Question

Balance Sheet at December 31 Cash Accounts receivable Prepaid expenses Equipment Wages payable Common stock and additional paid-in capital Retained earnings Income Statement for

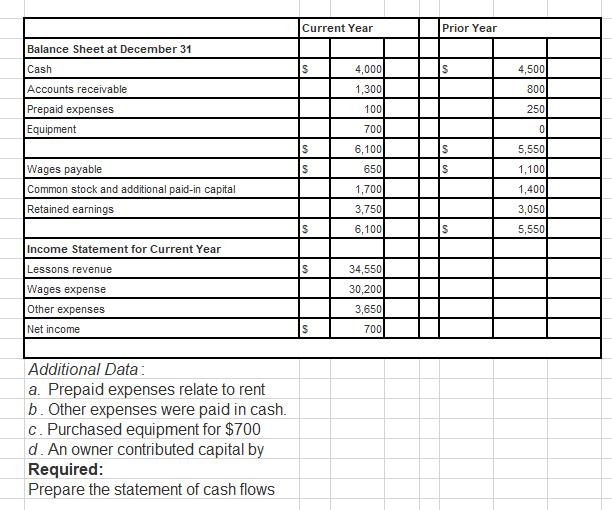

Balance Sheet at December 31 Cash Accounts receivable Prepaid expenses Equipment Wages payable Common stock and additional paid-in capital Retained earnings Income Statement for Current Year Lessons revenue Wages expense Other expenses Net income Additional Data: a. Prepaid expenses relate to rent b. Other expenses were paid in cash. c. Purchased equipment for $700 d. An owner contributed capital by Required: Prepare the statement of cash flows Current Year S $ $ $ $ S 4,000 1,300 100 700 6,100 650 1,700 3,750 6,100 34,550 30,200 3,650 700 Prior Year S S 4,500 800 250 0 5,550 1,100 1,400 3,050 5,550

Step by Step Solution

3.40 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

Statement of cashflow AWN 2 4 3 Cashflow from operations 5 6 A 7 8 B Revenue Wages Other Expens...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Core Concepts of Government and Not For Profit Accounting

Authors: Michael H. Granof, Penelope S. Wardlow

2nd edition

471737925, 978-0-470-4605, 978-0471737926

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App