Answered step by step

Verified Expert Solution

Question

1 Approved Answer

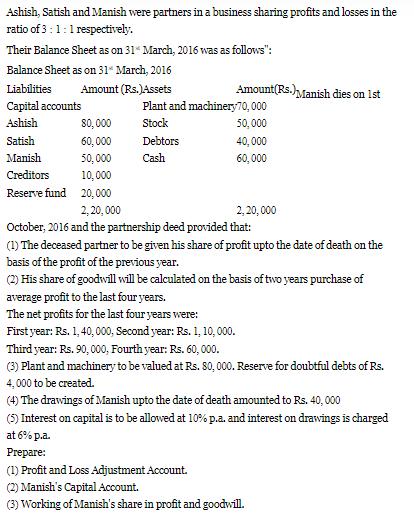

Ashish, Satish and Manish were partners in a business sharing profits and losses in the ratio of 3: 1: 1 respectively. Their Balance Sheet

Ashish, Satish and Manish were partners in a business sharing profits and losses in the ratio of 3: 1: 1 respectively. Their Balance Sheet as on 31 March, 2016 was as follows": Balance Sheet as on 31* March, 2016 Liabilities Amount (Rs.)Assets Capital accounts Ashish Satish Manish Creditors Reserve fund Amount(Rs.) Manish dies on 1st Plant and machinery70,000 Stock Debtors Cash 80,000 60,000 50,000 10,000 20,000 2,20,000 October, 2016 and the partnership deed provided that: 50,000 40,000 60,000 2,20,000 (1) The deceased partner to be given his share of profit upto the date of death on the basis of the profit of the previous year. (2) His share of goodwill will be calculated on the basis of two years purchase of average profit to the last four years. The net profits for the last four years were: First year: Rs. 1, 40, 000, Second year: Rs. 1, 10, 000. Third year: Rs. 90,000, Fourth year: Rs. 60,000. (3) Plant and machinery to be valued at Rs. 80,000. Reserve for doubtful debts of Rs. 4,000 to be created. (4) The drawings of Manish upto the date of death amounted to Rs. 40,000 (5) Interest on capital is to be allowed at 10% p.a. and interest on drawings is charged at 6% p.a. Prepare: (1) Profit and Loss Adjustment Account. (2) Manish's Capital Account. (3) Working of Manish's share in profit and goodwill.

Step by Step Solution

★★★★★

3.40 Rating (144 Votes )

There are 3 Steps involved in it

Step: 1

REF image Working Note Manish Profit 60000156126000 Interest on Capital 50000101006122500 Int on Dra...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started