Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In 2021, Joaquin disposed of some crypto he had held for several years. He is not entirely sure of his basis in the coins. How

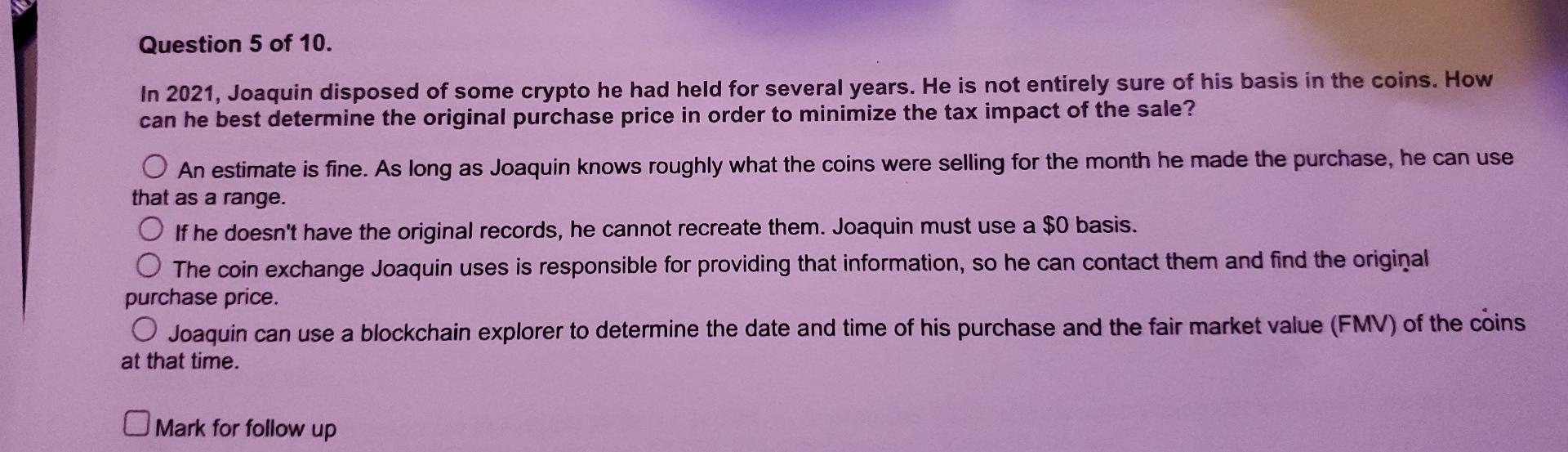

In 2021, Joaquin disposed of some crypto he had held for several years. He is not entirely sure of his basis in the coins. How can he best determine the original purchase price in order to minimize the tax impact of the sale? An estimate is fine. As long as Joaquin knows roughly what the coins were selling for the month he made the purchase, he can use that as a range. If he doesn't have the original records, he cannot recreate them. Joaquin must use a $0 basis. The coin exchange Joaquin uses is responsible for providing that information, so he can contact them and find the original purchase price. Joaquin can use a blockchain explorer to determine the date and time of his purchase and the fair market value (FMV) of the coins at that time. Mark for follow up

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started