In 2020, Mason, age 35 and single, earned wages of $75,000. Mason had no exclusions, and he had adjustments of $1,000. Masons itemized deductions for the year totaled $11,000. Mason has no QBI (and thus no QBI deduction). Mason's employer withheld federal income taxes of $5,000 from Mason's paychecks, and Mason is also entitled to an additional $2,500 tax credit.

What is Masons AGI?

What is Masons taxable income?

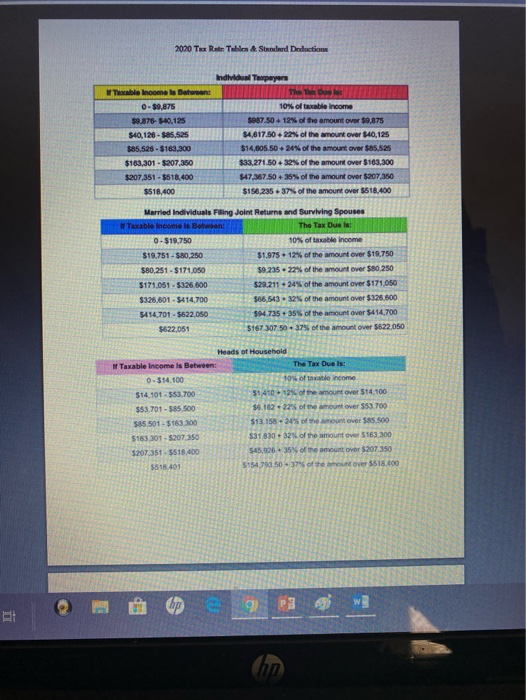

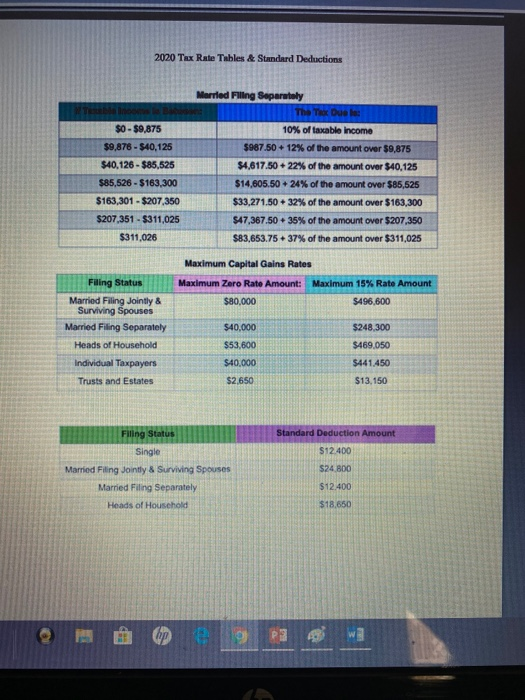

Using the 2020 single tax rates schedules (available in Module 4 folder), what is Masons federal income tax liability (before withholding and credits) for 2020?

What is Masons federal income tax liability after withholding and tax credits (i.e. the amount due or amount Mason needs to pay)?

2020 Tax Rate Table & Stended Deduction The home 375 SORT-140,125 $40126 - Ses 185525 - $163.300 $183,301 207 350 07351 - 518 400 Theme 1 03 fable income 598750.12% of the amount over 1875 $4.6175022% of the amount over 40,125 $14.605.50.24% of the amount over 85.52 $33 271.50.32% of the amount over $163.300 54738750 of the amount over $207 350 $156.235.37% of the amount over $518.400 1518.400 Married individuals Filling Joint Returns and Surviving Spou Taxable income is : The Tax Due 0.319.750 10% of taxable income $19.751 - 110.250 $1.975. 12% of the amount over $19.750 S80.251 - 5171 050 59.235 22% of the amount over $80,250 $171 051-5326,600 $29.211 +245 of the amount over $171.050 $326,601 - 5414,700 $66,543 -32% of the amount over $325,600 5414,701 - $622,050 $94.735.35% of the amount over $414,700 $622,051 $167 307 50 37% of the amount over 22050 Heads of Household Taxable income is Between: The Tax Duel 0.314,100 10% of the income $14.101 - 553,700 5140125 of the amount over $14,100 $53.701 - 585 500 56.162 22 of the amount over 553.700 55 501 5183300 513.158 -24% of the amount over $8.500 5153 301.5.207 350 531830+32of the amount over5163.300 15518 400 + 35% of the amount over $207.350 37% of the amount ho 2020 Tax Rate Tables & Standard Deductions $0-$9.875 $9,876 - $40,125 $40,126 - $85,525 $85,526 - $163,300 $163,301 - $207,350 $207,351 - $311,025 $311,026 Married Filing Separately The The Duele: 10% of taxable income $987.50 +12% of the amount over $9,875 $4,617.50 + 22% of the amount over $40,125 $14,605.50 +24% of the amount over $86,525 $33,271.50 + 32% of the amount over $163,300 547,367.50 + 35% of the amount over $207,350 $83,653.75 +37% of the amount over $311,025 Maximum Capital Gains Rates Maximum Zero Rate Amount: Maximum 15% Rate Amount $80,000 $496,600 Filing Status Married Filing Jointly & Surviving Spouses Married Filing Separately Heads of Household Individual Taxpayers Trusts and Estates 540,000 $53,600 $40,000 $2,650 $248,300 $469,050 $441.450 $13,150 H 1 Filing Status Standard Deduction Amount $24.800 Married Filing Jointly & Surviving Spouses Married Filing Separately Heads of Household $12.400 $18.650 O a 2020 Tax Rate Table & Stended Deduction The home 375 SORT-140,125 $40126 - Ses 185525 - $163.300 $183,301 207 350 07351 - 518 400 Theme 1 03 fable income 598750.12% of the amount over 1875 $4.6175022% of the amount over 40,125 $14.605.50.24% of the amount over 85.52 $33 271.50.32% of the amount over $163.300 54738750 of the amount over $207 350 $156.235.37% of the amount over $518.400 1518.400 Married individuals Filling Joint Returns and Surviving Spou Taxable income is : The Tax Due 0.319.750 10% of taxable income $19.751 - 110.250 $1.975. 12% of the amount over $19.750 S80.251 - 5171 050 59.235 22% of the amount over $80,250 $171 051-5326,600 $29.211 +245 of the amount over $171.050 $326,601 - 5414,700 $66,543 -32% of the amount over $325,600 5414,701 - $622,050 $94.735.35% of the amount over $414,700 $622,051 $167 307 50 37% of the amount over 22050 Heads of Household Taxable income is Between: The Tax Duel 0.314,100 10% of the income $14.101 - 553,700 5140125 of the amount over $14,100 $53.701 - 585 500 56.162 22 of the amount over 553.700 55 501 5183300 513.158 -24% of the amount over $8.500 5153 301.5.207 350 531830+32of the amount over5163.300 15518 400 + 35% of the amount over $207.350 37% of the amount ho 2020 Tax Rate Tables & Standard Deductions $0-$9.875 $9,876 - $40,125 $40,126 - $85,525 $85,526 - $163,300 $163,301 - $207,350 $207,351 - $311,025 $311,026 Married Filing Separately The The Duele: 10% of taxable income $987.50 +12% of the amount over $9,875 $4,617.50 + 22% of the amount over $40,125 $14,605.50 +24% of the amount over $86,525 $33,271.50 + 32% of the amount over $163,300 547,367.50 + 35% of the amount over $207,350 $83,653.75 +37% of the amount over $311,025 Maximum Capital Gains Rates Maximum Zero Rate Amount: Maximum 15% Rate Amount $80,000 $496,600 Filing Status Married Filing Jointly & Surviving Spouses Married Filing Separately Heads of Household Individual Taxpayers Trusts and Estates 540,000 $53,600 $40,000 $2,650 $248,300 $469,050 $441.450 $13,150 H 1 Filing Status Standard Deduction Amount $24.800 Married Filing Jointly & Surviving Spouses Married Filing Separately Heads of Household $12.400 $18.650 O a