Question

As you can see from the table , the premium MBS's base yield-to-maturity is 3.54%, and its base Average Life is 4.07 years, while the

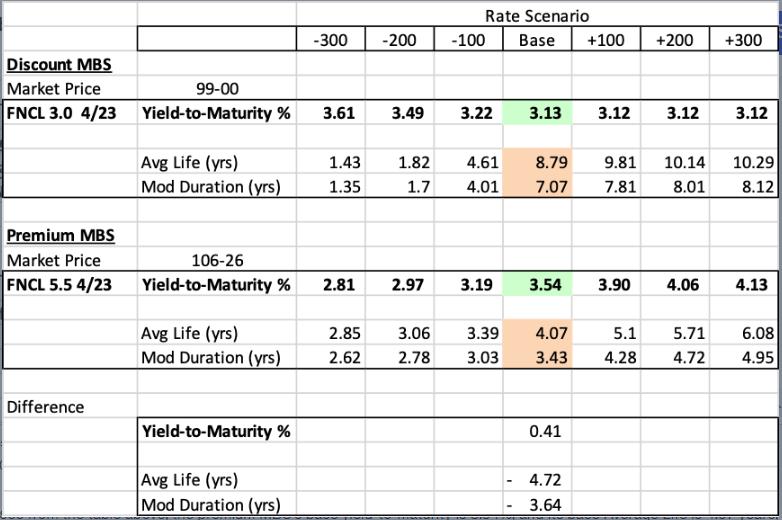

As you can see from the table , the premium MBS's base yield-to-maturity is 3.54%, and its base Average Life is 4.07 years, while the discount MBS's base yield-to-maturity is 3.13%, and its base Average Life is 8.79 years.

Usually, a longer-term investment demands for higher yield. But in this case, the Premium MBS has higher expected yield than the Discount MBS, but with only half of the expected term of the Discount MBS. Is that reasonable?

If you have to choose between the two MBS for next investment, which one to choose? And Why?

Discount MBS Market Price FNCL 3.0 4/23 Premium MBS Market Price FNCL 5.5 4/23 Difference BEMANNIV 99-00 Yield-to-Maturity % Avg Life (yrs) Mod Duration (yrs) 106-26 Yield-to-Maturity % Avg Life (yrs) Mod Duration (yrs) Yield-to-Maturity % Avg Life (yrs) Mod Duration (yrs) -300 3.61 3.49 1.43 1.35 Rate Scenario -200 -100 Base +100 +200 +300 2.85 2.62 1.82 1.7 2.81 2.97 3.06 2.78 3.22 3.13 3.12 4.61 4.01 3.19 - 8.79 9.81 7.07 7.81 3.39 4.07 3.03 MERRE TV VRV UVE 3.54 3.90 3.43 4.28 0.41 4.72 3.64 3.12 3.12 10.14 10.29 8.01 8.12 4.06 5.1 5.71 4.72 4.13 6.08 4.95 Ammer

Step by Step Solution

3.42 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION In this case it seems unusual that the Premium MBS has a higher expected yield but with onl...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started