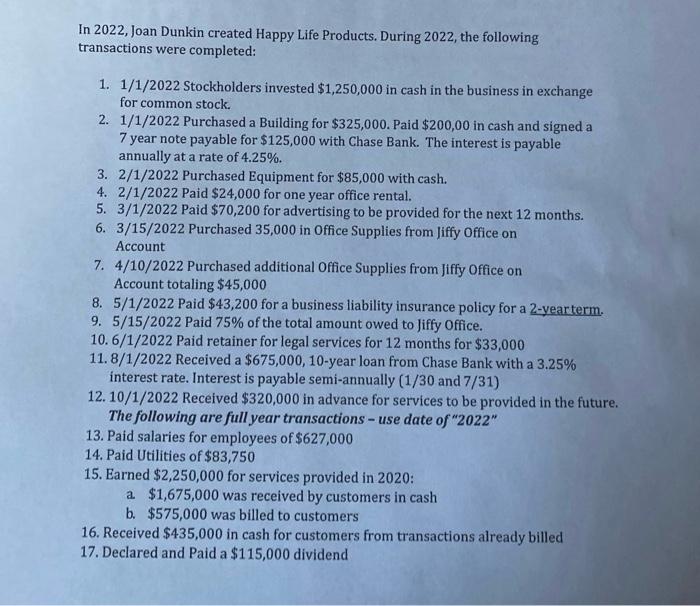

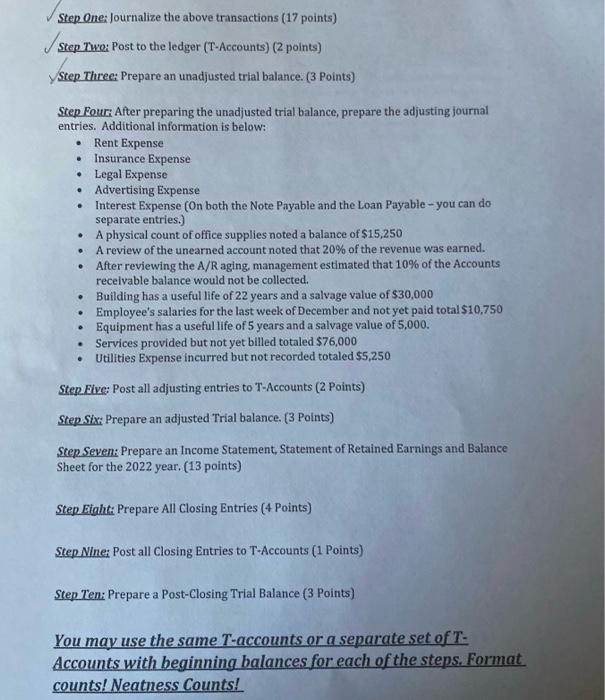

In 2022, Joan Dunkin created Happy Life Products. During 2022, the following transactions were completed: 1. 1/1/2022 Stockholders invested $1,250,000 in cash in the business in exchange for common stock. 2. 1/1/2022 Purchased a Building for $325,000. Paid $200,00 in cash and signed a 7 year note payable for $125,000 with Chase Bank. The interest is payable annually at a rate of 4.25%. 3. 2/1/2022 Purchased Equipment for $85,000 with cash. 4. 2/1/2022 Paid $24,000 for one year office rental. 5. 3/1/2022 Paid $70,200 for advertising to be provided for the next 12 months. 6. 3/15/2022 Purchased 35,000 in Office Supplies from liffy Office on Account 7. 4/10/2022 Purchased additional Office Supplies from Jiffy Office on Account totaling $45,000 8. 5/1/2022 Paid $43,200 for a business liability insurance policy for a 2-yearterm. 9. 5/15/2022 Paid 75% of the total amount owed to Jiffy office. 10. 6/1/2022 Paid retainer for legal services for 12 months for $33,000 11. 8/1/2022 Received a $675,000,10-year loan from Chase Bank with a 3.25% interest rate. Interest is payable semi-annually (1/30 and 7/31) 12. 10/1/2022 Received $320,000 in advance for services to be provided in the future. The following are full year transactions - use date of " 2022 " 13. Paid salaries for employees of $627,000 14. Paid Utilities of $83,750 15. Earned $2,250,000 for services provided in 2020: a. $1,675,000 was received by customers in cash b. $575,000 was billed to customers 16. Received $435,000 in cash for customers from transactions already billed 17. Declared and Paid a $115,000 dividend Step One: Journalize the above transactions (17 points) Step Two: Post to the ledger (T-Accounts) (2 points) Ytep Three: Prepare an unadjusted trial balance. (3 Points) Step Four: After preparing the unadjusted trial balance, prepare the adjusting journal entries. Additional information is below: - Rent Expense - Insurance Expense - Legal Expense - Advertising Expense - Interest Expense (On both the Note Payable and the Loan Payable - you can do separate entries.) - A physical count of office supplies noted a balance of $15,250 - A review of the unearned account noted that 20% of the revenue was earned. - After reviewing the A/R aging, management estimated that 10% of the Accounts recelvable balance would not be collected. - Building has a useful life of 22 years and a salvage value of $30,000 - Employee's salaries for the last week of December and not yet paid total $10,750 - Equipment has a useful life of 5 years and a salvage value of 5,000 . - Services provided but not yet billed totaled $76,000 - Utilities Expense incurred but not recorded totaled \$5,250 Sten Eive: Post all adjusting entries to T-Accounts (2 Points) Srep Sixi Prepare an adjusted Trial balance. (3 Points) Step Seven: Prepare an Income Statement, Statement of Retained Earnings and Balance Sheet for the 2022 year. ( 13 points) Step Eight: Prepare All Closing Entries (4 Points) Step Nine: Post all Closing Entries to T-Accounts (1 Points) Step Ten; Prepare a Post-Closing Trial Balance (3 Points) You may use the same T-accounts or a separate set of TAccounts with beginning balances for each of the steps. Format counts! Neatness Counts! In 2022, Joan Dunkin created Happy Life Products. During 2022, the following transactions were completed: 1. 1/1/2022 Stockholders invested $1,250,000 in cash in the business in exchange for common stock. 2. 1/1/2022 Purchased a Building for $325,000. Paid $200,00 in cash and signed a 7 year note payable for $125,000 with Chase Bank. The interest is payable annually at a rate of 4.25%. 3. 2/1/2022 Purchased Equipment for $85,000 with cash. 4. 2/1/2022 Paid $24,000 for one year office rental. 5. 3/1/2022 Paid $70,200 for advertising to be provided for the next 12 months. 6. 3/15/2022 Purchased 35,000 in Office Supplies from liffy Office on Account 7. 4/10/2022 Purchased additional Office Supplies from Jiffy Office on Account totaling $45,000 8. 5/1/2022 Paid $43,200 for a business liability insurance policy for a 2-yearterm. 9. 5/15/2022 Paid 75% of the total amount owed to Jiffy office. 10. 6/1/2022 Paid retainer for legal services for 12 months for $33,000 11. 8/1/2022 Received a $675,000,10-year loan from Chase Bank with a 3.25% interest rate. Interest is payable semi-annually (1/30 and 7/31) 12. 10/1/2022 Received $320,000 in advance for services to be provided in the future. The following are full year transactions - use date of " 2022 " 13. Paid salaries for employees of $627,000 14. Paid Utilities of $83,750 15. Earned $2,250,000 for services provided in 2020: a. $1,675,000 was received by customers in cash b. $575,000 was billed to customers 16. Received $435,000 in cash for customers from transactions already billed 17. Declared and Paid a $115,000 dividend Step One: Journalize the above transactions (17 points) Step Two: Post to the ledger (T-Accounts) (2 points) Ytep Three: Prepare an unadjusted trial balance. (3 Points) Step Four: After preparing the unadjusted trial balance, prepare the adjusting journal entries. Additional information is below: - Rent Expense - Insurance Expense - Legal Expense - Advertising Expense - Interest Expense (On both the Note Payable and the Loan Payable - you can do separate entries.) - A physical count of office supplies noted a balance of $15,250 - A review of the unearned account noted that 20% of the revenue was earned. - After reviewing the A/R aging, management estimated that 10% of the Accounts recelvable balance would not be collected. - Building has a useful life of 22 years and a salvage value of $30,000 - Employee's salaries for the last week of December and not yet paid total $10,750 - Equipment has a useful life of 5 years and a salvage value of 5,000 . - Services provided but not yet billed totaled $76,000 - Utilities Expense incurred but not recorded totaled \$5,250 Sten Eive: Post all adjusting entries to T-Accounts (2 Points) Srep Sixi Prepare an adjusted Trial balance. (3 Points) Step Seven: Prepare an Income Statement, Statement of Retained Earnings and Balance Sheet for the 2022 year. ( 13 points) Step Eight: Prepare All Closing Entries (4 Points) Step Nine: Post all Closing Entries to T-Accounts (1 Points) Step Ten; Prepare a Post-Closing Trial Balance (3 Points) You may use the same T-accounts or a separate set of TAccounts with beginning balances for each of the steps. Format counts! Neatness Counts