Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In 2020, Country ABC began construction of a hydroelectric dam on the XYZ River. The project is funded by a consortium of investors. It will

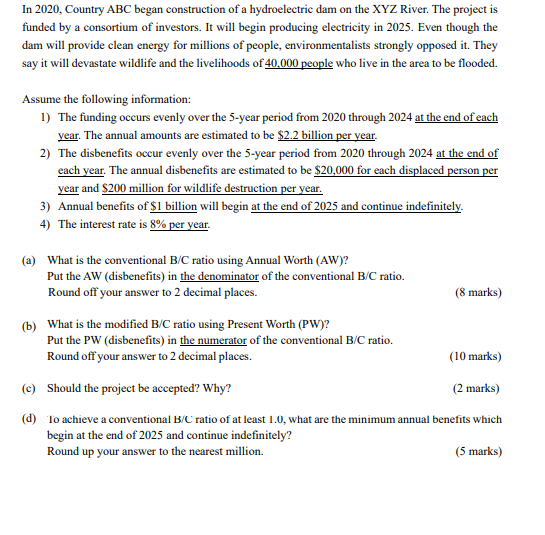

In 2020, Country ABC began construction of a hydroelectric dam on the XYZ River. The project is funded by a consortium of investors. It will begin producing electricity in 2025 . Even though the dam will provide clean energy for millions of people, environmentalists strongly opposed it. They say it will devastate wildlife and the livelihoods of 40.000 people who live in the area to be flooded. Assume the following information: 1) The funding occurs evenly over the 5-year period from 2020 through 2024 at the end of each year. The annual amounts are estimated to be $2.2 billion per year. 2) The disbenefits occur evenly over the 5-year period from 2020 through 2024 at the end of each year. The annual disbenefits are estimated to be $20,000 for each displaced person per year and $200 million for wildlife destruction per year. 3) Annual benefits of $1 billion will begin at the end of 2025 and continue indefinitely. 4) The interest rate is 8%peryear. (a) What is the conventional B/C ratio using Annual Worth (AW)? Put the AW (disbenefits) in the denominator of the conventional B/C ratio. Round off your answer to 2 decimal places. ( 8 marks) (b) What is the modified B/C ratio using Present Worth (PW)? Put the PW (disbenefits) in the numerator of the conventional B/C ratio. Round off your answer to 2 decimal places. (10 marks) (c) Should the project be accepted? Why? (2 marks) (d) Io achieve a conventional B/C ratio of at least 1.0 , what are the minimum annual benefits which begin at the end of 2025 and continue indefinitely? Round up your answer to the nearest million

In 2020, Country ABC began construction of a hydroelectric dam on the XYZ River. The project is funded by a consortium of investors. It will begin producing electricity in 2025 . Even though the dam will provide clean energy for millions of people, environmentalists strongly opposed it. They say it will devastate wildlife and the livelihoods of 40.000 people who live in the area to be flooded. Assume the following information: 1) The funding occurs evenly over the 5-year period from 2020 through 2024 at the end of each year. The annual amounts are estimated to be $2.2 billion per year. 2) The disbenefits occur evenly over the 5-year period from 2020 through 2024 at the end of each year. The annual disbenefits are estimated to be $20,000 for each displaced person per year and $200 million for wildlife destruction per year. 3) Annual benefits of $1 billion will begin at the end of 2025 and continue indefinitely. 4) The interest rate is 8%peryear. (a) What is the conventional B/C ratio using Annual Worth (AW)? Put the AW (disbenefits) in the denominator of the conventional B/C ratio. Round off your answer to 2 decimal places. ( 8 marks) (b) What is the modified B/C ratio using Present Worth (PW)? Put the PW (disbenefits) in the numerator of the conventional B/C ratio. Round off your answer to 2 decimal places. (10 marks) (c) Should the project be accepted? Why? (2 marks) (d) Io achieve a conventional B/C ratio of at least 1.0 , what are the minimum annual benefits which begin at the end of 2025 and continue indefinitely? Round up your answer to the nearest million Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started