Answered step by step

Verified Expert Solution

Question

1 Approved Answer

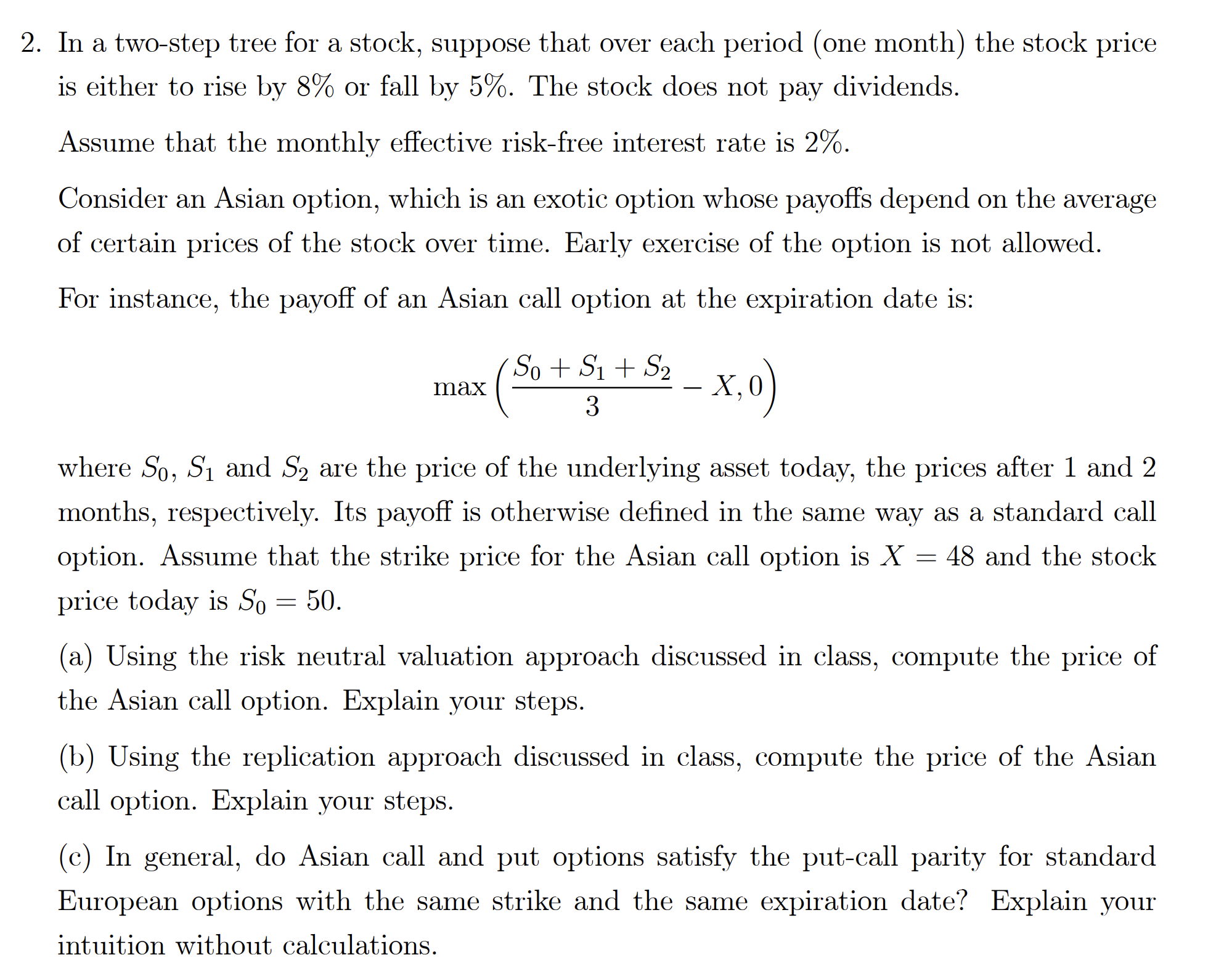

In a two - step tree for a stock, suppose that over each period ( one month ) the stock price is either to rise

In a twostep tree for a stock, suppose that over each period one month the stock price

is either to rise by or fall by The stock does not pay dividends.

Assume that the monthly effective riskfree interest rate is

Consider an Asian option, which is an exotic option whose payoffs depend on the average

of certain prices of the stock over time. Early exercise of the option is not allowed.

For instance, the payoff of an Asian call option at the expiration date is:

max

where and are the price of the underlying asset today, the prices after and

months, respectively. Its payoff is otherwise defined in the same way as a standard call

option. Assume that the strike price for the Asian call option is and the stock

price today is

a Using the risk neutral valuation approach discussed in class, compute the price of

the Asian call option. Explain your steps.

b Using the replication approach discussed in class, compute the price of the Asian

call option. Explain your steps.

c In general, do Asian call and put options satisfy the putcall parity for standard

European options with the same strike and the same expiration date? Explain your

intuition without calculations.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started