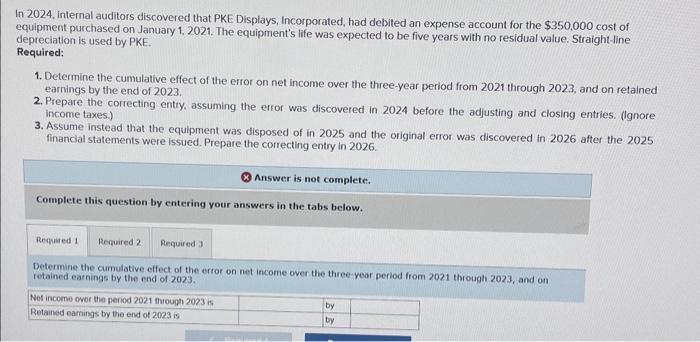

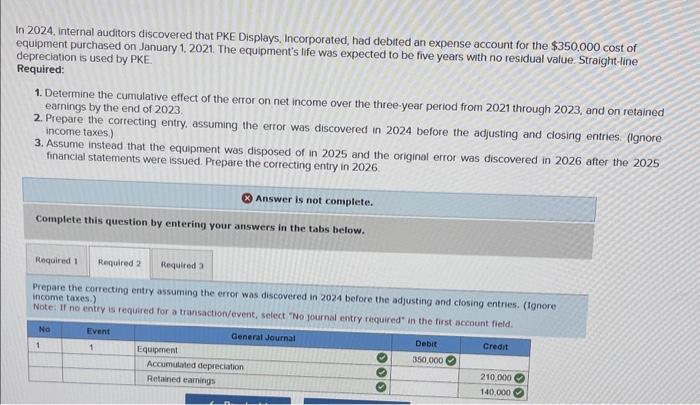

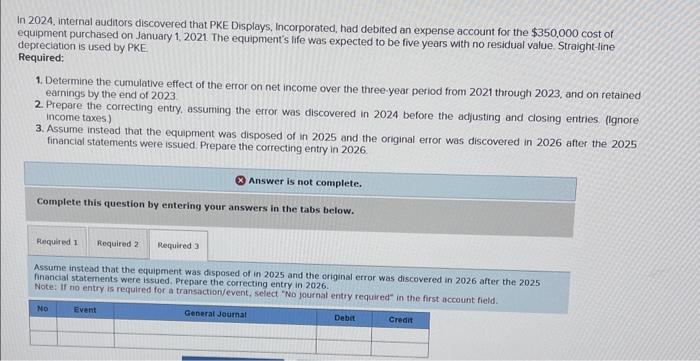

In 2024, internal auditors discovered that PKE Displays, Incorporated, had debited an expense account for the $350,000 cost of equipment purchased on January 1,2021. The equipment's life was expected to be five years with no residual value. Straight-line depreciation is used by PKE. Required: 1. Determine the cumulative effect of the error on net income over the three-year period from 2021 through 2023 , and on retained earnings by the end of 2023 . 2. Prepare the correcting entry, assuming the error was discovered in 2024 before the adjusting and closing entries. (lgnore income taxes.) 3. Assume instead that the equipment was disposed of in 2025 and the original error was discovered in 2026 after the 2025 financial statements were issued. Prepare the correcting entry in 2026. Answer is not complete. Complete this question by entering your answers in the tabs below. Determine the cumulative effect of the error on net income over the three year period from 2021 through 2023, and on retained earnings by the end of 2023 . In 2024. internal auditors discovered that PKE Displays, Incorporated, had debited an expense account for the $350.000 cost of equipment purchased on January 1, 2021. The equipment's life was expected to be five years with no residual value. Straight-line depreciation is used by PKE. Required: 1. Determine the cumulative effect of the error on net income over the three-year period from 2021 through 2023, and on retained earnings by the end of 2023 . 2. Prepare the correcting entry, assuming the error was discovered in 2024 before the adjusting and closing entries. (lgnore income taxes,) 3. Assume instead that the equipment was disposed of in 2025 and the original error was discovered in 2026 after the 2025 financial statements were issued. Prepare the correcting entry in 2026 Answer is not complete. Complete this question by entering your answers in the tabs below. Prepare the correcting entry assuming the error was discovered in 2024 before the adjusting and closing entries. (Ignore income taxes.) Note: If no entry is required for a transaction/event, select "No journal entry tepuired" in the first anma.nt wair. In 2024. internal auditors discovered that PKE Displays, Incorporated, had debited an expense account for the $350,000 cost of equipment purchased on January 1, 2021. The equipment's life was expected to be five years with no residual value. Straight-line depreciation is used by PKE Required: 1. Determine the cumulative effect of the error on net income over the three-year period from 2021 through 2023, and on retained earnings by the end of 2023 2. Prepare the correcting entry, assuming the error was discovered in 2024 before the adjusting and closing entries (lignore income taxes.) 3. Assume instead that the equipment was disposed of in 2025 and the original error was discovered in 2026 after the 2025 financial statements were issued. Prepare the correcting entry in 2026 Answer is not complete. Complete this question by entering your answers in the tabs below. Assume instead that the equipment was disposed of in 2025 and the original error was discovered in 2026 after the 2025 financal statements were issued, Prepare the correcting entry in 2026. Note: If no entry is required for a transactionvevent, sciect "No journal entry required" in the first account fietd