Answered step by step

Verified Expert Solution

Question

1 Approved Answer

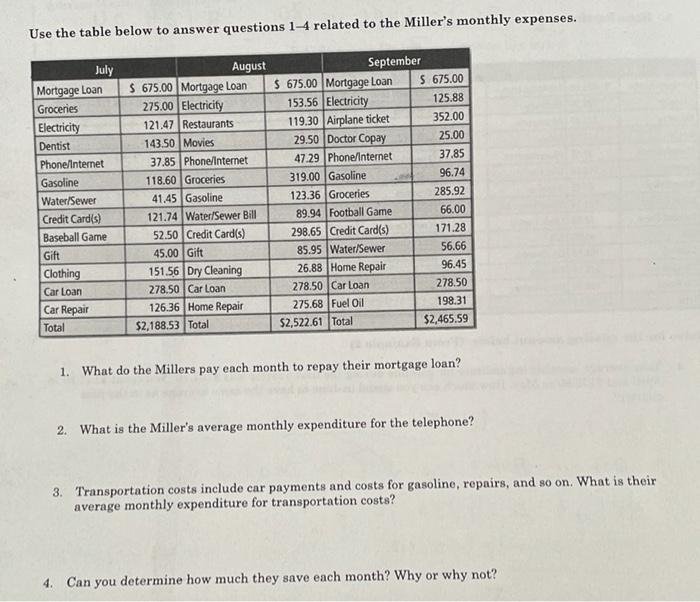

Use the table below to answer questions 1-4 related to the Miller's monthly expenses. July Mortgage Loan Groceries Electricity Dentist Phone/Internet Gasoline Water/Sewer Credit

Use the table below to answer questions 1-4 related to the Miller's monthly expenses. July Mortgage Loan Groceries Electricity Dentist Phone/Internet Gasoline Water/Sewer Credit Card(s) Baseball Game Gift Clothing Car Loan Car Repair Total August $ 675.00 Mortgage Loan 275.00 Electricity 121.47 Restaurants 143.50 Movies 37.85 Phone/Internet 118.60 Groceries 41.45 Gasoline 121.74 Water/Sewer Bill 52.50 Credit Card(s) 45.00 Gift 151.56 Dry Cleaning 278.50 Car Loan 126.36 Home Repair $2,188.53 Total September $ 675.00 Mortgage Loan 153.56 Electricity 119.30 Airplane ticket 29.50 Doctor Copay 47.29 Phone/Internet 319.00 Gasoline 123.36 Groceries 89.94 Football Game 298.65 Credit Card(s) 85.95 Water/Sewer 26.88 Home Repair 278.50 Car Loan 275.68 Fuel Oil $2,522.61 Total S 675.00 125.88 352.00 25.00 37.85 96.74 285.92 66.00 171.28 56.66 96.45 278.50 198.31 $2,465.59 1. What do the Millers pay each month to repay their mortgage loan? 2. What is the Miller's average monthly expenditure for the telephone? 3. Transportation costs include car payments and costs for gasoline, repairs, and so on. What is their average monthly expenditure for transportation costs? 4. Can you determine how much they save each month? Why or why not?

Step by Step Solution

★★★★★

3.48 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started