Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In a rapidly evolving global economy, companies are facing unprecedented challenges in maintaining financial stability and adhering to stringent accounting standards. One such company, XYZ

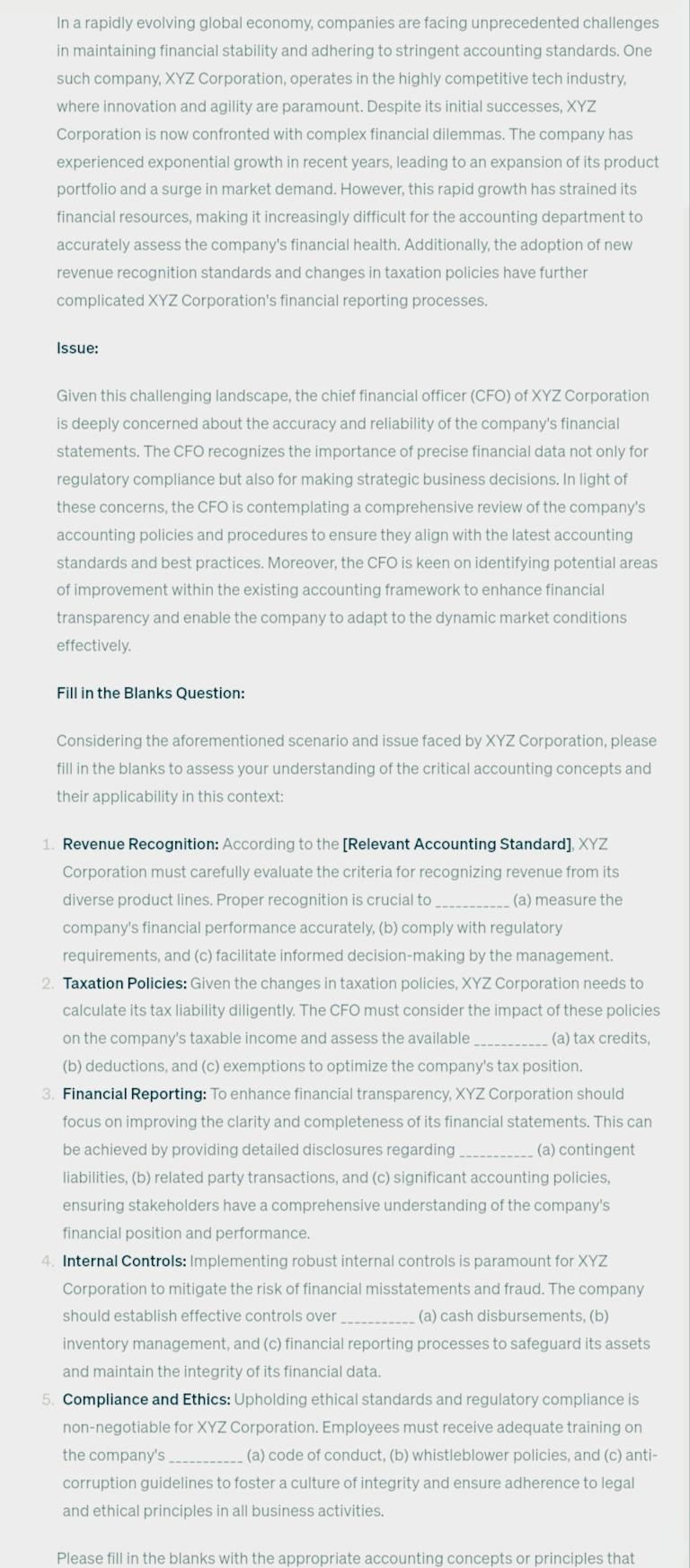

In a rapidly evolving global economy, companies are facing unprecedented challenges in maintaining financial stability and adhering to stringent accounting standards. One such company, XYZ Corporation, operates in the highly competitive tech industry, where innovation and agility are paramount. Despite its initial successes, XYZ Corporation is now confronted with complex financial dilemmas. The company has experienced exponential growth in recent years, leading to an expansion of its product portfolio and a surge in market demand. However, this rapid growth has strained its financial resources, making it increasingly difficult for the accounting department to accurately assess the company's financial health. Additionally, the adoption of new revenue recognition standards and changes in taxation policies have further complicated XYZ Corporation's financial reporting processes. Issue: Given this challenging landscape, the chief financial officer (CFO) of XYZ Corporation is deeply concerned about the accuracy and reliability of the company's financial statements. The CFO recognizes the importance of precise financial data not only for regulatory compliance but also for making strategic business decisions. In light of these concerns, the CFO is contemplating a comprehensive review of the company's accounting policies and procedures to ensure they align with the latest accounting standards and best practices. Moreover, the CFO is keen on identifying potential areas of improvement within the existing accounting framework to enhance financial transparency and enable the company to adapt to the dynamic market conditions effectively. Fill in the Blanks Question: Considering the aforementioned scenario and issue faced by XYZ Corporation, please fill in the blanks to assess your understanding of the critical accounting concepts and their applicability in this context: 1. Revenue Recognition: According to the [Relevant Accounting Standard], XYZ Corporation must carefully evaluate the criteria for recognizing revenue from its diverse product lines. Proper recognition is crucial to (a) measure the company's financial performance accurately, (b) comply with regulatory requirements, and (c) facilitate informed decision-making by the management. 2. Taxation Policies: Given the changes in taxation policies, XYZ Corporation needs to calculate its tax liability diligently. The CFO must consider the impact of these policies on the company's taxable income and assess the available (a) tax credits, (b) deductions, and (c) exemptions to optimize the company's tax position. 3. Financial Reporting: To enhance financial transparency, XYZ Corporation should focus on improving the clarity and completeness of its financial statements. This can be achieved by providing detailed disclosures regarding (a) contingent liabilities, (b) related party transactions, and (c) significant accounting policies, ensuring stakeholders have a comprehensive understanding of the company's financial position and performance. 4. Internal Controls: Implementing robust internal controls is paramount for XYZ Corporation to mitigate the risk of financial misstatements and fraud. The company should establish effective controls over (a) cash disbursements, (b) inventory management, and (c) financial reporting processes to safeguard its assets and maintain the integrity of its financial data. 5. Compliance and Ethics: Upholding ethical standards and regulatory compliance is non-negotiable for XYZ Corporation. Employees must receive adequate training on the company's (a) code of conduct, (b) whistleblower policies, and (c) anticorruption guidelines to foster a culture of integrity and ensure adherence to legal and ethical principles in all business activities. Please fill in the blanks with the appropriate accounting concepts or principles that

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started