Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In 2020, Blossom Contractors began construction on an office building. The building was expected to cost $47,290,000 in total, and was expected to be

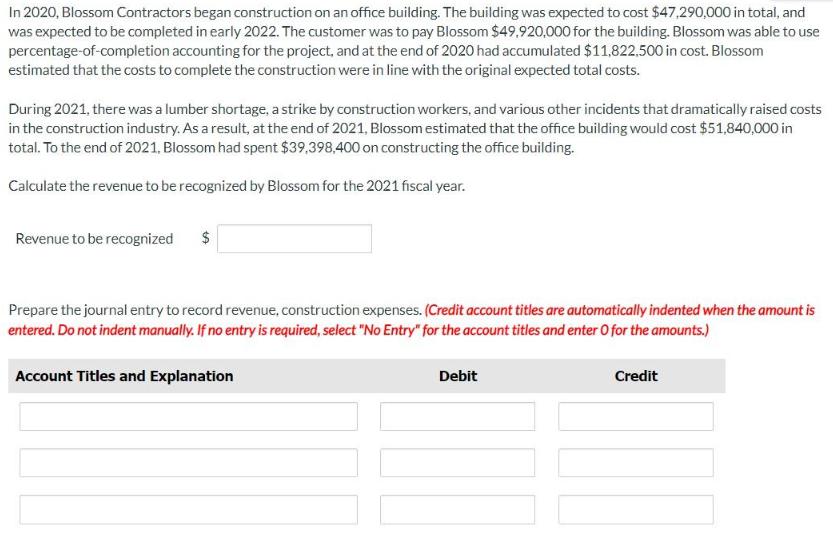

In 2020, Blossom Contractors began construction on an office building. The building was expected to cost $47,290,000 in total, and was expected to be completed in early 2022. The customer was to pay Blossom $49,920,000 for the building. Blossom was able to use percentage-of-completion accounting for the project, and at the end of 2020 had accumulated $11,822.500 in cost. Blossom estimated that the costs to complete the construction were in line with the original expected total costs. During 2021, there was a lumber shortage, a strike by construction workers, and various other incidents that dramatically raised costs in the construction industry. As a result, at the end of 2021, Blossom estimated that the office building would cost $51,840,000 in total. To the end of 2021, Blossom had spent $39,398,400 on constructing the office building. Calculate the revenue to be recognized by Blossom for the 2021 fiscal year. Revenue to be recognized $ Prepare the journal entry to record revenue, construction expenses. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Account Titles and Explanation Debit Credit

Step by Step Solution

★★★★★

3.42 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

2 Journal entries Date Account title and explanation Debit Credit 2020 Construction expense Ac 11822...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started