Answered step by step

Verified Expert Solution

Question

1 Approved Answer

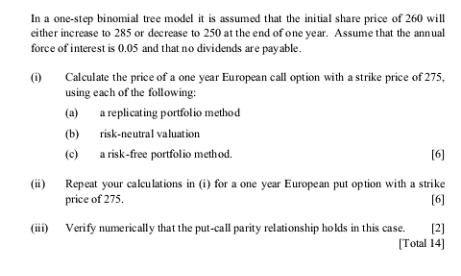

In a one-step binomial tree model it is assumed that the initial share price of 260 will either increase to 285 or decrease to

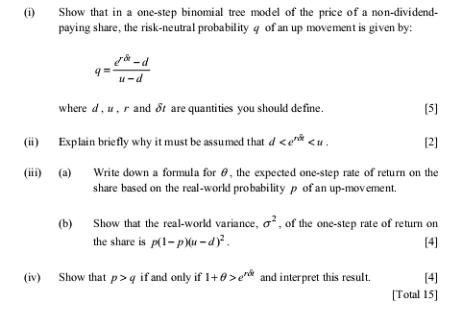

In a one-step binomial tree model it is assumed that the initial share price of 260 will either increase to 285 or decrease to 250 at the end of one year. Assume that the annual force of interest is 0.05 and that no dividends are payable. (1) (ii) Calculate the price of a one year European call option with a strike price of 275, using each of the following: (a) a replicating portfolio method (b) (c) risk-neutral valuation a risk-free portfolio method. [6] Repeat your calculations in (i) for a one year European put option with a strike price of 275. [6] (ii) Verify numerically that the put-call parity relationship holds in this case. [2] [Total 14] (1) (ii) (iii) Show that in a one-step binomial tree model of the price of a non-dividend- paying share, the risk-neutral probability q of an up movement is given by: 7-d u-d where d. u. r and ot are quantities you should define. Explain briefly why it must be assumed that d < q if and only if 1+0>e and interpret this result. [4] [Total 15]

Step by Step Solution

★★★★★

3.21 Rating (140 Votes )

There are 3 Steps involved in it

Step: 1

i Deriving the RiskNeutral Probability q In a onestep binomial tree model we consider two possible price movements for a share an up movement u and a ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started