Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In 5 months, you wish to issue promissory notes with a face value of AUD 3, 200, 000 to finance short-term inventory increases for

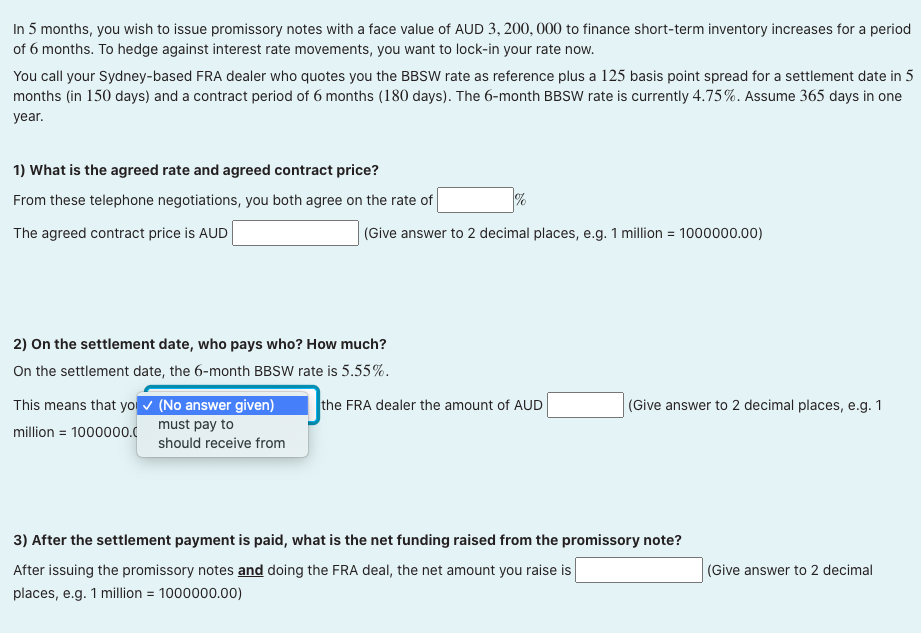

In 5 months, you wish to issue promissory notes with a face value of AUD 3, 200, 000 to finance short-term inventory increases for a period of 6 months. To hedge against interest rate movements, you want to lock-in your rate now. You call your Sydney-based FRA dealer who quotes you the BBSW rate as reference plus a 125 basis point spread for a settlement date in 5 months (in 150 days) and a contract period of 6 months (180 days). The 6-month BBSW rate is currently 4.75%. Assume 365 days in one year. 1) What is the agreed rate and agreed contract price? From these telephone negotiations, you both agree on the rate of The agreed contract price is AUD % (Give answer to 2 decimal places, e.g. 1 million = 1000000.00) 2) On the settlement date, who pays who? How much? On the settlement date, the 6-month BBSW rate is 5.55%. This means that you (No answer given) must pay to million = 1000000.0 the FRA dealer the amount of AUD (Give answer to 2 decimal places, e.g. 1 should receive from 3) After the settlement payment is paid, what is the net funding raised from the promissory note? After issuing the promissory notes and doing the FRA deal, the net amount you raise is places, e.g. 1 million = 1000000.00) (Give answer to 2 decimal

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started