Answered step by step

Verified Expert Solution

Question

1 Approved Answer

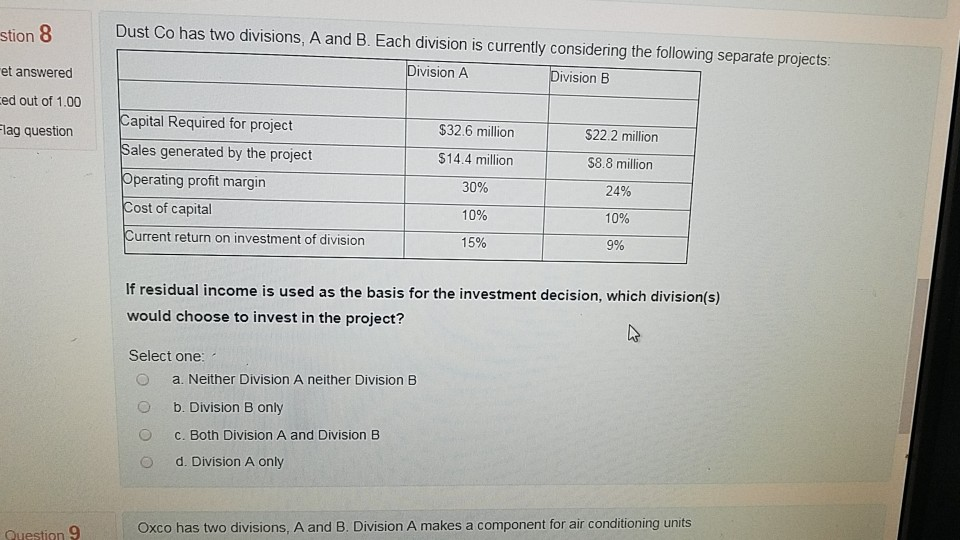

in 8Dust Co has two divisions, A and B. Each division is currently considering the following separate projects: stion et answered ed out of 1.00

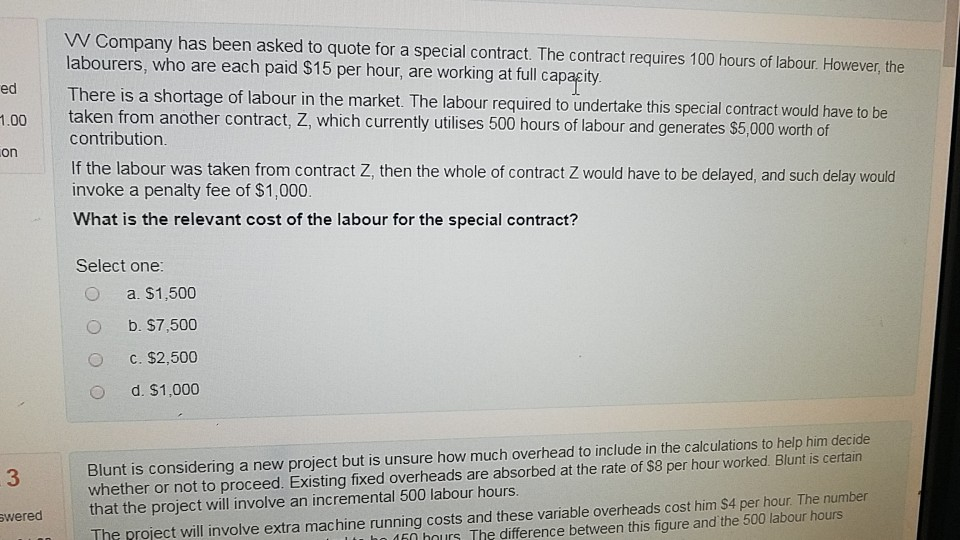

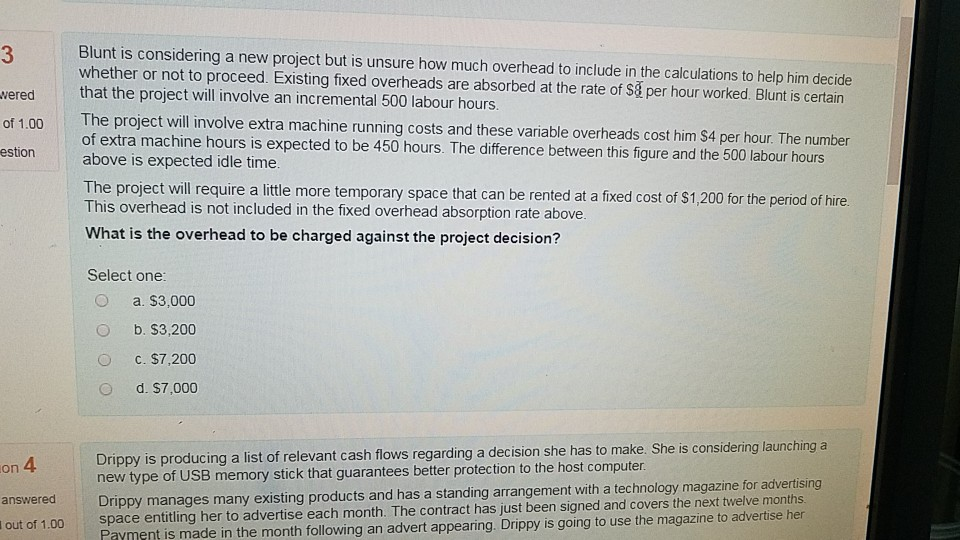

in 8Dust Co has two divisions, A and B. Each division is currently considering the following separate projects: stion et answered ed out of 1.00 lag question vision A Division EB Capital Required for project Sales generated by the project Operating profit margin Cost of capital Current return on investment of division $32.6 million $14.4 million 30% $22.2 million $8.8 million 20% 15% 5% If residual income is used as the basis for the investment decision, which division(s) would choose to invest in the project? Select one O a. Neither Division A neither Division B O b. Division B only O c. Both Division A and Division B O d. Division A only Oxco has two divisions, A and B. Division A makes a component for air conditioning units VW Company has been asked to quote for a special contract. The contract requires 100 hours of labour. However, the labourers, who are each paid $15 per hour, are working at full capagity. ed 1.00 on There is a shortage of labour i taken from another contract, Z, which currently utilises 500 hours of labour and generates $5,000 worth of contribution. n the market. The labour required to undertake this special contract would have to be If the labour was taken from contract Z, then the whole of contract Z would have to be delayed, and such delay would invoke a penalty fee of $1,000 What is the relevant cost of the labour for the special contract? Select one O O O a. S1.500 b. S7,500 c. $2,500 d. $1,000 Blunt is considering a new project but is unsure how much overhead to include in the calculations to help him decide whether or not to proceed. Existing fixed overheads are absorbed at the rate of S8 per hour worked. Blunt is certain 3 the project will involve an incremental 500 labour hours. The project will involve extra machine running costs and these variable overheads cost him $4 per hour. The number sweredthat 10 hours The difference between this figure and the 500 labour hours Blunt is considering a new project but is unsure how much overhead to include in the calculations to help him decide whether or not to proceed. Existing fixed overheads are absorbed at the rate of S8 per hour worked. Blunt is certain 3 vered that the project will involve an incremental 500 labour hours. of estionabove is expected idle time The project will involve extra machine running costs and these variable overheads cost him $4 per hour. The number of extra machine hours is expected to be 450 hours. The difference between this figure and the 500 labour hours he project will require a little more temporary space that can be rented at a fixed cost of $1,200 for the period of hire This overhead is not included in the fixed overhead absorption rate above What is the overhead to be charged against the project decision? Select one O a. S3,000 O O O b. S3,200 c. $7,200 d. $7,000 Drippy is producing a list of relevant cash flows regarding a decision she has to make. She is considering I new type of USB memory stick that guarantees better protection to the host computer Drippy manages many existing products and has a standing arrangement with a technology magazine for advertising aunching a 4 on answered out of 1.00 space entitling her to advertise each month. The contract has just been signed and covers the next twelve months ayment is made in the month following an advert appearing. Drippy is going to use the magazine to advertise her

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started