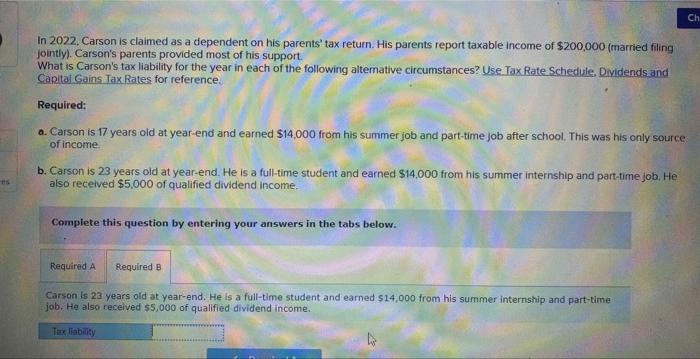

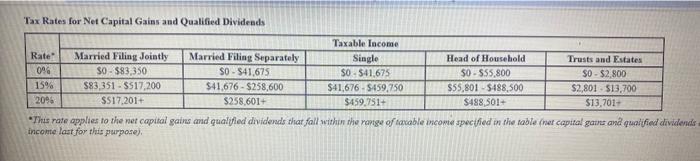

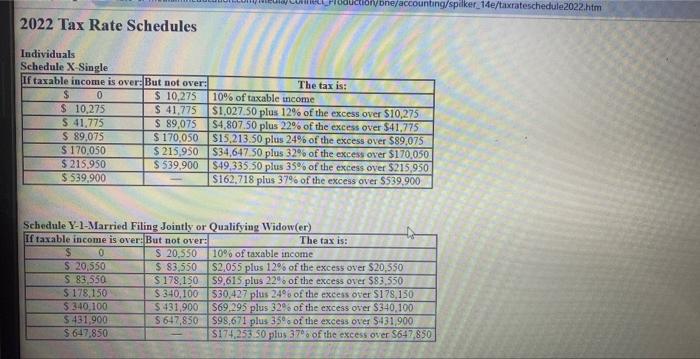

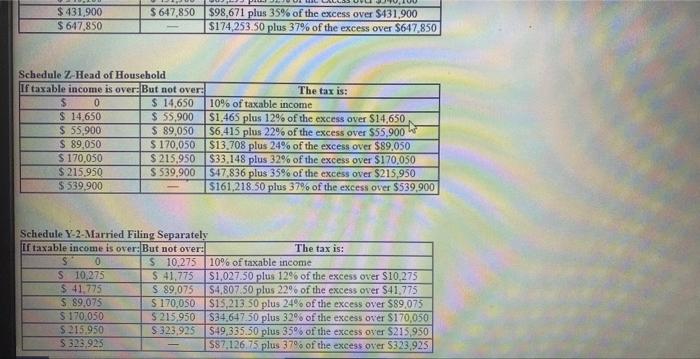

In 2022. Carson is claimed as a dependent on his parents' tax return. His parents report taxable income of $200,000 (married filing jointly). Carson's parents provided most of his support. What is Carson's tax liability for the year in each of the following altemative circumstances? Use Tax Rate Schedule, Dividends and Capital Gains Tax Rates for reference. Required: a. Carson is 17 years old at year-end and earned $14,000 from his summer job and part-time job after school. This was his only source of income. b. Carson is 23 years old at year-end. He is a full-time student and earned $14,000 from his summer internship and part-time job. He also recelved $5,000 of qualified dividend income. Complete this question by entering your answers in the tabs below. Carson is 23 years old at year-end. He is a full-time student and earned $14,000 from his summer internship and part-time job. He also recelved $5,000 of qualified dividend income. Tax Rates for Net Capital Gains and Qualified Dividends - This rate applies to the net capital gains and qualifled dividends that fall within the roptse of tavable income spectfied in she fable (net capital gains ana quajified dividen income last for this purposej. 2022 Tax Rate Schedules Individuals Schedule X-Single \begin{tabular}{|c|c|c|} \hline$431,900 & $647,850 & $98,671 plus 35% of the excess over $431,900 \\ \hline$647,850 & & $174,253.50 plus 37% of the excess over $647,850 \\ \hline \end{tabular} Schedule Z-Head of Household \begin{tabular}{|c|c|l|l|} \hline If taxable income is over: But not over: & \multicolumn{1}{|c|}{ The tax is: } \\ \hline$514,650 & 10% of taxable income \\ \hline$14,650 & $55,900 & $1,465 plus 12% of the excess over $14,650 \\ \hline$55,900 & $89,050 & $6,415 plus 22% of the excess over $55,900 \\ \hline$89,050 & $170,050 & $13,708 plus 24% of the excess over $89,050 \\ \hline$170,050 & $215,950 & $33,148 plus 32% of the excess over $170,050 \\ \hline$215,950 & $539,900 & $47,836 plus 35% of the excess over $215,950 \\ \hline$539,900 & & $161,218.50 plus 37% of the excess over $539,900 \\ \hline \end{tabular} Schedule Y-2-Married Filing Separately