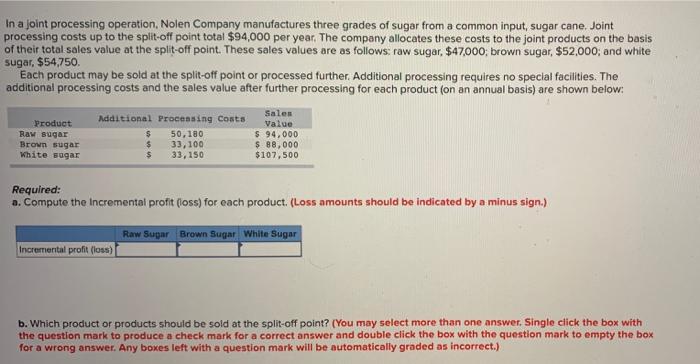

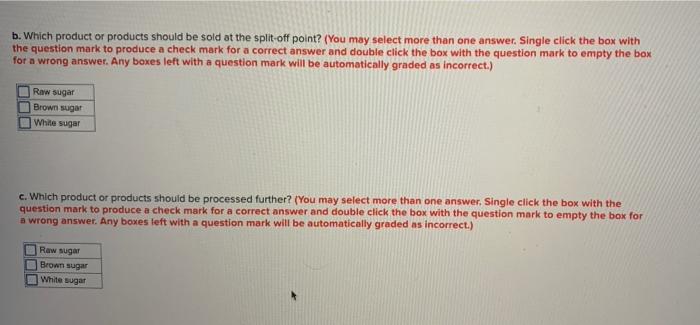

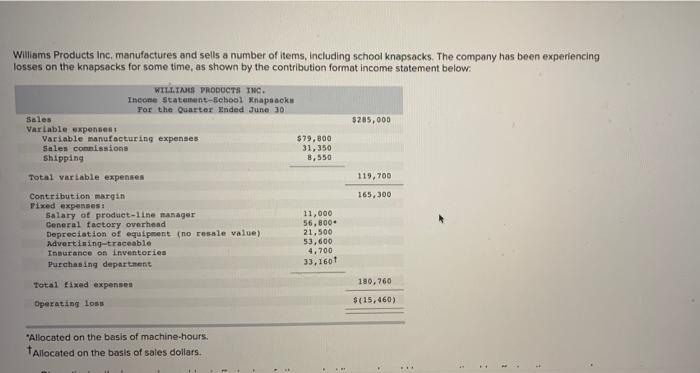

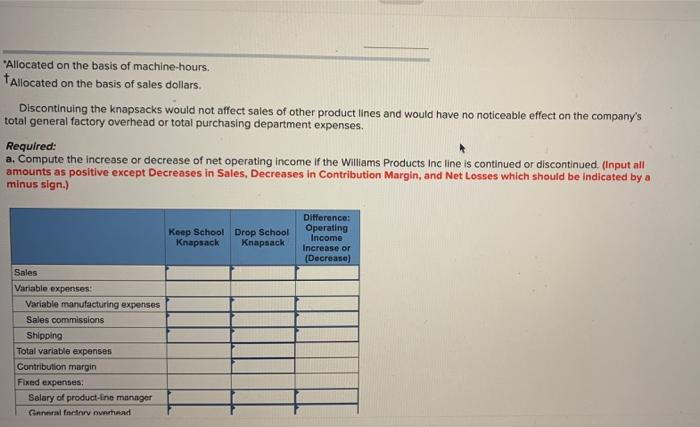

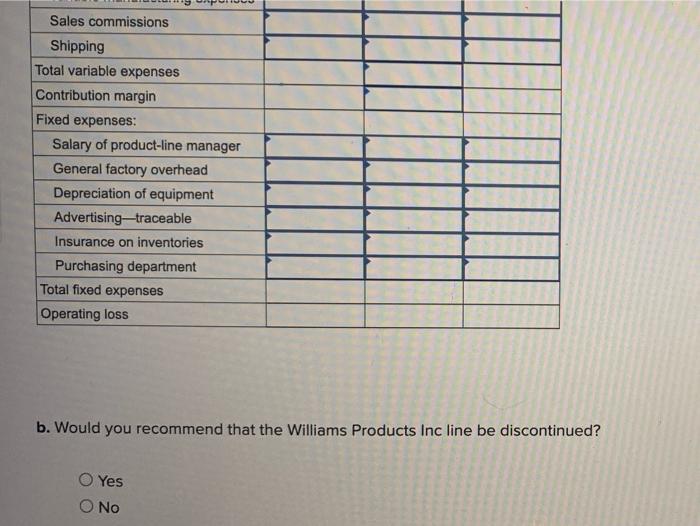

In a joint processing operation, Nolen Company manufactures three grades of sugar from a common input, sugar cane. Joint processing costs up to the split-off point total $94,000 per year. The company allocates these costs to the joint products on the basis of their total sales value at the split-off point. These sales values are as follows: raw sugar $47000; brown sugar, $52,000; and white sugar, $54,750 Each product may be sold at the split-off point or processed further. Additional processing requires no special facilities. The additional processing costs and the sales value after further processing for each product (on an annual basis) are shown below: Additional Processing Costs Product Raw sugar Brown sugar White sugar $ $ $ 50, 180 33,100 33,150 Sales Value $ 94,000 $ 88,000 $107,500 Required: a. Compute the incremental profit (joss) for each product. (Loss amounts should be indicated by a minus sign.) Raw Sugar Brown Sugar White Sugar Incremental profit foss) b. Which product or products should be sold at the split-off point? (You may select more than one answer. Single click the box with the question mark to produce a check mark for a correct answer and double click the box with the question mark to empty the box for a wrong answer. Any boxes left with a question mark will be automatically graded as incorrect.) b. Which product or products should be sold at the split off point? (You may select more than one answer. Single click the box with the question mark to produce a check mark for a correct answer and double click the box with the question mark to empty the box for a wrong answer. Any boxes left with a question mark will be automatically graded as incorrect.) Raw sugar Brown sugar White sugar c. Which product or products should be processed further? (You may select more than one answer. Single click the box with the question mark to produce a check mark for a correct answer and double click the box with the question mark to empty the box for a wrong answer. Any boxes left with a question mark will be automatically graded as incorrect) Raw sugar Brown sugar White sugar Williams Products Inc, manufactures and sells a number of items, including school knapsacks. The company has been experiencing losses on the knapsacks for some time, as shown by the contribution format income statement below. $285,000 WILLIAMS PRODUCTS INC. Income Statement-School Ynapsacks For the Quarter Ended June 30 Sales Variable expenses Variable manufacturing expenses $79,800 Sales comissions 31,350 Shipping 8,550 Total variable expenses 119,700 165.300 Contribution margin Fixed expenses Salary of product-line manager General factory overhead Depreciation of equipment (no resale value) Advertising-traceable Insurance on inventories 11,000 56, 8004 21,500 53,600 4.700 33,1601 Purchasing department Total fixed expenses 180,760 $(15,460) Operating loss "Allocated on the basis of machine-hours. tAllocated on the basis of sales dollars. "Allocated on the basis of machine-hours. Allocated on the basis of sales dollars. Discontinuing the knapsacks would not affect sales of other product lines and would have no noticeable effect on the company's total general factory overhead or total purchasing department expenses. Required: a. Compute the increase or decrease of net operating income of the Williams Products Inc line is continued or discontinued. (Input all amounts as positive except Decreases in Sales, Decreases in Contribution Margin, and Net Losses which should be indicated by a minus sign.) Keep School Drop School Knapsack Knapsack Difference: Operating Income Increase or (Decrease) Sales Variable expenses Variable manufacturing expenses Sales commissions Shipping Total variable expenses Contribution margin Fixed expenses Salary of product-line manager Generalfarar verhead Sales commissions Shipping Total variable expenses Contribution margin Fixed expenses: Salary of product-line manager General factory overhead Depreciation of equipment Advertising-traceable Insurance on inventories Purchasing department Total fixed expenses Operating loss b. Would you recommend that the Williams Products Inc line be discontinued? O Yes O No