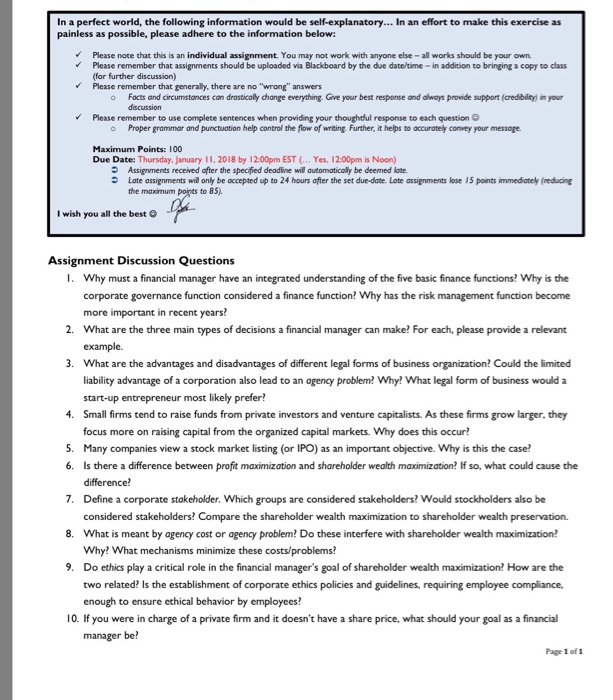

In a perfect world, the following information would be painless as possible, please adhere to the information below: In an effort to make this exercise as Please note that this is an individual assignment You may not work with anyone else - all works should be your own Please remember that assignments should be uploaded via Blackboard by the due date/time- in addition to bringing a copy to cass (for further discussion) Please remember that generaly, there are no "wrong" answers o Facts and circumstances con drastically change everything. Give your best response and always provide support (credibilty) in your discussion Please remember to use complete sentences when providing your thoughtful response to each question o Proper grammar and punctuation help control the flow of writing. Further, it helps to accurately convey your messoge Maximum Points: 100 Due Date: Thursday, January 11, 2018 by 12:00pm EST (... Yes, 12:00pm is Noon) Assignments received fter the specified deadline will autornat cally be deemed late. Lote assignments wil only be accepted up to 24 hours after the set dued te late assements lose 15 ponts m medately (redir the maximum points to wish you all the best Assignment Discussion Questions I. Why must a financial manager have an integrated understanding of the five basic finance functions? Why is the corporate governance function considered a finance function? Why has the risk management function become more important in recent years? What are the three main types of decisions a financial manager can make? For each, please provide a relevant example. 2. 3. What are the advantages and disadvantages of different legal forms of business organization Could the limited liability advantage of a corporation also lead to an ogency problem? Why? What legal form of business would a start-up entrepreneur most likely prefer? . Small firms tend to raise funds from private investors and venture capitalists. As these firms grow larger, they focus more on raising capital from the organized capital markets. Why does this occur? Many companies view a stock market listing (or IPO) as an important objective. Why is this the case? Is there a difference between profit maximization and shareholder wealth maximization? If so, what could cause the difference Define a corporate stakeholder. Which groups are considered stakeholders? Would stockholders also be considered stakeholders? Compare the shareholder wealth maximization to shareholder wealth preservation. What is meant by agency cost or agency problem? Do these interfere with shareholder wealth maximization? Why? What mechanisms minimize these costs/problems? Do ethics play a critical role in the financial manager's goal of shareholder wealth maximization? How are the two related? Is the establishment of corporate ethics policies and guidelines, requiring employee compliance. 5. 6. 7. 8. 9. ensure ethical behavior by employees? 10. If you were in charge of a private firm and it doesn't have a share price, what should your goal as a financial manager be? Page 1 of 1