Answered step by step

Verified Expert Solution

Question

1 Approved Answer

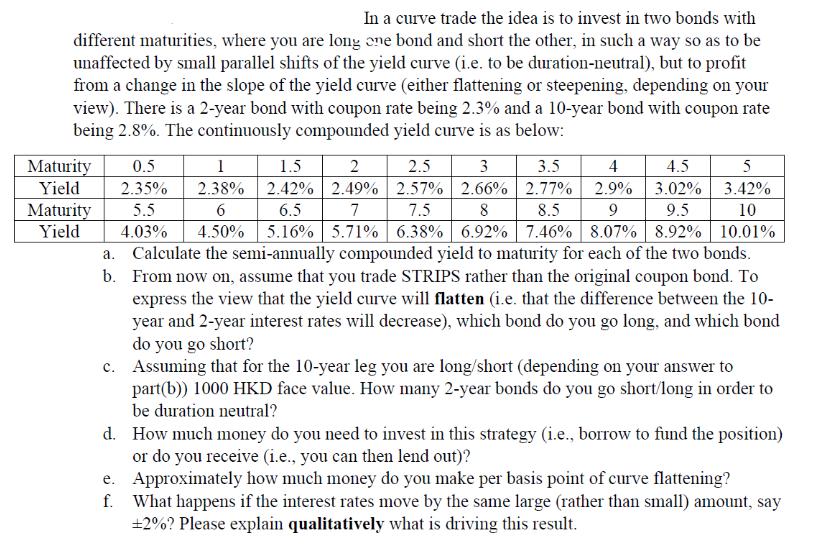

In a curve trade the idea is to invest in two bonds with different maturities, where you are long one bond and short the

In a curve trade the idea is to invest in two bonds with different maturities, where you are long one bond and short the other, in such a way so as to be unaffected by small parallel shifts of the yield curve (i.e. to be duration-neutral), but to profit from a change in the slope of the yield curve (either flattening or steepening, depending on your view). There is a 2-year bond with coupon rate being 2.3% and a 10-year bond with coupon rate being 2.8%. The continuously compounded yield curve is as below: Maturity 0.5 1 1.5 2 3 4 4.5 5 2.35% 2.38% 2.42% 2.49% 2.66% 2.9% 3.02% 3.42% 5.5 6 6.5 7 7.5 8 8.5 9 9.5 10 Yield Maturity Yield 4.03% 4.50% 5.16% 5.71% 6.38% 6.92% 7.46% 8.07% 8.92% 10.01% a. Calculate the semi-annually compounded yield to maturity for each of the two bonds. From now on, assume that you trade STRIPS rather than the original coupon bond. To express the view that the yield curve will flatten (i.e. that the difference between the 10- year and 2-year interest rates will decrease), which bond do you go long, and which bond do you go short? b. c. Assuming that for the 10-year leg you are long/short (depending on your answer to part(b)) 1000 HKD face value. How many 2-year bonds do you go short/long in order to be duration neutral? 2.5 2.57% 3.5 2.77% d. How much money do you need to invest in this strategy (i.e., borrow to fund the position) or do you receive (i.e., you can then lend out)? e. Approximately how much money do you make per basis point of curve flattening? f. What happens if the interest rates move by the same large (rather than small) amount, say 2%? Please explain qualitatively what is driving this result.

Step by Step Solution

★★★★★

3.39 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started