Question

You have $400,000 to invest in a residential property worth $3,000,000 in Mong Kok and you are choosing between the following fully amortizing monthly

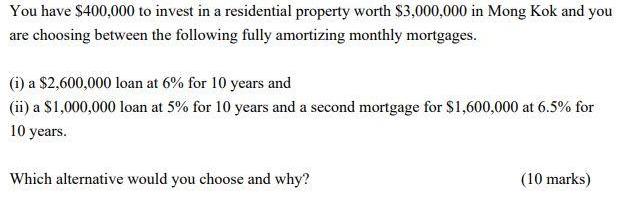

You have $400,000 to invest in a residential property worth $3,000,000 in Mong Kok and you are choosing between the following fully amortizing monthly mortgages. (i) a $2,600,000 loan at 6% for 10 years and (ii) a $1,000,000 loan at 5% for 10 years and a second mortgage for $1,600,000 at 6.5% for 10 years. Which alternative would you choose and why? (10 marks)

Step by Step Solution

3.52 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Part i Loan Amount 2600000 Period n 10 years12 120 months Rate r 6 pa or 05 per month Now to find mo...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Probability And Statistics

Authors: Morris H. DeGroot, Mark J. Schervish

4th Edition

9579701075, 321500466, 978-0176861117, 176861114, 978-0134995472, 978-0321500465

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App