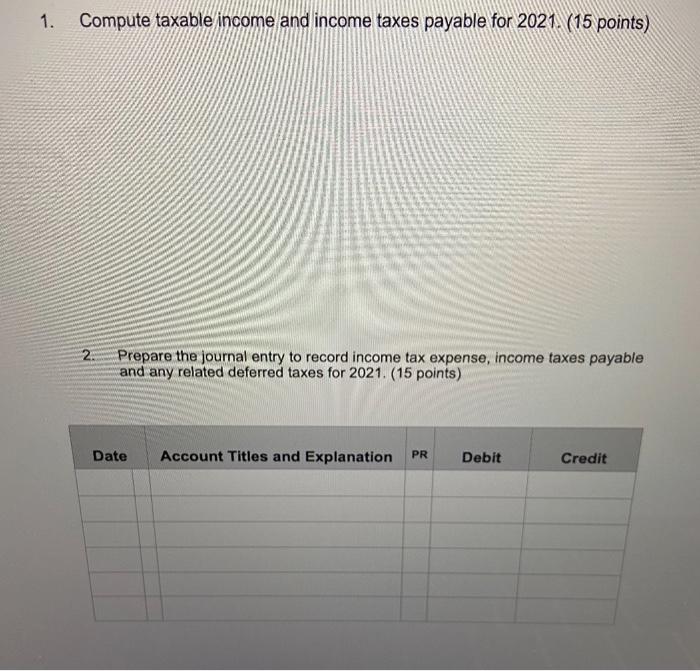

In 2021, the Bullish Company reported pretax accounting income of $100,000, The following items cause taxable income to be different than accounting income: 1. Warranty expense accrued for financial reporting purposes was $5,000. Actual warranty cost paid was $2,000. 2. Gross profit on construction contracts using the percentage-of- completion method for financial reporting was $92,000. Bullish uses the completed contract method for tax purposes. The gross profit reported for tax purposes under this method was $62,000. 3. Depreciation Expense on the company's books for property, plant and equipment amounts to $60,000. Bullish's tax depreciation using MACRS was $80,000. 4. A $3,500 non-deductible fine was charged to expense for financial reporting purposes. 5. Interest earned on tax-exempt municipal bonds was $1,400. Bullish's tax rate is 20% for all years and the company expects to report taxable income in all future years. There are no deferred taxes at the beginning of the year. Instructions 1.Compute taxable income and income taxes payable for 2021. 2.Prepare the journal entry to record income tax expense, income taxes payable and any related deferred taxes for 2021. 3.Prepare a partial income statement for the year ended 2021 that illustrates the reporting of Federal Income Tax Expense. 4.Present and describe how the timing differences would appear in the 2021 balance sheet, ... what are the account names, identify what section of the balance sheet the timing differences would be reported and the amount of any timing differences. Compute taxable income and income taxes payable for 2021. (15 points) 2. Prepare the journal entry to record income tax expense, income taxes payable and any related deferred taxes for 2021. (15 points) Date Account Titles and Explanation PR Debit Credit 3. Prepare a partial income statement, in good form, beginning with Income before taxes, for the year ended 2021 that illustrates the reporting of Federal Income Tax Expense. (5 points) I 4. Present and describe how the timing differences would appear in the 2021 balance sheet, i.e., what are the account names, identify what section of the balance sheet the timing differences would be reported and the amount of any timing differences. (5 points)