Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In 2024, Cullumber Inc. sold 14,500 units of its product at an average price of $390 per unit. Cullumber purchased 19,400 units of its

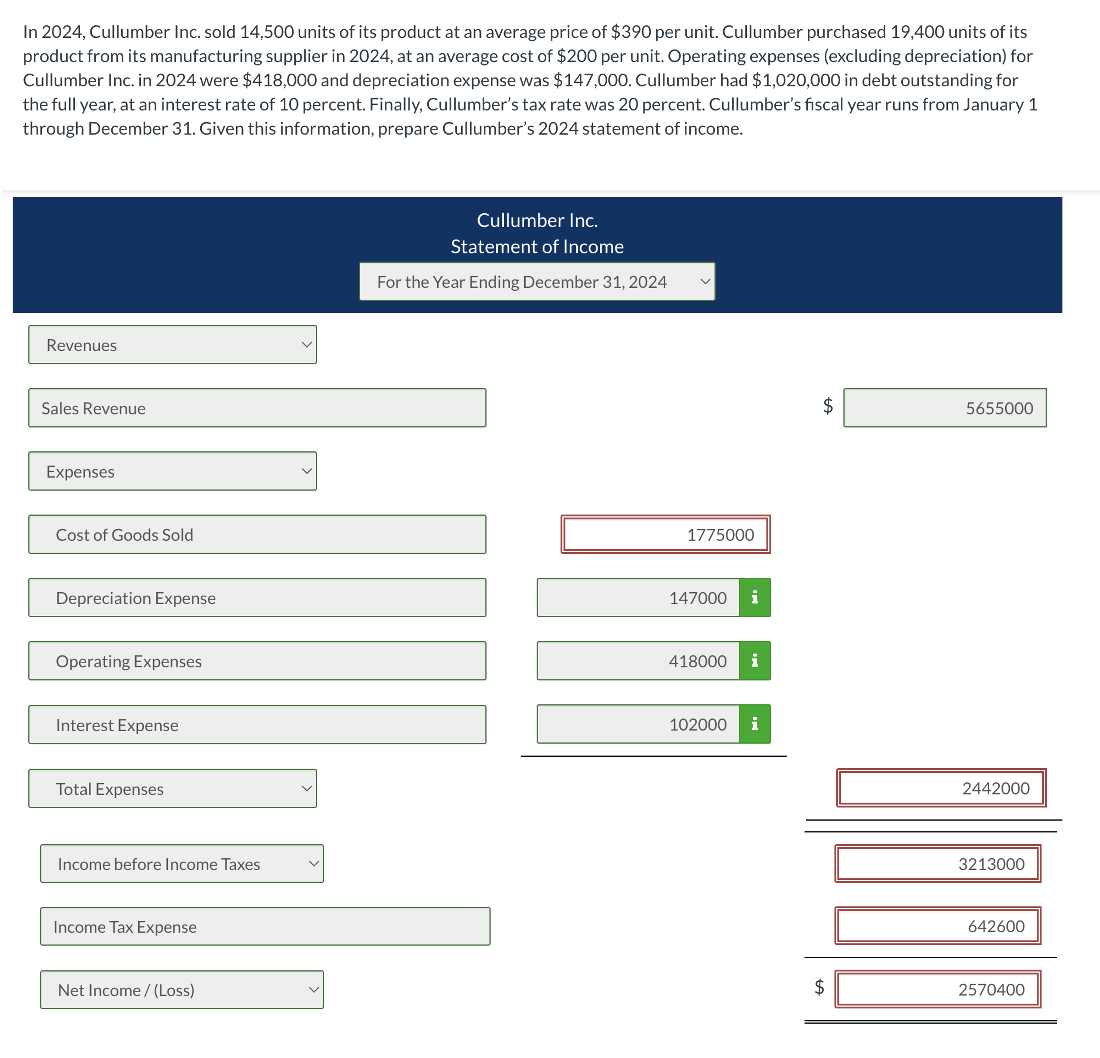

In 2024, Cullumber Inc. sold 14,500 units of its product at an average price of $390 per unit. Cullumber purchased 19,400 units of its product from its manufacturing supplier in 2024, at an average cost of $200 per unit. Operating expenses (excluding depreciation) for Cullumber Inc. in 2024 were $418,000 and depreciation expense was $147,000. Cullumber had $1,020,000 in debt outstanding for the full year, at an interest rate of 10 percent. Finally, Cullumber's tax rate was 20 percent. Cullumber's fiscal year runs from January 1 through December 31. Given this information, prepare Cullumber's 2024 statement of income. Revenues Sales Revenue Expenses Cost of Goods Sold Cullumber Inc. Statement of Income For the Year Ending December 31, 2024 1775000 Depreciation Expense 147000 i Operating Expenses Interest Expense Total Expenses Income before Income Taxes Income Tax Expense Net Income/(Loss) 418000 i 102000 i $ 5655000 2442000 3213000 642600 $ 2570400

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started