In 2020, Laureen is currently single. She paid $2,440 of qualified tuition and related expenses for each of her twin daughters Sheri and Meri to attend State University as freshmen ($2,440 each for a total of $4,880). Sheri and Meri qualify as Laureens dependents. Laureen also paid $1,770 for her son Ryans (also Laureens dependent) tuition and related expenses to attend his junior year at State University. Finally, Laureen paid $1,270 for herself to attend seminars at a community college to help her improve her job skills.

a. What is the maximum amount of education credits Laureen can claim for these expenditures? Laureen's AGI is $45,000. If Laureen claims education credits for her three children and herself, how much credit is she allowed to claim in total? If she claims education credits for her children, how much of her childrens tuition costs that do not generate credits may she deduct as for AGI expenses?

c. Laureens AGI is $45,000 and Laureen paid $12,140 (not $1,770) for Ryan to attend graduate school (i.e., his fifth year, not his junior year).

Please show how you get your answer

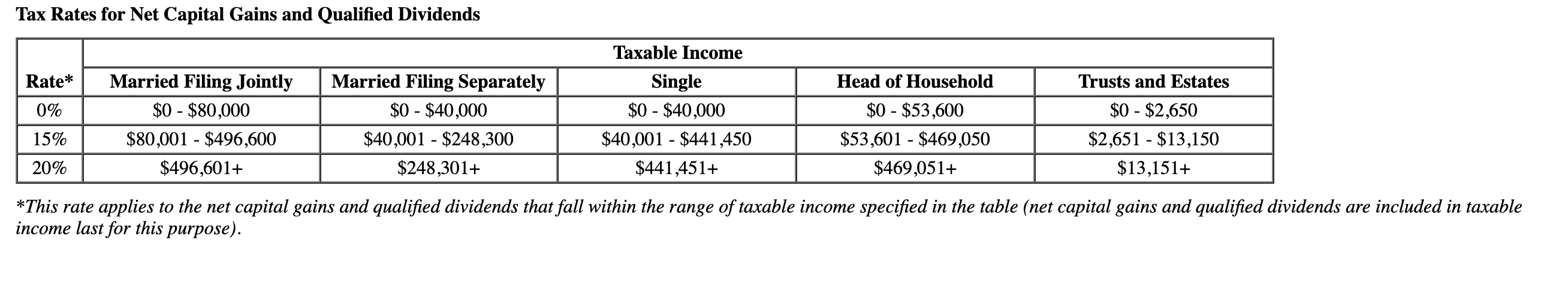

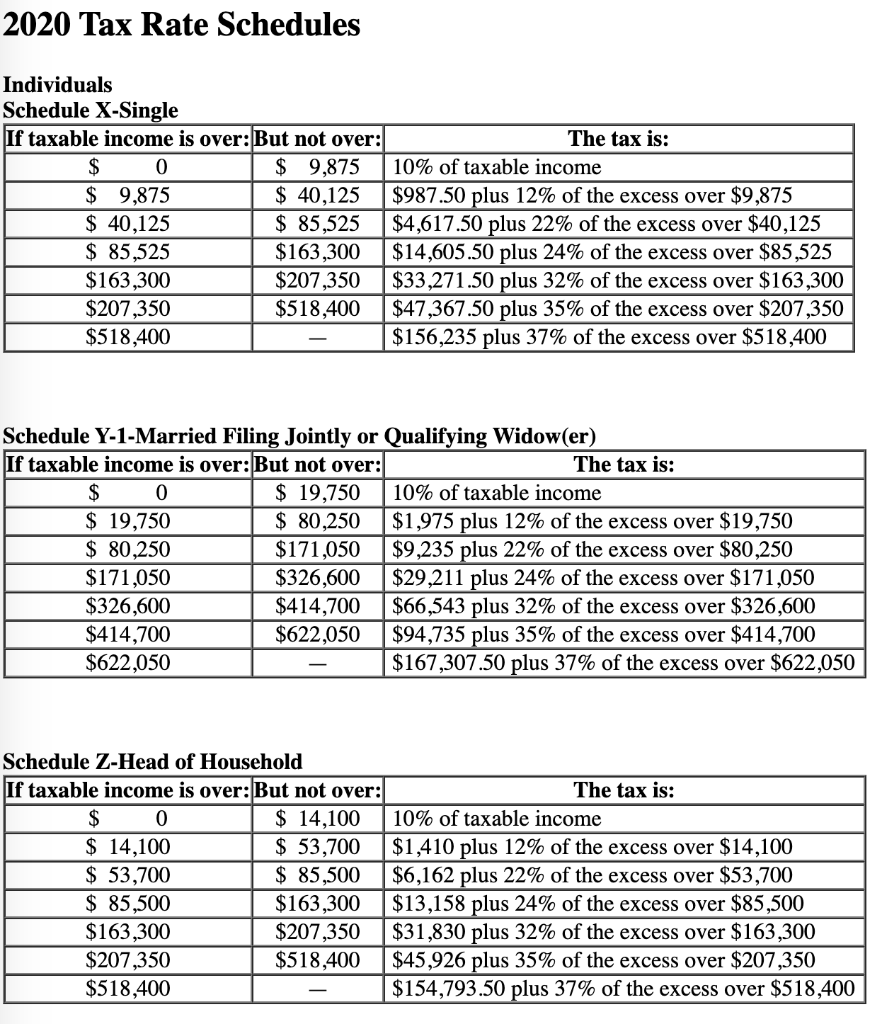

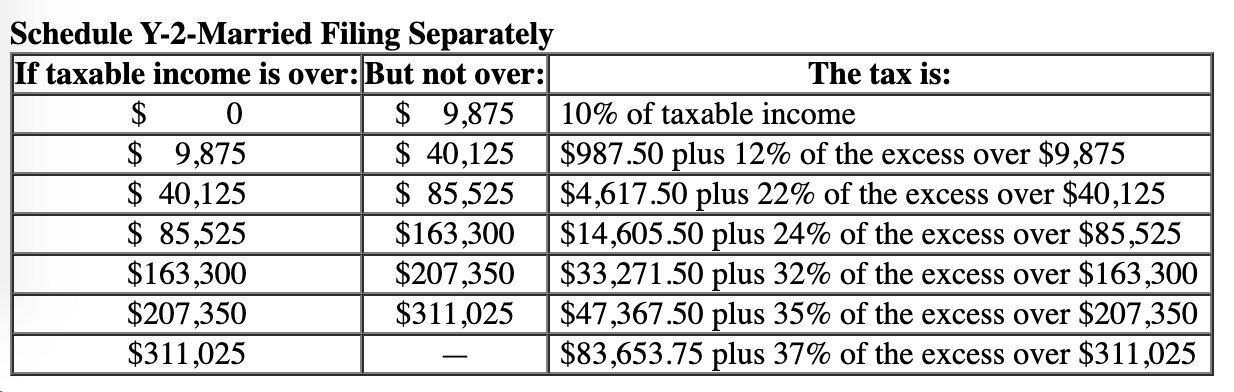

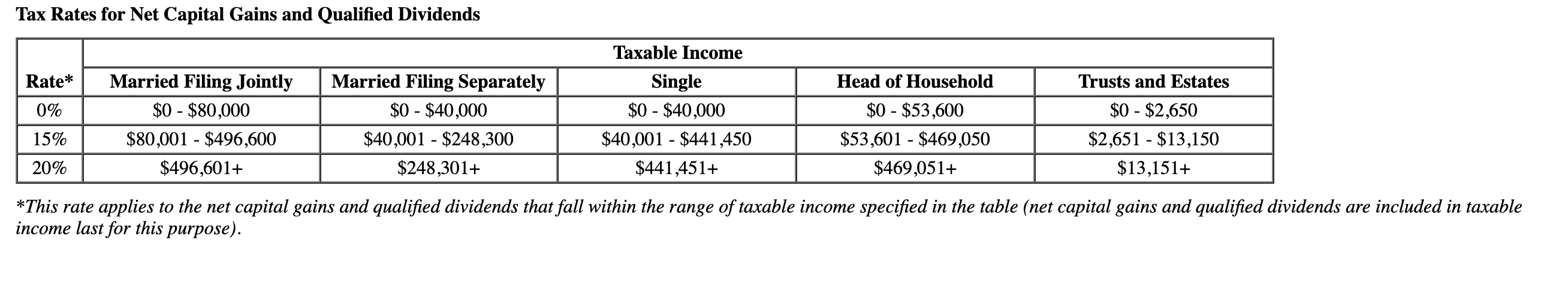

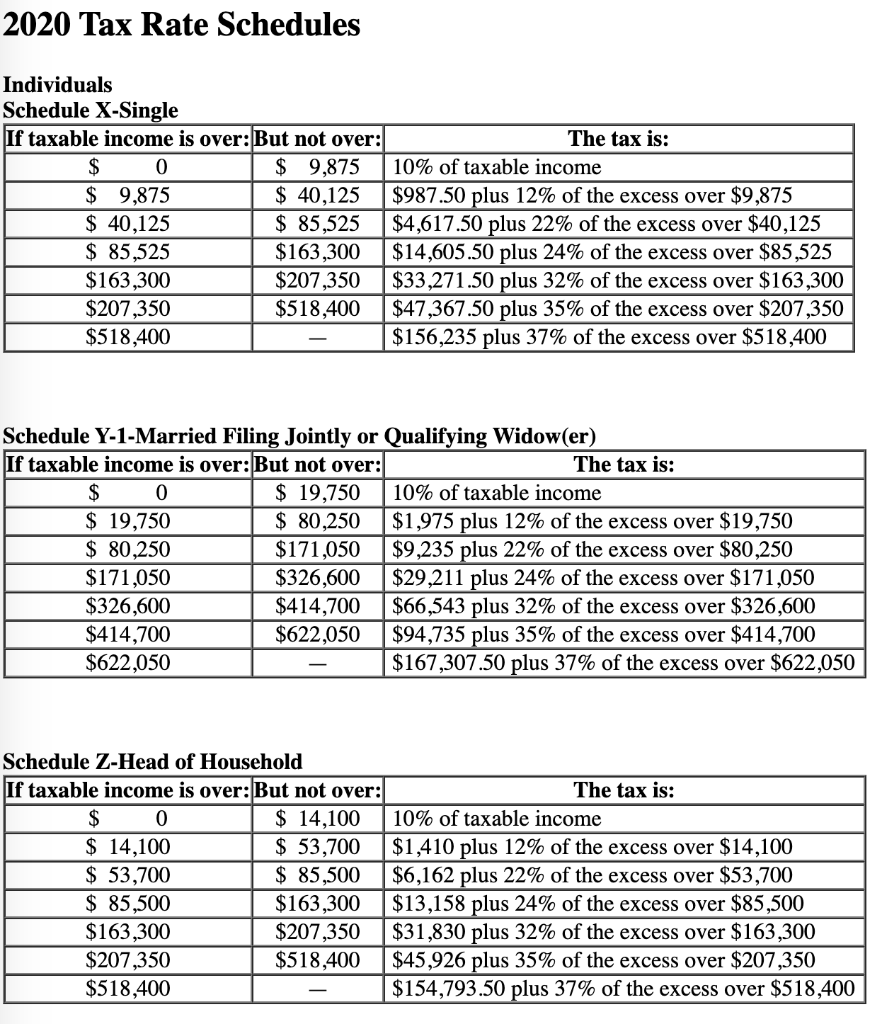

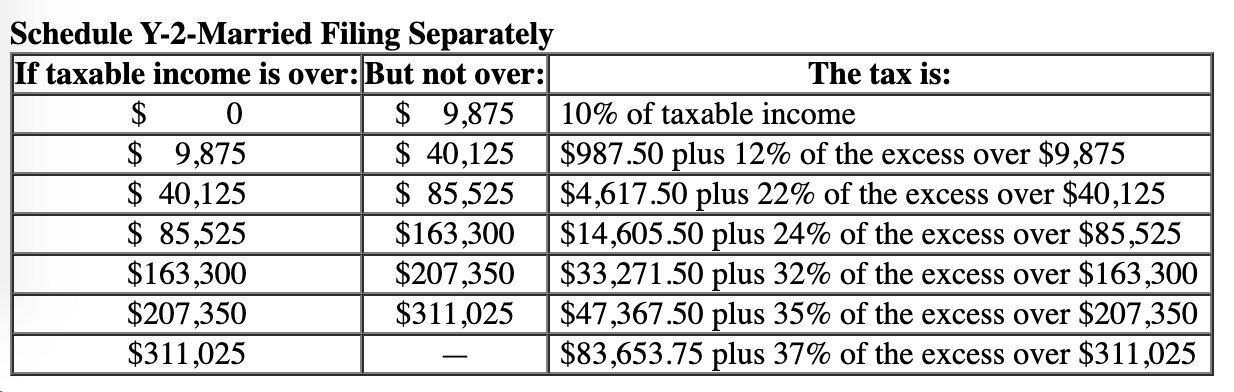

Tax Rates for Net Capital Gains and Qualified Dividends Taxable Income Rate* Married Filing Jointly Married Filing Separately Single Head of Household Trusts and Estates 0% $0 - $80,000 $0 - $40,000 $0 - $40,000 $0 - $53,600 $0 - $2,650 15% $80,001 - $496,600 $40,001 - $248,300 $40,001 - $441,450 $53,601 - $469,050 $2,651 - $13,150 20% $496,601+ $248,301+ $441,451+ $469,051+ $13,151+ *This rate applies to the net capital gains and qualified dividends that fall within the range of taxable income specified in the table (net capital gains and qualified dividends are included in taxable income last for this purpose). 2020 Tax Rate Schedules Individuals Schedule X-Single If taxable income is over: But not over: The tax is: $ 0 $ 9,875 10% of taxable income $ 9,875 $ 40,125 $987.50 plus 12% of the excess over $9,875 $ 40,125 $ 85,525 $4,617.50 plus 22% of the excess over $40,125 $ 85,525 $163,300 $14,605.50 plus 24% of the excess over $85,525 $163,300 $207,350 $33,271.50 plus 32% of the excess over $163,300 $207,350 $518,400 $47,367.50 plus 35% of the excess over $207,350 $518,400 $156,235 plus 37% of the excess over $518,400 Schedule Y-1-Married Filing Jointly or Qualifying Widow(er) If taxable income is over: But not over: The tax is: $ 0 $ 19,750 10% of taxable income $ 19,750 $ 80,250 $1,975 plus 12% of the excess over $19,750 $ 80,250 $171,050 $9,235 plus 22% of the excess over $80,250 $171,050 $326,600 $29,211 plus 24% of the excess over $171,050 $326,600 $414,700 $66,543 plus 32% of the excess over $326,600 $414,700 $622,050 $94,735 plus 35% of the excess over $414,700 $622,050 $167,307.50 plus 37% of the excess over $622,050 Schedule Z-Head of Household If taxable income is over: But not over: The tax is: $ 0 $ 14,100 10% of taxable income $ 14,100 $ 53,700 $1,410 plus 12% of the excess over $14,100 $ 53,700 $ 85,500 $6,162 plus 22% of the excess over $53,700 $ 85,500 $163,300 $13,158 plus 24% of the excess over $85,500 $163,300 $207,350 $31,830 plus 32% of the excess over $163,300 $207,350 $518,400 $45,926 plus 35% of the excess over $207,350 $518,400 $154,793.50 plus 37% of the excess over $518,400 Schedule Y-2-Married Filing Separately If taxable income is over: But not over: The tax is: $ 0 $ 9,875 10% of taxable income $ 9,875 $ 40,125 $987.50 plus 12% of the excess over $9,875 $ 40,125 $ 85,525 $4,617.50 plus 22% of the excess over $40,125 $ 85,525 $163,300 $14,605.50 plus 24% of the excess over $85,525 $163,300 $207,350 $33,271.50 plus 32% of the excess over $163,300 $207,350 $311,025 $47,367.50 plus 35% of the excess over $207,350 $311,025 $83,653.75 plus 37% of the excess over $311,025 Tax Rates for Net Capital Gains and Qualified Dividends Taxable Income Rate* Married Filing Jointly Married Filing Separately Single Head of Household Trusts and Estates 0% $0 - $80,000 $0 - $40,000 $0 - $40,000 $0 - $53,600 $0 - $2,650 15% $80,001 - $496,600 $40,001 - $248,300 $40,001 - $441,450 $53,601 - $469,050 $2,651 - $13,150 20% $496,601+ $248,301+ $441,451+ $469,051+ $13,151+ *This rate applies to the net capital gains and qualified dividends that fall within the range of taxable income specified in the table (net capital gains and qualified dividends are included in taxable income last for this purpose). 2020 Tax Rate Schedules Individuals Schedule X-Single If taxable income is over: But not over: The tax is: $ 0 $ 9,875 10% of taxable income $ 9,875 $ 40,125 $987.50 plus 12% of the excess over $9,875 $ 40,125 $ 85,525 $4,617.50 plus 22% of the excess over $40,125 $ 85,525 $163,300 $14,605.50 plus 24% of the excess over $85,525 $163,300 $207,350 $33,271.50 plus 32% of the excess over $163,300 $207,350 $518,400 $47,367.50 plus 35% of the excess over $207,350 $518,400 $156,235 plus 37% of the excess over $518,400 Schedule Y-1-Married Filing Jointly or Qualifying Widow(er) If taxable income is over: But not over: The tax is: $ 0 $ 19,750 10% of taxable income $ 19,750 $ 80,250 $1,975 plus 12% of the excess over $19,750 $ 80,250 $171,050 $9,235 plus 22% of the excess over $80,250 $171,050 $326,600 $29,211 plus 24% of the excess over $171,050 $326,600 $414,700 $66,543 plus 32% of the excess over $326,600 $414,700 $622,050 $94,735 plus 35% of the excess over $414,700 $622,050 $167,307.50 plus 37% of the excess over $622,050 Schedule Z-Head of Household If taxable income is over: But not over: The tax is: $ 0 $ 14,100 10% of taxable income $ 14,100 $ 53,700 $1,410 plus 12% of the excess over $14,100 $ 53,700 $ 85,500 $6,162 plus 22% of the excess over $53,700 $ 85,500 $163,300 $13,158 plus 24% of the excess over $85,500 $163,300 $207,350 $31,830 plus 32% of the excess over $163,300 $207,350 $518,400 $45,926 plus 35% of the excess over $207,350 $518,400 $154,793.50 plus 37% of the excess over $518,400 Schedule Y-2-Married Filing Separately If taxable income is over: But not over: The tax is: $ 0 $ 9,875 10% of taxable income $ 9,875 $ 40,125 $987.50 plus 12% of the excess over $9,875 $ 40,125 $ 85,525 $4,617.50 plus 22% of the excess over $40,125 $ 85,525 $163,300 $14,605.50 plus 24% of the excess over $85,525 $163,300 $207,350 $33,271.50 plus 32% of the excess over $163,300 $207,350 $311,025 $47,367.50 plus 35% of the excess over $207,350 $311,025 $83,653.75 plus 37% of the excess over $311,025