Use the financial statements to work the following 10 questions #15---#24. I only accept formulas we studied in this class (=those in the textbook.) 'Cash flow from operating activities' of XYZ Corp for 2019 is $ thousand. I recommend you use 'indirect method'. If necessary, round to the nearest thousand dollars. If it is a negative cash flow (= cash outflow), make sure you use - (minus sign) in front of the number, uch as -ZZZ. You do not need to add + sign for a positive cash flow. XYZ Corp purchased $ thousand of inventory in 2019. Use a positive number, although it is a cash outflow. XYZ Corp. Financial Statements 2019 2018 Balance Sheet ($thousand) Assets Cash Account receivable Inventories Prepaid expense Property, plant and equipment(gross) Less: Accumulated depreciation Goodwill Total Asset II $ $ $ $ $ $ $ $ 4,306 6,150 3,260 1,553 168,189 (82,130) 4,395 105,723 $ $ $ $ $ $ $ $ 2,011 5,330 3,167 1,736 160,139 (75,941) 4,395 100,837 Liabilities and Shareholders' equity Account payable Accrued liabilities Income Tax payable Long-term debt Total Liability Common stock Additional paid in capital Retained earning Total Liability and Equity illus $ $ $ $ $ $ $ $ $ 2,320 2,441 514 17,621 22,896 915 7,775 74,137 105,723 $ $ $ $ $ $ $ $ $ 2,463 2,416 559 16,771 22,209 1,065 8,525 69,038 100,837 Income Statement ($thousand) Sales revenue Cost of goods sold Operating expenses Depreciation Interest expenses Gain on sales of equipment Income tax expense Net Income $ $ $ $ $ $ $ $ 2019 74,330 35,663 12,134 11,749 528 400 3,664 10,992 $ $ $ $ $ $ $ $ 2018 67,305 34,876 11,517 10,519 501 illus Ilus 2,473 7,419 Notes -In 2019 $15,000 thousand worth of new plant and equipment are added. -In 2019 one equipmemt is sold. -No items impacted retained earnings other than net income and dividends. -Tax rate is 25%. 'Cash flow from investing activities' of XYZ Corp for 2019 is $ thousand. If it is a negative cash flow (= cash outflow), make sure you use - (minus sign) in front of the number, such as -ZZZ. You do not need to add + sign for a positive cash flow