Question

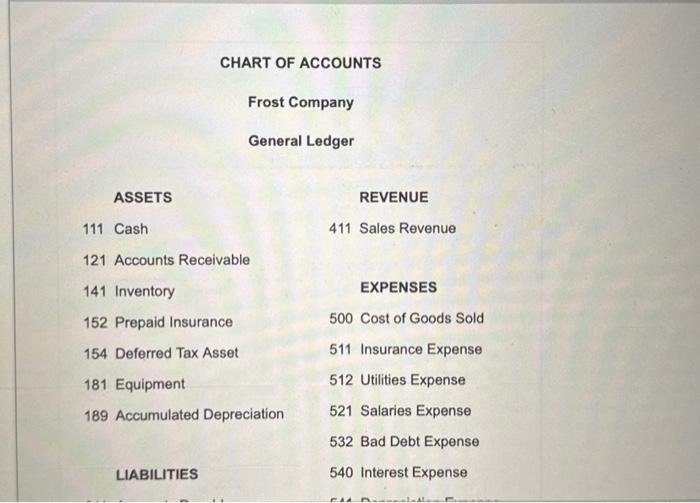

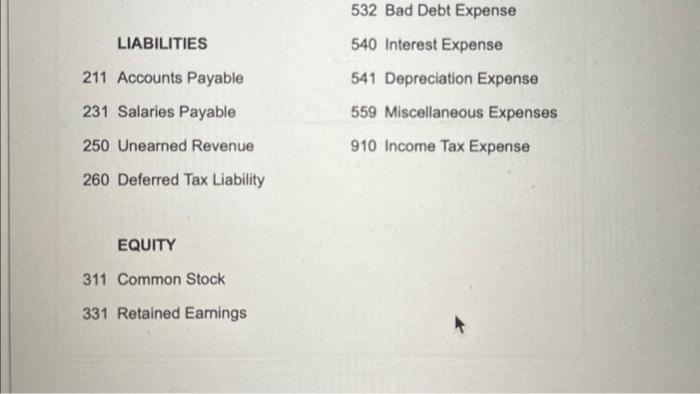

In 2020, Frost Company, which began operations in 2018, decided to change from LIFO to FIFO because management believed that FIFO better represened the flow

In 2020, Frost Company, which began operations in 2018, decided to change from LIFO to FIFO because management believed that FIFO better represened the flow of their inventory. Management prepared the following analysis showing the effect of this change:

ending inventory LIFO FIFO cumulative difference

______________________________________________________

12/31/2018. $239,600. $271,600 $31,200

12/31/2019. $246,400. $301,800 $55,400

12/31/2020. $255,000 $328,700. $73,700

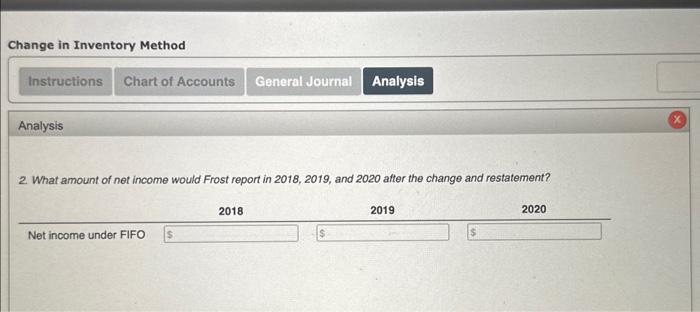

Frost reported net income of $2,487,000, $2,332,000, and $2,057,000 in 2018, 2019, and 2020, respectively. The tax rate is 40%.

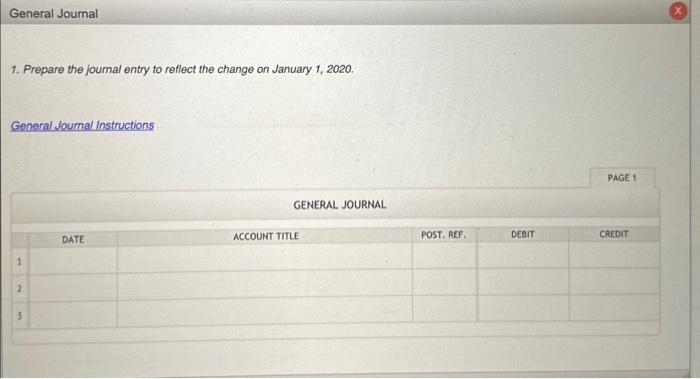

Required:

- Prepare the journal entry necessary to record the change.

- What amount of net income would Frost report in 2018, 2019, and 2020?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started