Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In 2021, employee Asteria earned a $150,000 salary subject to Social Security and Medicare taxes. Note the 6.2% employee share and the 6.2% employer

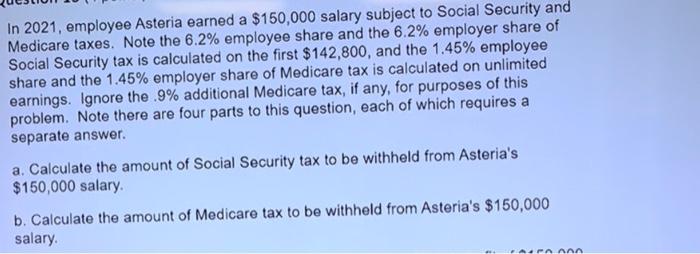

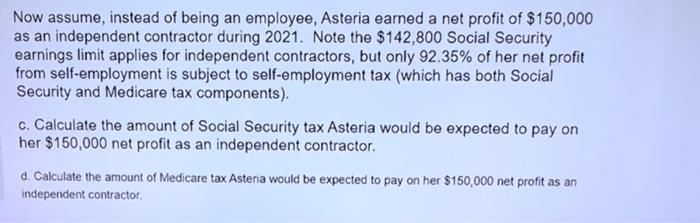

In 2021, employee Asteria earned a $150,000 salary subject to Social Security and Medicare taxes. Note the 6.2% employee share and the 6.2% employer share of Social Security tax is calculated on the first $142,800, and the 1.45% employee share and the 1.45% employer share of Medicare tax is calculated on unlimited earnings. Ignore the .9% additional Medicare tax, if any, for purposes of this problem. Note there are four parts to this question, each of which requires a separate answer. a. Calculate the amount of Social Security tax to be withheld from Asteria's $150,000 salary. b. Calculate the amount of Medicare tax to be withheld from Asteria's $150,000 salary. 0000 Now assume, instead of being an employee, Asteria earned a net profit of $150,000 as an independent contractor during 2021. Note the $142,800 Social Security earnings limit applies for independent contractors, but only 92.35% of her net profit from self-employment is subject to self-employment tax (which has both Social Security and Medicare tax components). c. Calculate the amount of Social Security tax Asteria would be expected to pay on her $150,000 net profit as an independent contractor. d. Calculate the amount of Medicare tax Asteria would be expected to pay on her $150,000 net profit as an independent contractor.

Step by Step Solution

★★★★★

3.27 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Answers For 2021 the wage limit for social security ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started