Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In 2020 Sky purchased an automobile that had a fair market value of $92,000. She uses the car 90% for business. Her son, Ben,

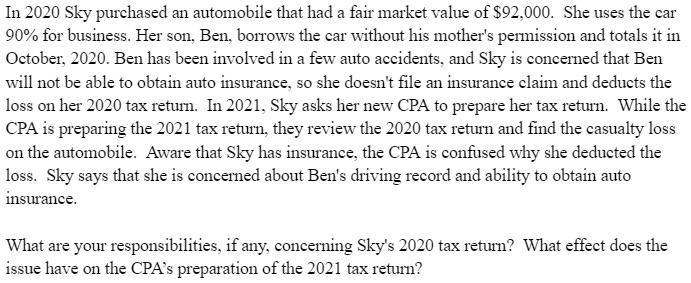

In 2020 Sky purchased an automobile that had a fair market value of $92,000. She uses the car 90% for business. Her son, Ben, borrows the car without his mother's permission and totals it in October, 2020. Ben has been involved in a few auto accidents, and Sky is concerned that Ben will not be able to obtain auto insurance, so she doesn't file an insurance claim and deducts the loss on her 2020 tax return. In 2021, Sky asks her new CPA to prepare her tax return. While the CPA is preparing the 2021 tax return, they review the 2020 tax return and find the casualty loss on the automobile. Aware that Sky has insurance, the CPA is confused why she deducted the loss. Sky says that she is concerned about Ben's driving record and ability to obtain auto insurance. What are your responsibilities, if any, concerning Sky's 2020 tax return? What effect does the issue have on the CPA's preparation of the 2021 tax return?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

You must talk to your client and understand about her sons driving record in detai...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started