In a three-period economy, there is a group of risk-neutral investors and a firm that has...

Fantastic news! We've Found the answer you've been seeking!

Question:

Transcribed Image Text:

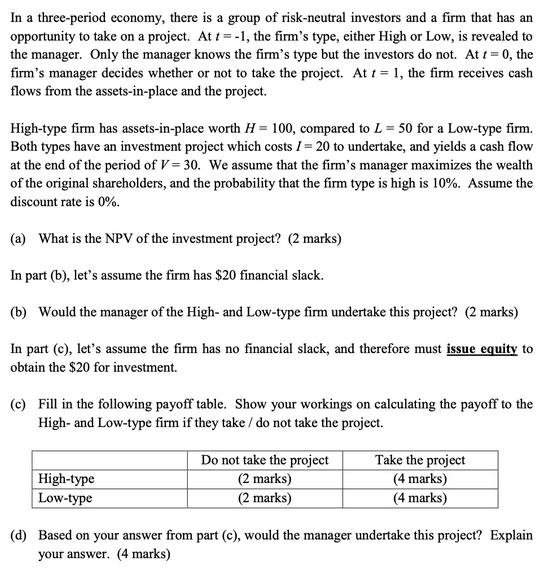

In a three-period economy, there is a group of risk-neutral investors and a firm that has an opportunity to take on a project. At t = -1, the firm's type, either High or Low, is revealed to the manager. Only the manager knows the firm's type but the investors do not. At 1 = 0, the firm's manager decides whether or not to take the project. At t = 1, the firm receives cash flows from the assets-in-place and the project. High-type firm has assets-in-place worth H=100, compared to L = 50 for a Low-type firm. Both types have an investment project which costs /= 20 to undertake, and yields a cash flow at the end of the period of V = 30. We assume that the firm's manager maximizes the wealth of the original shareholders, and the probability that the firm type is high is 10%. Assume the discount rate is 0%. (a) What is the NPV of the investment project? (2 marks) In part (b), let's assume the firm has $20 financial slack. (b) Would the manager of the High- and Low-type firm undertake this project? (2 marks) In part (c), let's assume the firm has no financial slack, and therefore must issue equity to obtain the $20 for investment. (c) Fill in the following payoff table. Show your workings on calculating the payoff to the High- and Low-type firm if they take / do not take the project. High-type Low-type Do not take the project (2 marks) (2 marks) Take the project (4 marks) (4 marks) (d) Based on your answer from part (c), would the manager undertake this project? Explain your answer. (4 marks) In a three-period economy, there is a group of risk-neutral investors and a firm that has an opportunity to take on a project. At t = -1, the firm's type, either High or Low, is revealed to the manager. Only the manager knows the firm's type but the investors do not. At 1 = 0, the firm's manager decides whether or not to take the project. At t = 1, the firm receives cash flows from the assets-in-place and the project. High-type firm has assets-in-place worth H=100, compared to L = 50 for a Low-type firm. Both types have an investment project which costs /= 20 to undertake, and yields a cash flow at the end of the period of V = 30. We assume that the firm's manager maximizes the wealth of the original shareholders, and the probability that the firm type is high is 10%. Assume the discount rate is 0%. (a) What is the NPV of the investment project? (2 marks) In part (b), let's assume the firm has $20 financial slack. (b) Would the manager of the High- and Low-type firm undertake this project? (2 marks) In part (c), let's assume the firm has no financial slack, and therefore must issue equity to obtain the $20 for investment. (c) Fill in the following payoff table. Show your workings on calculating the payoff to the High- and Low-type firm if they take / do not take the project. High-type Low-type Do not take the project (2 marks) (2 marks) Take the project (4 marks) (4 marks) (d) Based on your answer from part (c), would the manager undertake this project? Explain your answer. (4 marks)

Expert Answer:

Answer rating: 100% (QA)

a NPV of the investment project Cash flows Project payoff 30 Project cost 20 10 Probability firm i... View the full answer

Related Book For

Posted Date:

Students also viewed these finance questions

-

Identify and detail one internal SWOT element and one external SWOT element explicitly communicated in the UberHEALTH case study, making sure to define the SWOT element adequately from the article...

-

Spotlighting opportunities for business in Africa and strategies to succeed in the world's next big growth market Acha Leke @achaleke - Senior Partner and Chairman of Africa Region, McKinsey &...

-

Managing Scope Changes Case Study Scope changes on a project can occur regardless of how well the project is planned or executed. Scope changes can be the result of something that was omitted during...

-

2. A firm's or cash flow, is its profits after deductions for all expenses, including or wear and tear on capital goods such as machinery.

-

If v(0)=0, find v(t), i1(t), and i2(t) in the circuit in Fig. 6.63. i, (mA) 20 -20

-

Communicate how you intend to complete the project. Include timelines and resources required. Be sure to include: a. Analysis - how will you determine the needs of the database b. Design - what...

-

Scott Badger and Maxine Giesen are partners in a business. On December 31 of the current year, the partners equities are Scott, \($60,000.00\) and Maxine, \($90,000.00.\) The net income for the year...

-

This financial information is available for Hoyle Corporation. The weighted-average number of shares of common stock outstanding was 180,000 for 2009 and 150,000 for 2010.InstructionsCalculate...

-

7. How does the law of assignment of rights ensure that the debtor is not disadvantaged by the assignment? (2 marks)

-

Kilmer Company has demand for its only product that exceeds its manufacturing capacity. The company provided the following information for the machine whose limited capacity is prohibiting the...

-

Christmas Anytime Issues $700,000 of 5% bonds, due in 15 years, with Interest payable semiannually on June 30 and December 31 each year. Calculate the issue price of a bond and complete the first...

-

6) A 50-kg sofa up a moving ramp at constant speed. The ramp makes an angle of 10 with the horizontal. The coefficient of kinetic friction between the sofa and the ramp is 0.3. Determine the force...

-

A borrower can obtain an 80 percent loan with an 9 percent interest rate and monthly payments. The loan is to be fully amortized over 25 years. Alternatively, he could obtain a 90 percent loan at an...

-

You have just invested in a portfolio of three stocks. The amount of money that you invested in each stock and its beta are summarized below. Stock Investment Beta A $204,000 1.50 B 306,000 0.60...

-

Matters subject to examination (s.372 of the Civil Enforcement Regulation) where the debtor is a corporation, the name and address of, and other pertinent information relating to, any director or...

-

A partial listing of costs incurred at BFAR Mfg during March 2022 appears below: Administrative salaries Depreciation on administrative equipment Depreciation on production equipment Direct labor...

-

Suppose that you could invest in the following projects but have only $30,000 to invest. How would you make your decision and which projects would you invest in? Project Cost $ 8,000 11,000 9,000...

-

Let \(h: \boldsymbol{x} \mapsto \mathbb{R}\) be a convex function and let \(\boldsymbol{X}\) be a random variable. Use the subgradient definition of convexity to prove Jensen's inequality: \[...

-

The purpose of this exercise is to prove the following Vapnik-Chernovenkis bound: for any finite class \(\mathscr{G}\) (containing only a finite number \(|\mathscr{G}|\) of possible functions) and a...

-

Using Jensen's inequality, show that the Kullback-Leibler divergence between probability densities \(f\) and \(g\) is always positive; that is, \[ \mathbb{E} \ln...

Study smarter with the SolutionInn App