Answered step by step

Verified Expert Solution

Question

1 Approved Answer

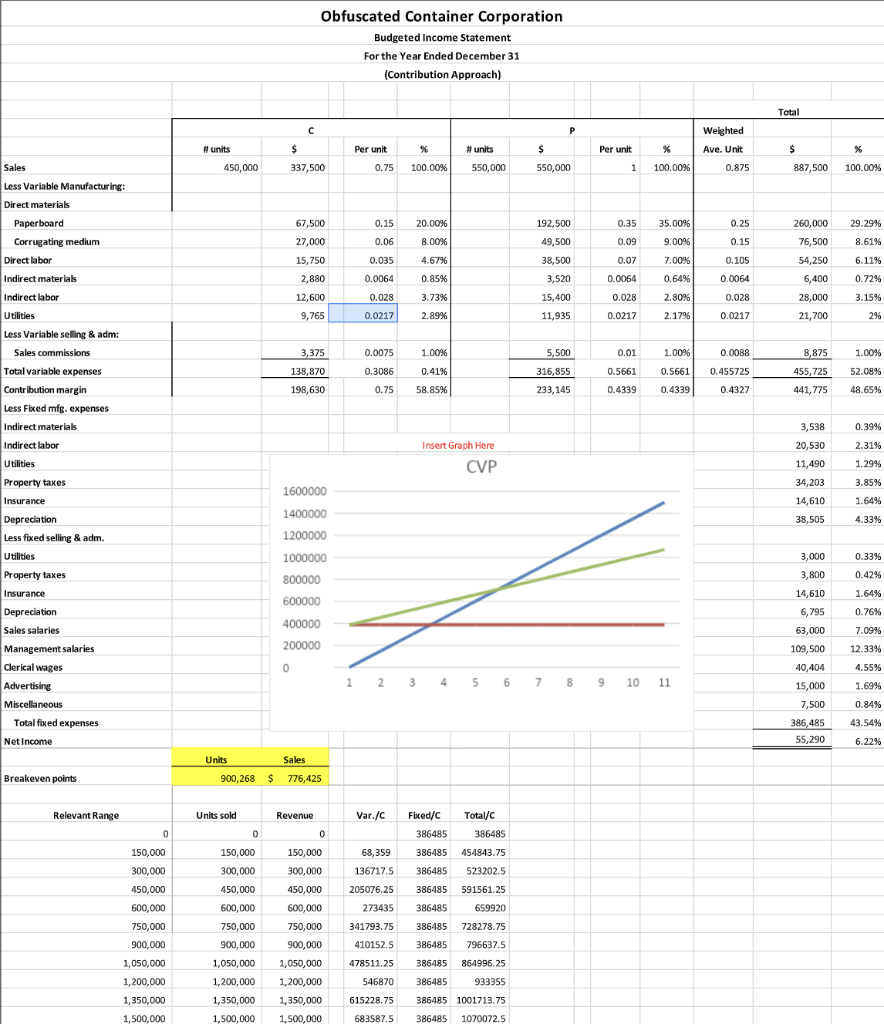

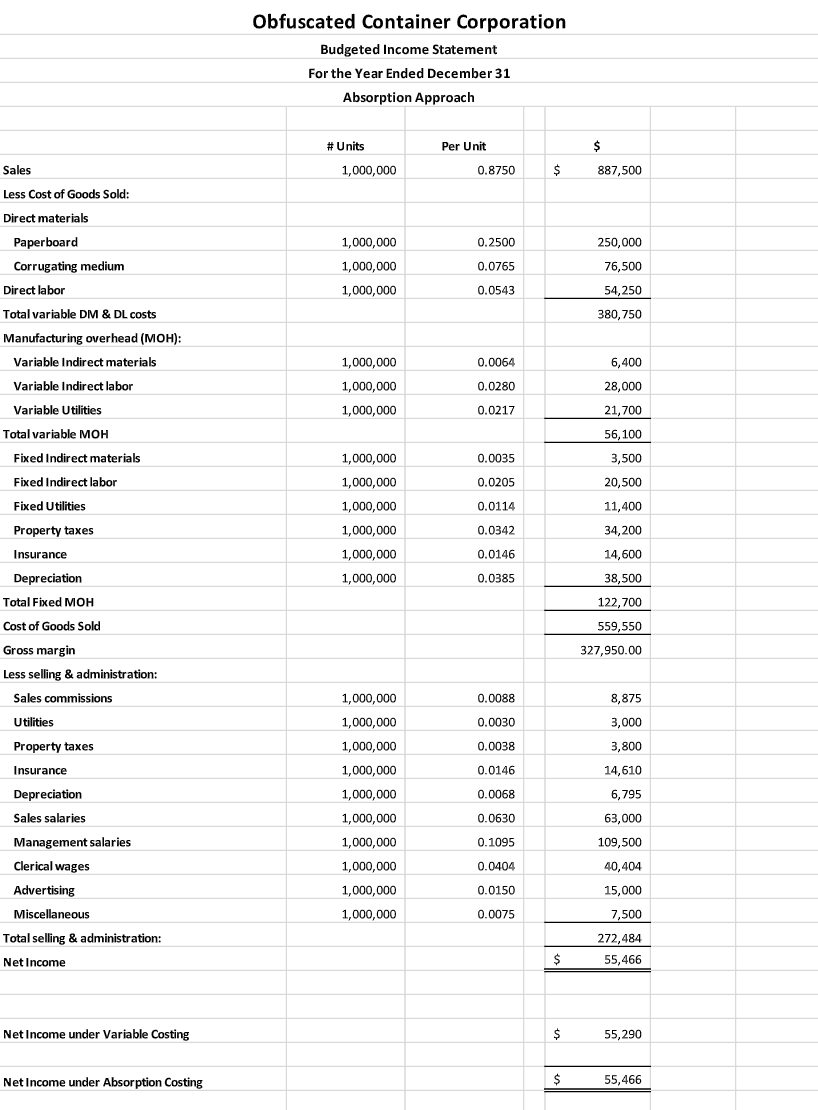

In a coherent memo to the management of Obsfucated Container Corporation, explain/reconcile the difference in net income between the absorption costing and variable costing(contribution) income

In a coherent memo to the management of Obsfucated Container Corporation, explain/reconcile the difference in net income between the absorption costing and variable costing(contribution) income statements. Be sure to explain clearly to management why there are differences in net income used for external financial reporting purposes(absorption costing) and net income used in decision making (variable costing). The two income statements are below.

Obfuscated Container Corporation Budgeted Income Statement For the Year Ended December 31 (Contribution Approach) Total P Weighted #units $ % Per unit % % $ % Per unit 0.75 #units 550,000 $ 550,000 Ave. Unit 0.875 Sales 450,000 337,500 100.0096 1 100.00% 887,500 100.00% Less Variable Manufacturing: Direct materials 0.15 20.00% 0.35 35.00% 0.25 260,000 76,500 192,500 49,500 38,500 29.29% 8.61% 0.06 8.00% 0.09 9.0096 0.15 0.035 4.67% 0.07 7.00% 54,250 6.11% 67,500 27,000 15,750 2,880 12,600 9,765 0.105 0.0064 0.0064 0.8596 3,520 0.0064 0.6496 0.72% 15,400 0.028 0.0217 3.15% 3.7396 2.89% 0.028 0.0217 2.80% 2.1796 6,400 28,000 21,700 0.028 0.0217 11,935 2% Paperboard Corrugating medium Direct labor Indirect materials Indirect labor Utilities Less Variable selling & adm: & : Sales commissions Total variable expenses Contribution margin Less Fixed mfg. expenses Indirect materials Indirect labor Utilities 3,375 1.0096 0.01 1.0096 0.0088 8,875 1.00% 0.0075 0.3086 5,500 316,855 138,870 0.41% 0.5661 0.455725 52.08% 0.5661 0.4339 455,725 441,775 198,630 0.75 58.8596 233,145 0.4339 0.4327 48.65% 3,538 20,530 0.39% 2.31% Insert Graph Here CVP 11,490 1.2996 34,203 3.85% 1600000 14,610 1.64% 1400000 38,505 4.33% 1200000 1000000 0.33% Property taxes Insurance Depreciation Less fixed selling & adm. Utilities Property taxes Insurance Depreciation Sales salaries Management salaries 3,000 3,800 800000 0.42% 1.64% 600000 14,610 6,795 63,000 0.76% 400000 200000 0 7.09% 12.33% clerical wages 1 2 3 3 4 5 109,500 40,404 15,000 7,500 4.55% 1.69% 1 6 7 8 10 9 11 0.84% Advertising Miscellaneous Total fixed expenses Net Income 43.54% 386,485 55,290 6.22% Units Sales Breakeven points 900,268 $ 776,425 Relevant Range Units sold Revenue Var./C 0 0 0 Fixed/C Total/C 386485 386485 386485 454843.75 386485 523202.5 68,359 150,000 300,000 150,000 300,000 136717.5 205076.25 273435 591561.25 150,000 300,000 450,000 600,000 750,000 900,000 1,050,000 386485 386485 450,000 600,000 750,000 900,000 1,050,000 659920 341793.75 450,000 600,000 750,000 900,000 1,050,000 1.200,000 1,350,000 1,500,000 410152.5 478511.25 546B70 386485 728278.75 386485 796637.5 386485 864996.25 386485 933355 386485 1001713.75 386485 1070072.5 1,200,000 1,200,000 1,350,000 615228.75 1,350,000 1,500,000 1,500,000 683587.5 Obfuscated Container Corporation Budgeted Income Statement For the Year Ended December 31 Absorption Approach Per Unit #Units 1,000,000 $ 887,500 Sales 0.8750 $ Less Cost of Goods Sold: Direct materials 1,000,000 0.2500 250,000 76,500 0.0765 1,000,000 1,000,000 0.0543 54,250 380,750 Paperboard Corrugating medium Direct labor Total variable DM & DL costs Manufacturing overhead (MOH): Variable Indirect materials Variable Indirect labor Variable Utilities Total variable MOH Fixed Indirect materials 1,000,000 0.0064 6,400 28,000 0.0280 1,000,000 1,000,000 0.0217 21,700 56,100 0.0035 3,500 Fixed Indirect labor 1,000,000 1,000,000 1,000,000 0.0205 20,500 Fixed Utilities 0.0114 11,400 Property taxes 1,000,000 0.0342 34,200 Insurance 1,000,000 0.0146 14,600 Depreciation 1,000,000 0.0385 38,500 122,700 Total Fixed MOH Cost of Goods Sold 559,550 327,950.00 Gross margin Less selling & administration: 1,000,000 0.0088 8,875 1,000,000 3,000 1,000,000 Sales commissions Utilities Property taxes Insurance Depreciation Sales salaries Management salaries 0.0030 0.0038 0.0146 3,800 14,610 1,000,000 1,000,000 0.0068 6,795 1,000,000 0.0630 63,000 1,000,000 0.1095 109,500 Clerical wages 1,000,000 0.0404 40,404 1,000,000 0.0150 15,000 Advertising Miscellaneous 1,000,000 0.0075 7,500 Total selling & administration: 272,484 Net Income $ 55,466 Net Income under Variable Costing $ 55,290 Net Income under Absorption Costing $ 55,466

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started