Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In 2023, Comet Corporation sold farm land for $500,000. Comet originally had acquired the land for $400,000 several years ago. Previously, Comet had reported

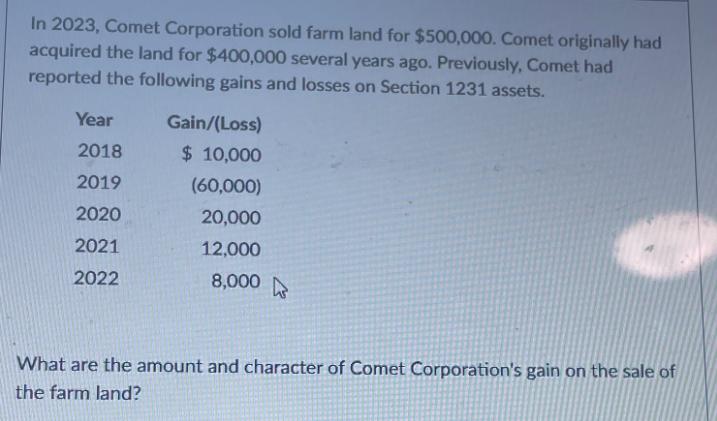

In 2023, Comet Corporation sold farm land for $500,000. Comet originally had acquired the land for $400,000 several years ago. Previously, Comet had reported the following gains and losses on Section 1231 assets. Year Gain/(Loss) 2018 $ 10,000 2019 (60,000) 2020 20,000 2021 12,000 2022 8,000 What are the amount and character of Comet Corporation's gain on the sale of the farm land?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The gain on the sale of the farm land is calculated as the selling price minus the original purchase ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

664229577ac7f_985158.pdf

180 KBs PDF File

664229577ac7f_985158.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started