Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In 2025, RH Corporation bought a zone of unimproved land for $1,400,000. RH Corporation decided to improve and alter the land by separating the

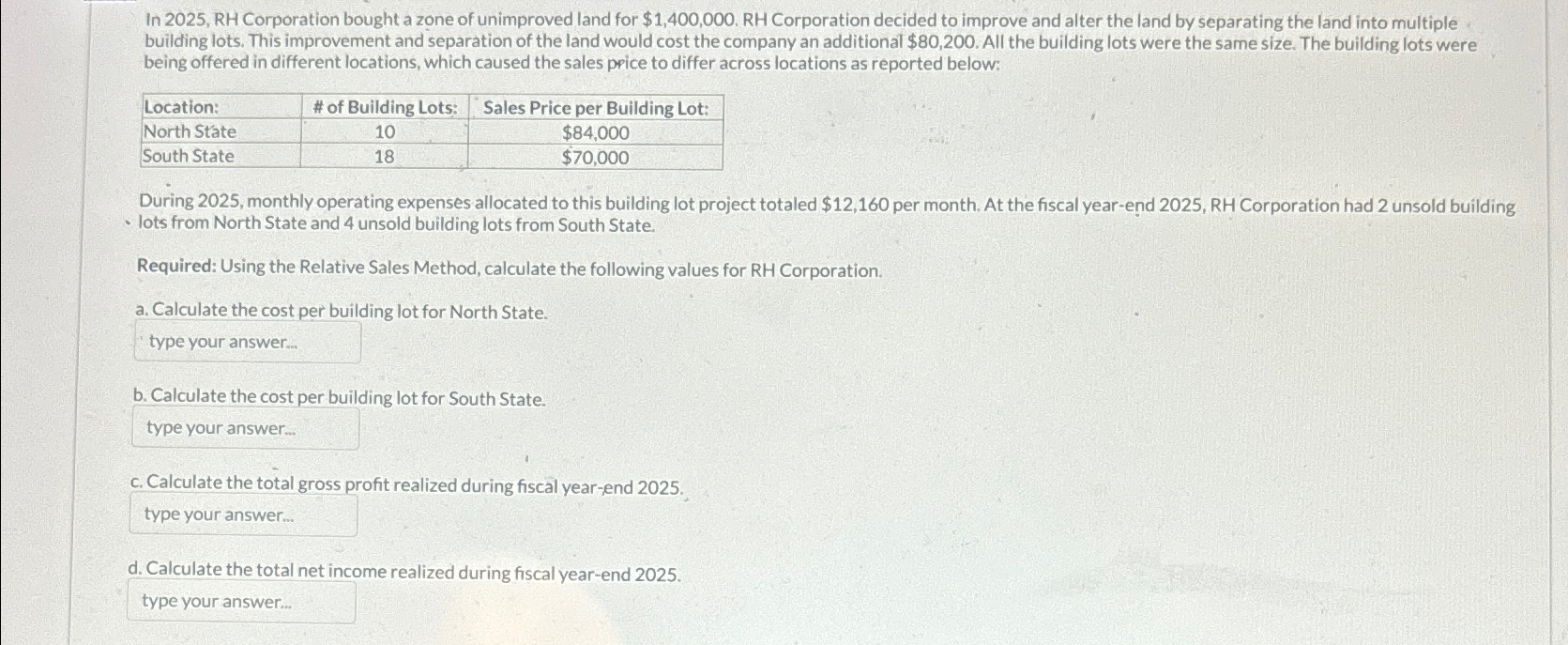

In 2025, RH Corporation bought a zone of unimproved land for $1,400,000. RH Corporation decided to improve and alter the land by separating the land into multiple building lots. This improvement and separation of the land would cost the company an additional $80,200. All the building lots were the same size. The building lots were being offered in different locations, which caused the sales price to differ across locations as reported below: Location: North State South State # of Building Lots: Sales Price per Building Lot: $84,000 $70,000 10 18 During 2025, monthly operating expenses allocated to this building lot project totaled $12,160 per month. At the fiscal year-end 2025, RH Corporation had 2 unsold building lots from North State and 4 unsold building lots from South State. Required: Using the Relative Sales Method, calculate the following values for RH Corporation. a. Calculate the cost per building lot for North State. type your answer... b. Calculate the cost per building lot for South State. type your answer.... c. Calculate the total gross profit realized during fiscal year-end 2025. type your answer... d. Calculate the total net income realized during fiscal year-end 2025. type your answer...

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started