Question

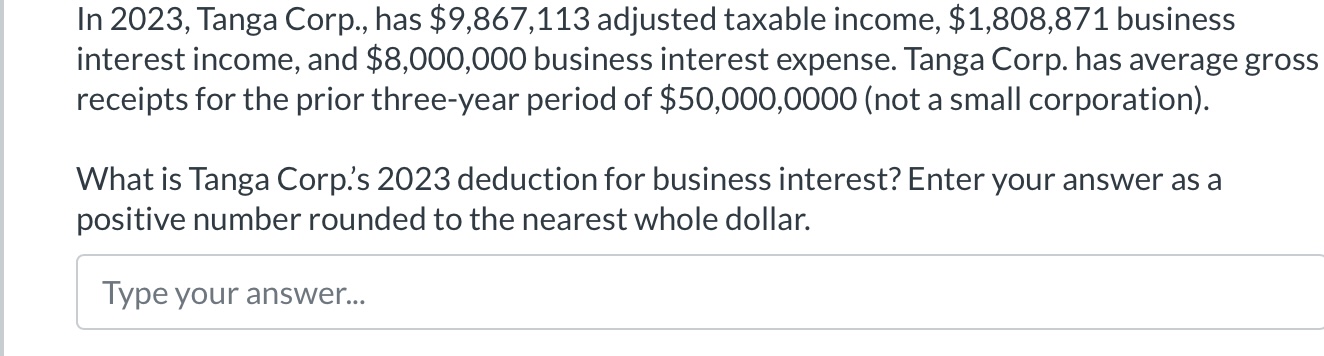

In 2023, Tanga Corp., has $9,867,113 adjusted taxable income, $1,808,871 business interest income, and $8,000,000 business interest expense. Tanga Corp. has average gross receipts

In 2023, Tanga Corp., has $9,867,113 adjusted taxable income, $1,808,871 business interest income, and $8,000,000 business interest expense. Tanga Corp. has average gross receipts for the prior three-year period of $50,000,0000 (not a small corporation). What is Tanga Corp.'s 2023 deduction for business interest? Enter your answer as a positive number rounded to the nearest whole dollar. Type your answer...

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

South-Western Federal Taxation 2019 Comprehensive

Authors: David M. Maloney, William A. Raabe, William H. Hoffman, James C. Young

42th Edition

1337702544, 978-1337702546, 133770301X, 978-1337703017

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App