Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In 2020, Kanyiti ltd started a sporting equipment business with GHC7000 from personal savings which he lodged into a bank account for the business.

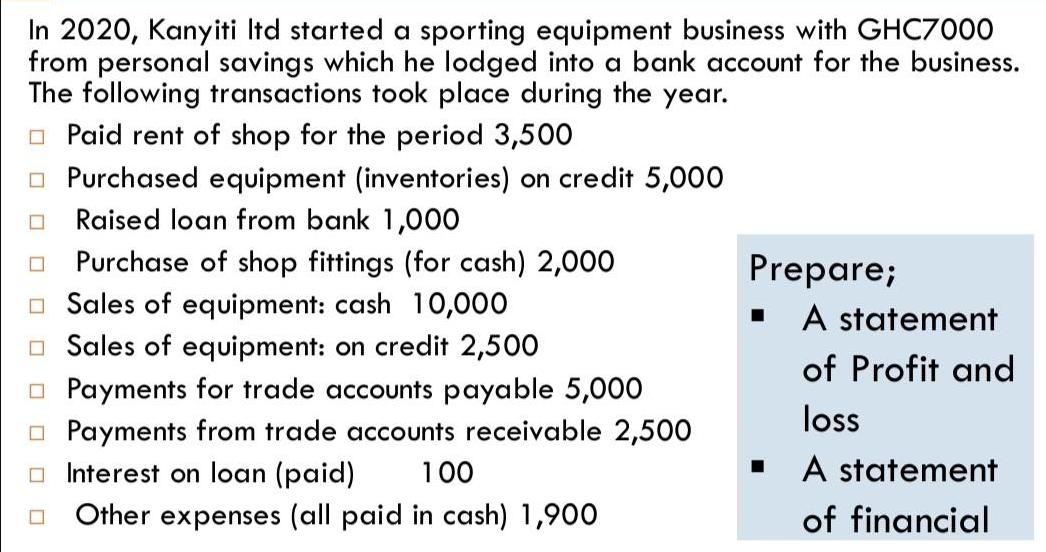

In 2020, Kanyiti ltd started a sporting equipment business with GHC7000 from personal savings which he lodged into a bank account for the business. The following transactions took place during the year. Paid rent of shop for the period 3,500 Purchased equipment (inventories) on credit 5,000 Raised loan from bank 1,000 Purchase of shop fittings (for cash) 2,000 Sales of equipment: cash 10,000 Sales of equipment: on credit 2,500 Payments for trade accounts payable 5,000 Payments from trade accounts receivable 2,500 Interest on loan (paid) 100 Other expenses (all paid in cash) 1,900 Prepare; A statement of Profit and loss A statement of financial

Step by Step Solution

There are 3 Steps involved in it

Step: 1

SOLUTION To prepare the statement of profit and loss and the statement of financial position for Kan...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started