Question

In a celebrated takeover case, an investor with significant wealth made a public offer to purchase the stock of one of the major automakers for

In a celebrated takeover case, an investor with significant wealth made a public offer to purchase the stock of one of the major automakers for $44 per share when that same stock was trading at only $39 per share. Consider each of the following questions in turn:

a. If the market believes the acquisition will occur, what do you think the share price will be shortly after the announcement? Why? If you were a shareholder, would you sell your stock for $44 if you could? Why or why not?

b. If the market believes the acquisition will not be completed, what do you think the share price will be shortly after the announcement? Why?

c. In this case, the acquisition attempt was effectively stopped, partially because of a poison pill defense in place to protect existing stockholders. The share price after the acquisition failed settled at around $37 per share. Did the defensive tactic protect shareholders in this case?

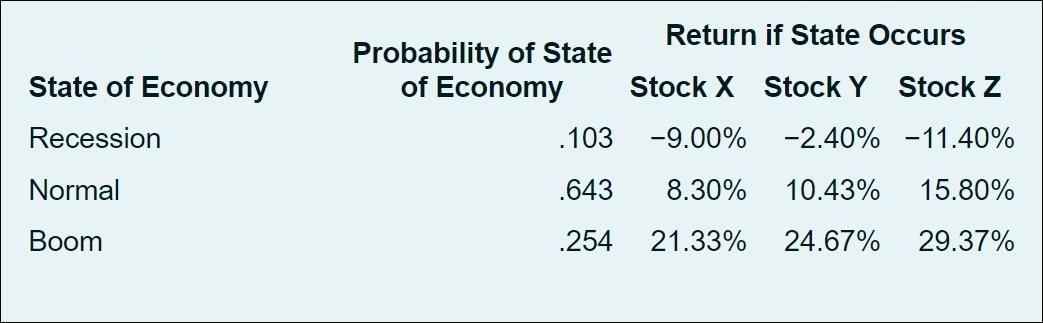

2. You decide to invest in a portfolio consisting of 25 percent Stock X, 36 percent Stock Y, and the remainder in Stock Z. Based on the following information, a. Calculate the expected return of your portfolio?

b. Calculate the variance and Standard Deviation of your portfolio?

c. Your expected return is 15%, Is it the right choice of your portfolio mix. Explain

State of Economy Recession Normal Boom Return if State Occurs Stock X Stock Y Stock Z .103 -9.00% -2.40% -11.40% .643 8.30% 10.43% 15.80% .254 21.33% 24.67% 29.37% Probability of State of Economy

Step by Step Solution

3.39 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started