Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In 2020, ABC Leasing collected rent revenue from a tenant of $80 million. The rent received will be used for 2021 tenant occupancy (ie,

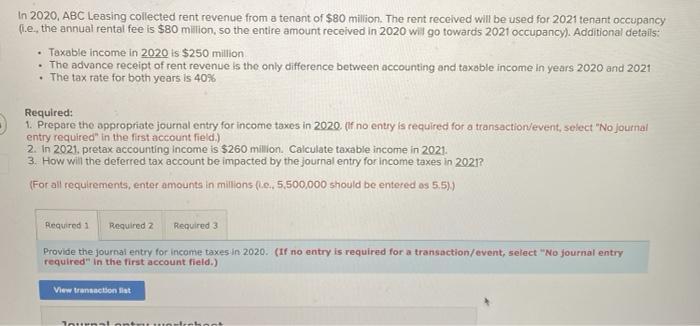

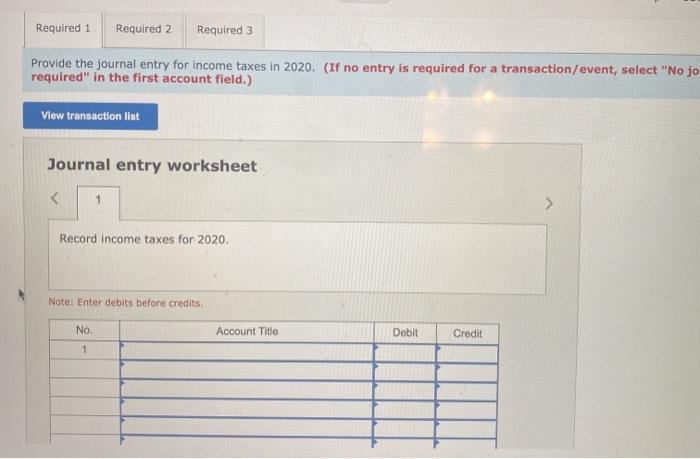

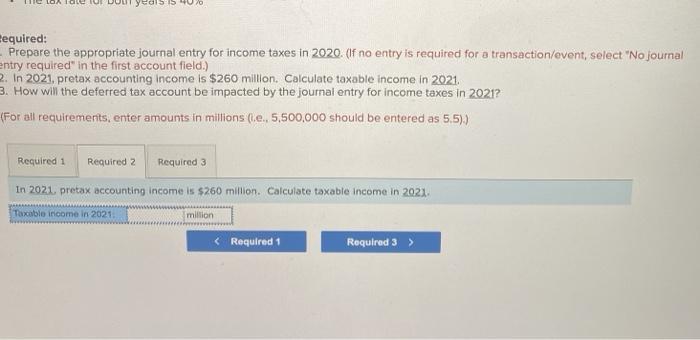

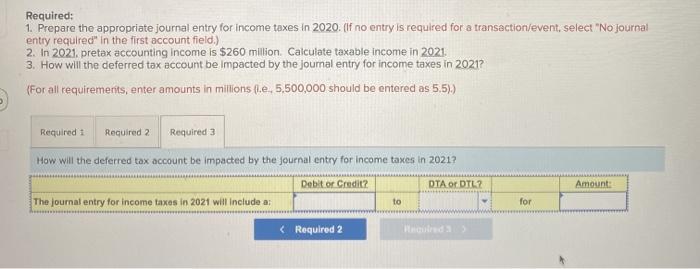

In 2020, ABC Leasing collected rent revenue from a tenant of $80 million. The rent received will be used for 2021 tenant occupancy (ie, the annual rental fee is $80 million, so the entire amount received in 2020 will go towards 2021 occupancy). Additional details: Taxable income in 2020 is $250 million The advance receipt of rent revenue is the only difference between accounting and taxable income in years 2020 and 2021 . The tax rate for both years is 40% Required: 1. Prepare the appropriate journal entry for income taxes in 2020. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) 2. In 2021. pretax accounting income is $260 million. Calculate taxable income in 2021. 3. How will the deferred tax account be impacted by the journal entry for income taxes in 2021? (For all requirements, enter amounts in millions (.e., 5,500,000 should be entered as 5.5).) Required 1 Required 2 Required 3 Provide the journal entry for income taxes in 2020. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal aunslebont Required 1 Required 2 Required 3 Provide the journal entry for income taxes in 2020. (If no entry is required for a transaction/event, select "No jo required" in the first account field.) View transaction list Journal entry worksheet < 1 Record income taxes for 2020. Note: Enter debits before credits. No. 1 Account Title Debit Credit 15:15 40 tequired: - Prepare the appropriate journal entry for income taxes in 2020. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) 2. In 2021, pretax accounting income is $260 million. Calculate taxable income in 2021. 3. How will the deferred tax account be impacted by the journal entry for income taxes in 2021? (For all requirements, enter amounts in millions (.e., 5,500,000 should be entered as 5.5).) Required 1 Required 2 Required 3 In 2021. pretax accounting income is $260 million. Calculate taxable income in 2021. Taxable income in 2021. million < Required 1 Required 3 > Required: 1. Prepare the appropriate journal entry for income taxes in 2020. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) 2. In 2021. pretax accounting income is $260 million. Calculate taxable income in 2021. 3. How will the deferred tax account be impacted by the journal entry for income taxes in 2021? (For all requirements, enter amounts in millions (.e., 5,500,000 should be entered as 5.5).) Required 1 Required 2 Required 3 How will the deferred tax account be impacted by the journal entry for income taxes in 2021? Debit or Credit? The journal entry for income taxes in 2021 will include a: < Required 2 to DTA or DTL? Required 3 > for Amount:

Step by Step Solution

★★★★★

3.32 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

2 3 General Journal No 1 Income tax expense Deferred tax ass...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started