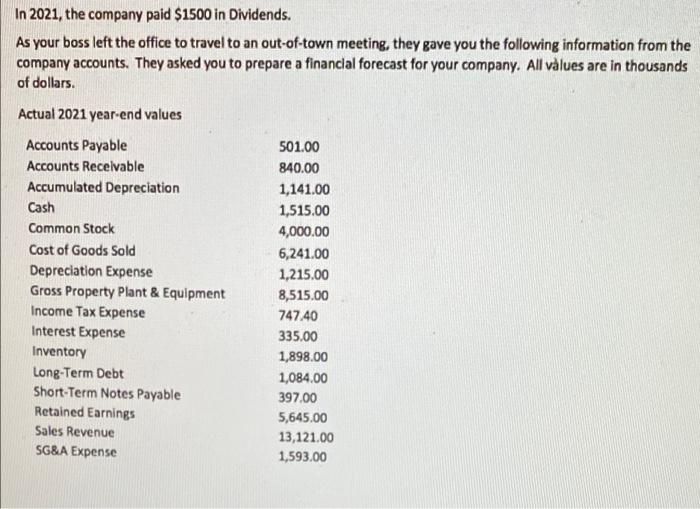

In 2021, the company paid $1500 in Dividends. As your boss left the office to travel to an out-of-town meeting, they gave you the following information from the company accounts. They asked you to prepare a financial forecast for your company. All values are in thousands of dollars. Actual 2021 year-end values

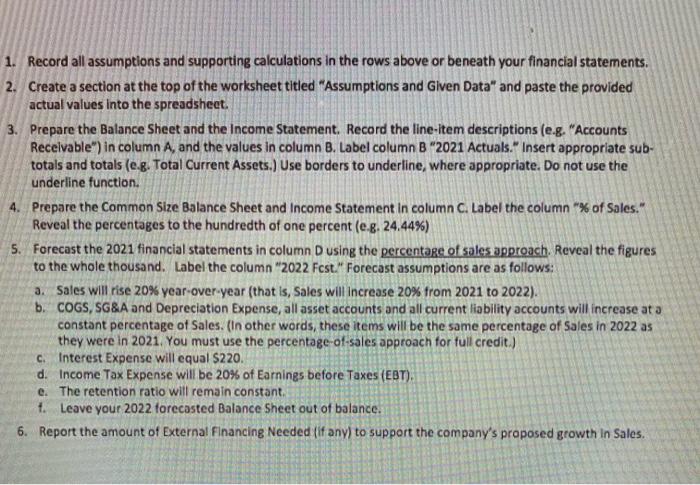

In 2021, the company paid $1500 in Dividends. As your boss left the office to travel to an out-of-town meeting, they gave you the following information from the company accounts. They asked you to prepare a financial forecast for your company. All values are in thousands of dollars. Actual 2021 year-end values Accounts Payable Accounts Receivable Accumulated Depreciation Cash Common Stock Cost of Goods Sold Depreciation Expense Gross Property Plant & Equipment Income Tax Expense Interest Expense Inventory Long-Term Debt Short-Term Notes Payable Retained Earnings Sales Revenue SG&A Expense 501.00 840.00 1,141.00 1,515.00 4,000.00 6,241.00 1,215.00 8,515.00 747.40 335.00 1,898.00 1,084.00 397.00 5,645.00 13,121.00 1,593.00 1. Record all assumptions and supporting calculations in the rows above or beneath your financial statements. 2. Create a section at the top of the worksheet titled "Assumptions and Given Data" and paste the provided actual values into the spreadsheet. 3. Prepare the Balance Sheet and the Income Statement. Record the line-item descriptions (e.g. "Accounts Receivable) in column A, and the values in column B. Label column B "2021 Actuals." Insert appropriate sub- totals and totals (e.g. Total Current Assets.) Use borders to underline, where appropriate. Do not use the underline function. 4. Prepare the Common Size Balance Sheet and Income Statement in column C. Label the column % of Sales." Reveal the percentages to the hundredth of one percent (e.g. 24,44%) 5. Forecast the 2021 financial statements in column D using the percentage of sales approach. Reveal the figures to the whole thousand. Label the column "2022 Fcst. Forecast assumptions are as follows: a. Sales will rise 20% year-over-year (that is, Sales will increase 20% from 2021 to 2022). b. COGS, SG&A and Depreciation Expense, all asset accounts and all current liability accounts will increase at a constant percentage of Sales. (In other words, these items will be the same percentage of Sales in 2022 as they were in 2021. You must use the percentage-of-sales approach for full credit.) c. Interest Expense will equal $220. d. Income Tax Expense will be 20% of Earnings before Taxes (EBT). e. The retention ratio will remain constant. 1. Leave your 2022 forecasted Balance Sheet out of balance. 6. Report the amount of External Financing Needed (if any) to support the company's proposed growth in Sales