Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In a plant making 10 000 tons/year of product A has a cost data explained below. To produce 1 kg of A, 0.83 kg of

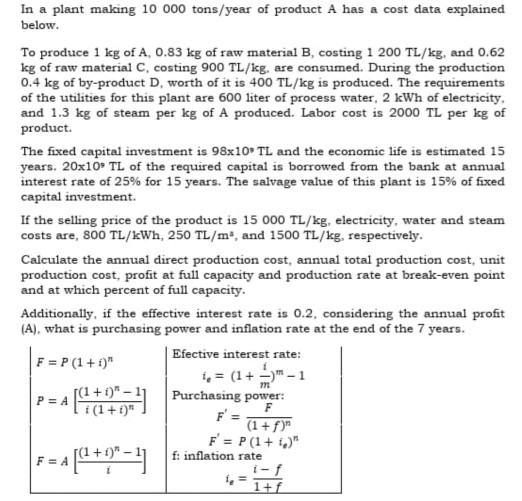

In a plant making 10 000 tons/year of product A has a cost data explained below. To produce 1 kg of A, 0.83 kg of raw material B, costing 1 200 TL/kg, and 0.62 kg of raw material C, costing 900 TL/kg, are consumed. During the production 0.4 kg of by-product D, worth of it is 400 TL/kg is produced. The requirements of the utilities for this plant are 600 liter of process water, 2 kWh of electricity, and 1.3 kg of steam per kg of A produced. Labor cost is 2000 TL per kg of product. The fixed capital investment is 98x10 TL and the economic life is estimated 15 years, 20x10 TL of the required capital is borrowed from the bank at annual interest rate of 25% for 15 years. The salvage value of this plant is 15% of fixed capital investment. If the selling price of the product is 15 000 TL/kg, electricity, water and steam costs are, 800 TL/kWh, 250 TL/m", and 1500 TL/kg, respectively. Calculate the annual direct production cost, annual total production cost, unit production cost, profit at full capacity and production rate at break-even point and at which percent of full capacity. Additionally, if the effective interest rate is 0.2, considering the annual profit (A), what is purchasing power and inflation rate at the end of the 7 years. F=P(1 + i)" Efective interest rate: ie= (1 + - 1 Purchasing power: + ) -11 F = (1 + f)" F = P(1 + i)" f: inflation rate i- ST

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access with AI-Powered Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started