Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In 2025, TC Air Inc.'s net income was $1,200,000. Air had 115,000 ordinary shares outstanding at year-end. There were two ordinary share transactions during

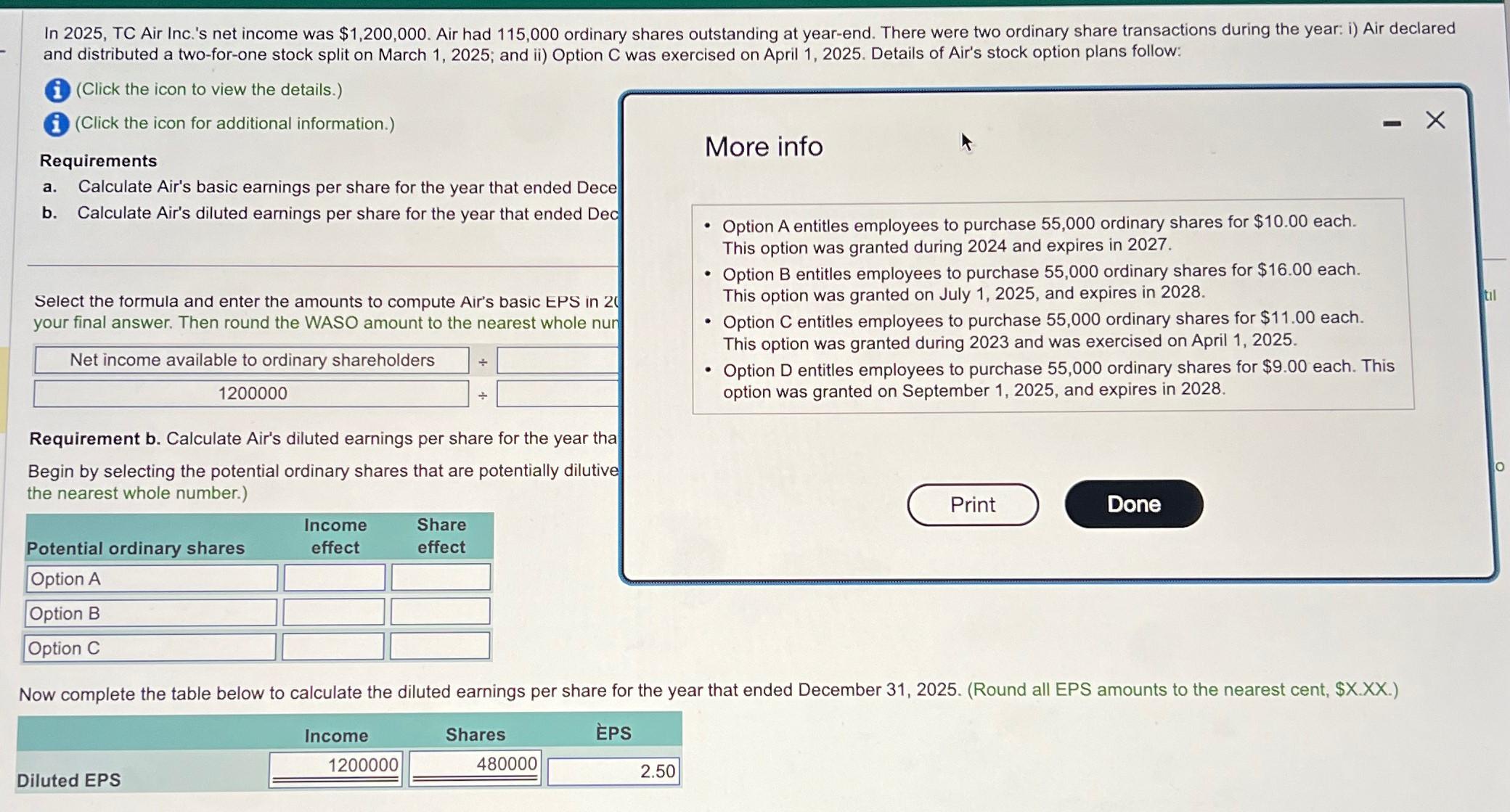

In 2025, TC Air Inc.'s net income was $1,200,000. Air had 115,000 ordinary shares outstanding at year-end. There were two ordinary share transactions during the year: i) Air declared and distributed a two-for-one stock split on March 1, 2025; and ii) Option C was exercised on April 1, 2025. Details of Air's stock option plans follow: (Click the icon to view the details.) (Click the icon for additional information.) Requirements a. b. Calculate Air's basic earnings per share for the year that ended Dece Calculate Air's diluted earnings per share for the year that ended Dec More info Select the formula and enter the amounts to compute Air's basic EPS in 20 your final answer. Then round the WASO amount to the nearest whole nun Net income available to ordinary shareholders 1200000 + Requirement b. Calculate Air's diluted earnings per share for the year tha Begin by selecting the potential ordinary shares that are potentially dilutive the nearest whole number.) Potential ordinary shares Income effect Share effect Option A Option B Option A entitles employees to purchase 55,000 ordinary shares for $10.00 each. This option was granted during 2024 and expires in 2027. Option B entitles employees to purchase 55,000 ordinary shares for $16.00 each. This option was granted on July 1, 2025, and expires in 2028. til Option C entitles employees to purchase 55,000 ordinary shares for $11.00 each. This option was granted during 2023 and was exercised on April 1, 2025. Option D entitles employees to purchase 55,000 ordinary shares for $9.00 each. This option was granted on September 1, 2025, and expires in 2028. Print Done Option C Now complete the table below to calculate the diluted earnings per share for the year that ended December 31, 2025. (Round all EPS amounts to the nearest cent, $X.XX.) Diluted EPS Income 1200000 Shares EPS 480000 2.50 10

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started