Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In 20X6, Dalia Corp., a calendar fiscal-year company, discovered that depreciation expense was erroneously overstated $76,000 in both 204 and 205 for financial reporting purposes.

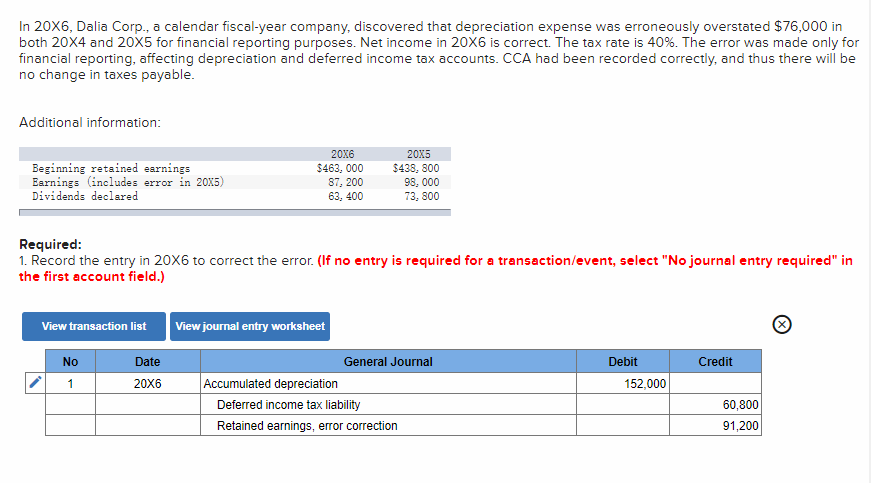

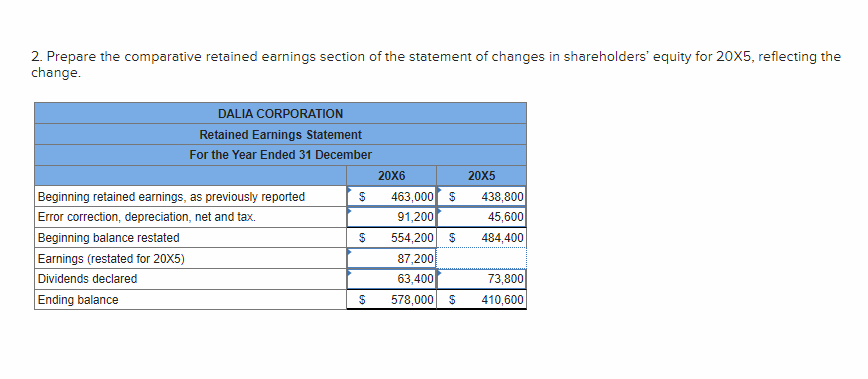

In 20X6, Dalia Corp., a calendar fiscal-year company, discovered that depreciation expense was erroneously overstated $76,000 in both 204 and 205 for financial reporting purposes. Net income in 206 is correct. The tax rate is 40%. The error was made only for financial reporting, affecting depreciation and deferred income tax accounts. CCA had been recorded correctly, and thus there will be no change in taxes payable. Additional information: Required: 1. Record the entry in 206 to correct the error. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) 2. Prepare the comparative retained earnings section of the statement of changes in shareholders' equity for 205, reflecting the change

In 20X6, Dalia Corp., a calendar fiscal-year company, discovered that depreciation expense was erroneously overstated $76,000 in both 204 and 205 for financial reporting purposes. Net income in 206 is correct. The tax rate is 40%. The error was made only for financial reporting, affecting depreciation and deferred income tax accounts. CCA had been recorded correctly, and thus there will be no change in taxes payable. Additional information: Required: 1. Record the entry in 206 to correct the error. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) 2. Prepare the comparative retained earnings section of the statement of changes in shareholders' equity for 205, reflecting the change Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started