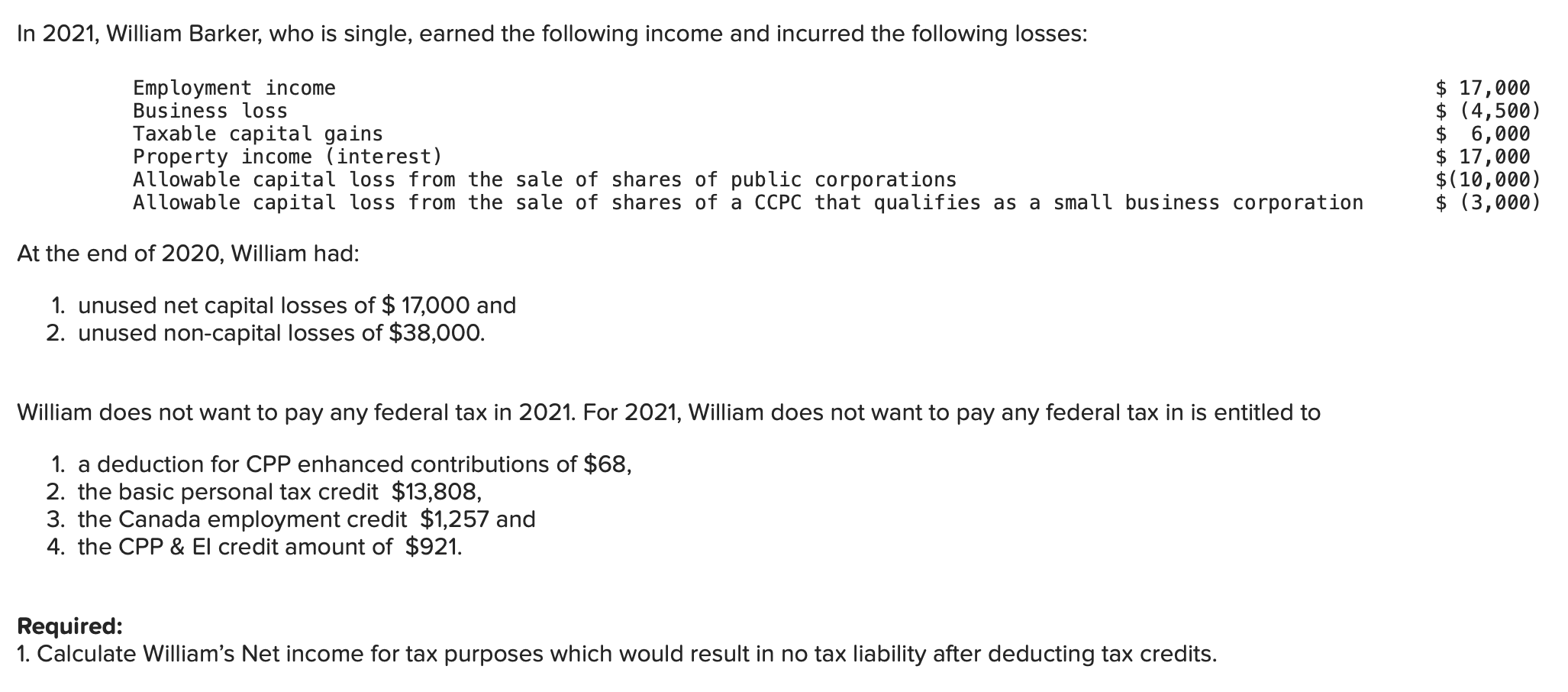

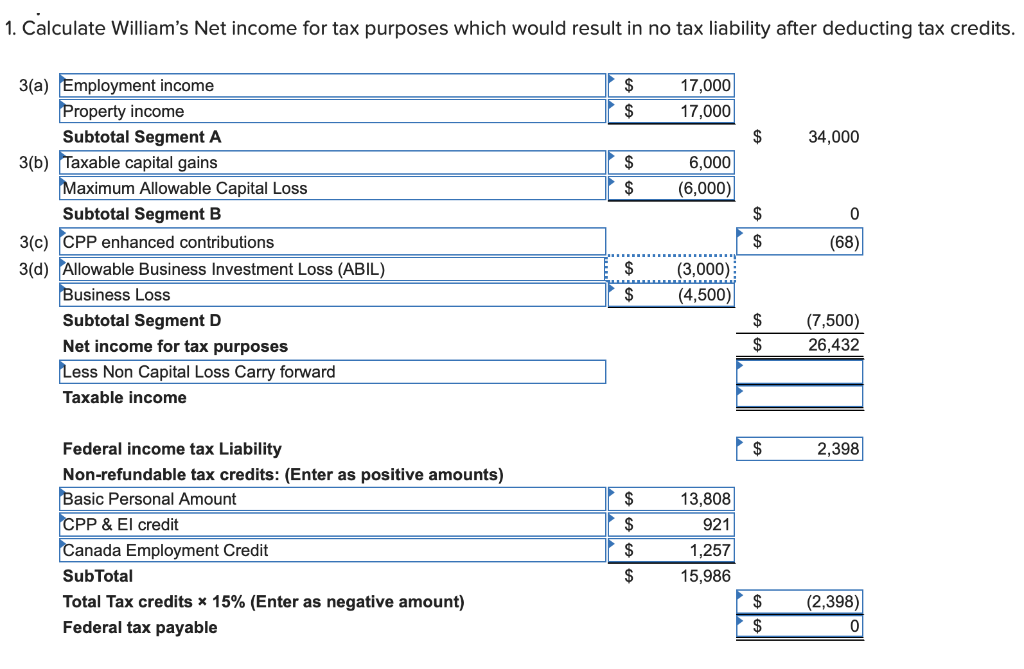

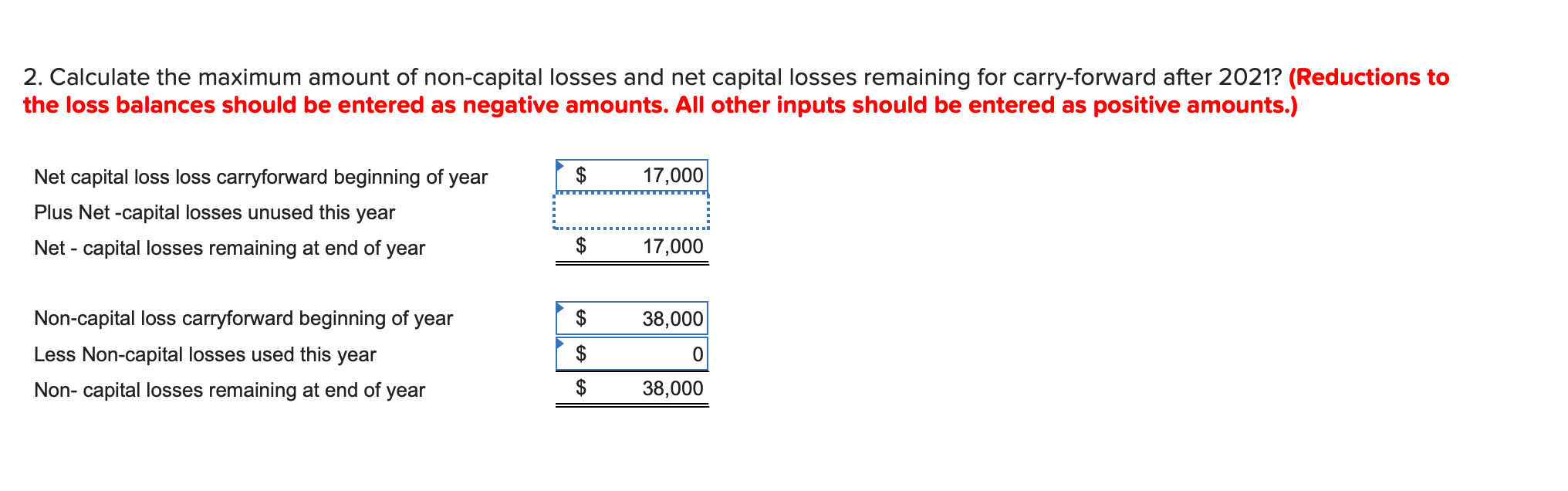

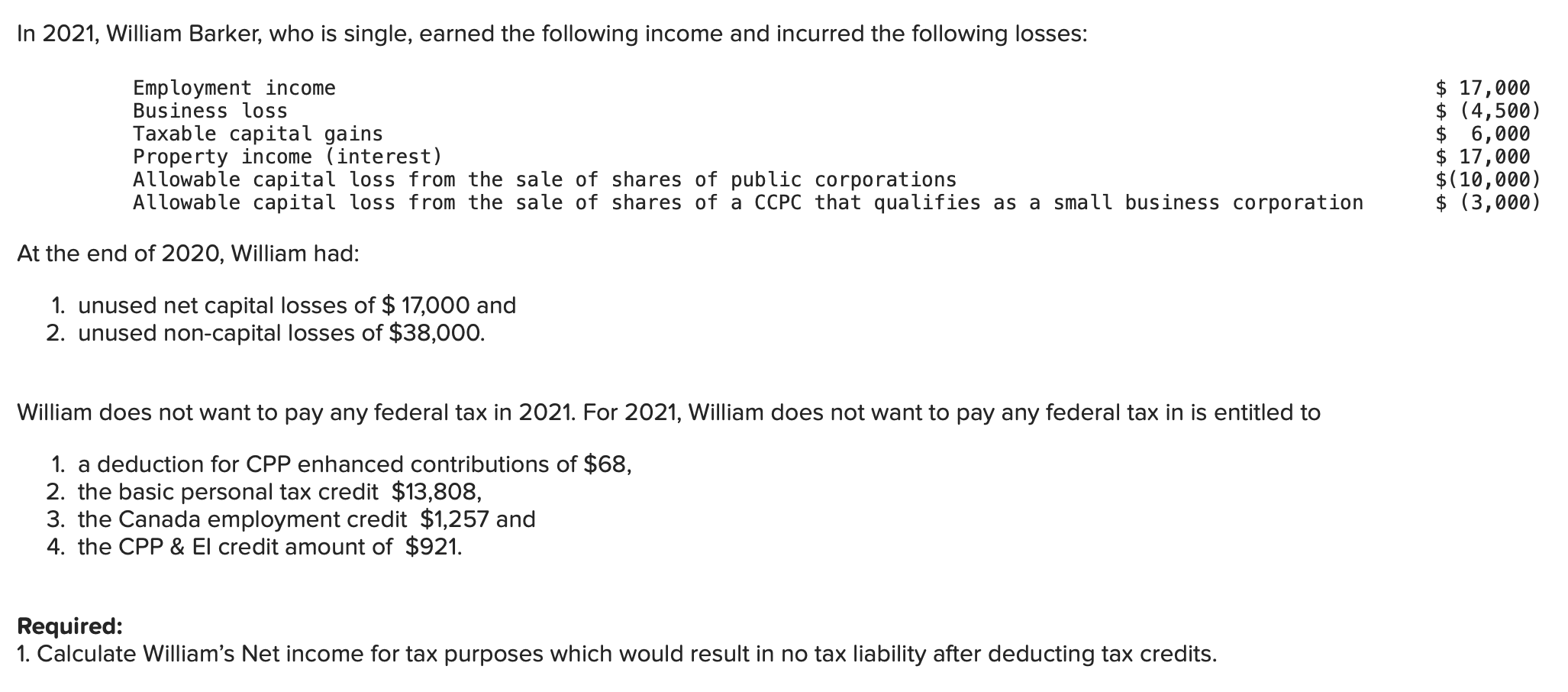

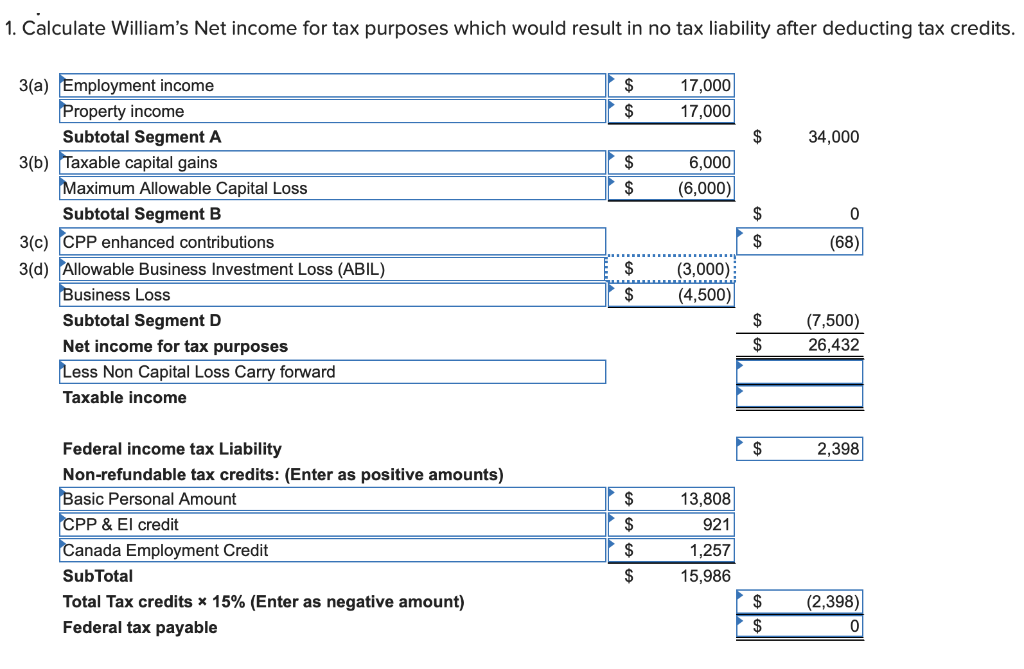

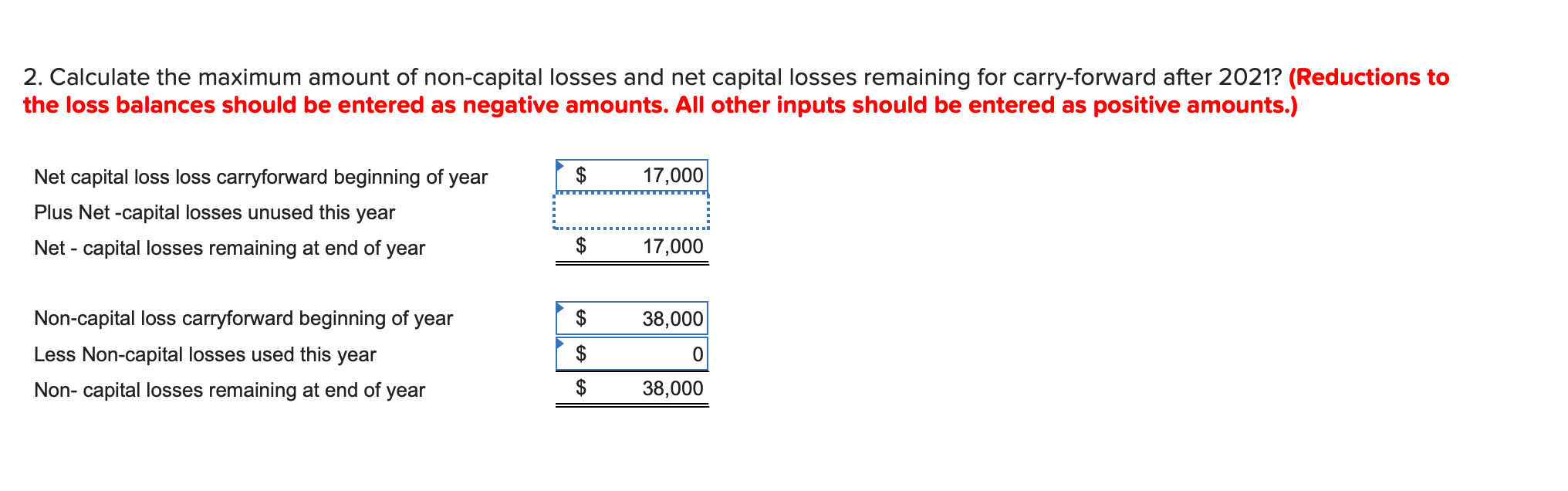

In 2021, William Barker, who is single, earned the following income and incurred the following losses: Employment income Business loss Taxable capital gains Property income (interest) Allowable capital loss from the sale of shares of public corporations Allowable capital loss from the sale of shares of a CCPC that qualifies as a small business corporation $ 17,000 $ (4,500) $ 6,000 $ 17,000 $(10,000) $ (3,000) At the end of 2020, William had: 1. unused net capital losses of $ 17,000 and 2. unused non-capital losses of $38,000. William does not want to pay any federal tax in 2021. For 2021, William does not want to pay any federal tax in is entitled to 1. a deduction for CPP enhanced contributions of $68, 2. the basic personal tax credit $13,808, 3. the Canada employment credit $1,257 and 4. the CPP & El credit amount of $921. Required: 1. Calculate William's Net income for tax purposes which would result in no tax liability after deducting tax credits. 1. Calculate William's Net income for tax purposes which would result in no tax liability after deducting tax credits. $ 17,000 17,000 $ $ 34,000 $ 6,000 (6,000) $ $ 0 3(a) Employment income Property income Subtotal Segment A 3(b) Taxable capital gains Maximum Allowable Capital Loss Subtotal Segment B 3(c) CPP enhanced contributions 3(d) Allowable Business Investment Loss (ABIL) Business Loss Subtotal Segment D Net income for tax purposes Less Non Capital Loss Carry forward Taxable income (68) $ (3,000) (4,500) $ $ $ (7,500) 26,432 2,398 Federal income tax Liability Non-refundable tax credits: (Enter as positive amounts) Basic Personal Amount CPP & El credit Canada Employment Credit SubTotal Total Tax credits * 15% (Enter as negative amount) Federal tax payable $ $ $ $ 13,808 921 1,257 15,986 $ $ (2,398) 0 2. Calculate the maximum amount of non-capital losses and net capital losses remaining for carry-forward after 2021? (Reductions to the loss balances should be entered as negative amounts. All other inputs should be entered as positive amounts.) $ 17,000 Net capital loss loss carryforward beginning of year Plus Net -capital losses unused this year Net - capital losses remaining at end of year $ 17,000 $ 38,000 Non-capital loss carryforward beginning of year Less Non-capital losses used this year Non-capital losses remaining at end of year $ 0 38,000 In 2021, William Barker, who is single, earned the following income and incurred the following losses: Employment income Business loss Taxable capital gains Property income (interest) Allowable capital loss from the sale of shares of public corporations Allowable capital loss from the sale of shares of a CCPC that qualifies as a small business corporation $ 17,000 $ (4,500) $ 6,000 $ 17,000 $(10,000) $ (3,000) At the end of 2020, William had: 1. unused net capital losses of $ 17,000 and 2. unused non-capital losses of $38,000. William does not want to pay any federal tax in 2021. For 2021, William does not want to pay any federal tax in is entitled to 1. a deduction for CPP enhanced contributions of $68, 2. the basic personal tax credit $13,808, 3. the Canada employment credit $1,257 and 4. the CPP & El credit amount of $921. Required: 1. Calculate William's Net income for tax purposes which would result in no tax liability after deducting tax credits. 1. Calculate William's Net income for tax purposes which would result in no tax liability after deducting tax credits. $ 17,000 17,000 $ $ 34,000 $ 6,000 (6,000) $ $ 0 3(a) Employment income Property income Subtotal Segment A 3(b) Taxable capital gains Maximum Allowable Capital Loss Subtotal Segment B 3(c) CPP enhanced contributions 3(d) Allowable Business Investment Loss (ABIL) Business Loss Subtotal Segment D Net income for tax purposes Less Non Capital Loss Carry forward Taxable income (68) $ (3,000) (4,500) $ $ $ (7,500) 26,432 2,398 Federal income tax Liability Non-refundable tax credits: (Enter as positive amounts) Basic Personal Amount CPP & El credit Canada Employment Credit SubTotal Total Tax credits * 15% (Enter as negative amount) Federal tax payable $ $ $ $ 13,808 921 1,257 15,986 $ $ (2,398) 0 2. Calculate the maximum amount of non-capital losses and net capital losses remaining for carry-forward after 2021? (Reductions to the loss balances should be entered as negative amounts. All other inputs should be entered as positive amounts.) $ 17,000 Net capital loss loss carryforward beginning of year Plus Net -capital losses unused this year Net - capital losses remaining at end of year $ 17,000 $ 38,000 Non-capital loss carryforward beginning of year Less Non-capital losses used this year Non-capital losses remaining at end of year $ 0 38,000